UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

☐ |

|

OR |

|

☒ |

|

|

For the fiscal year ended |

OR |

|

☐ |

|

OR |

|

☐ |

|

|

Date of event requiring this shell company report |

Commission File Number:

(Exact name of registrant as specified in its charter)

Republic of

(State or other jurisdiction of incorporation or organization)

Telephone: +39 049 931811

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Telephone:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

The |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

As of the date of this annual report on Form 20-F, there were

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such a shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Accelerated filer ☐ |

Non-accelerated filer ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to Section 250.10D-1(b).

☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S.GAAP ☐ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow:

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐ No ☐

TABLE OF CONTENTS

|

||

ITEM 1. |

1 |

|

A. |

1 |

|

B. |

1 |

|

C. |

1 |

|

ITEM 2. |

1 |

|

A. |

1 |

|

B. |

1 |

|

ITEM 3. |

1 |

|

A. |

1 |

|

B. |

1 |

|

C. |

1 |

|

D. |

1 |

|

ITEM 4. |

37 |

|

A. |

37 |

|

B. |

38 |

|

C. |

68 |

|

D. |

68 |

|

ITEM 4A. |

68 |

|

ITEM 5. |

69 |

|

A. |

69 |

|

B. |

80 |

|

C. |

92 |

|

D. |

92 |

|

E. |

92 |

|

ITEM 6. |

93 |

|

A. |

93 |

|

B. |

96 |

|

C. |

102 |

|

D. |

107 |

|

E. |

107 |

|

f. |

disclosure of a registrant's actionto recover erroneously awarded compensation |

107 |

ITEM 7. |

107 |

|

A. |

107 |

|

B. |

108 |

|

C. |

111 |

|

ITEM 8. |

112 |

|

A. |

112 |

|

B. |

112 |

|

ITEM 9. |

112 |

|

A. |

112 |

|

B. |

112 |

|

C. |

112 |

|

D. |

112 |

|

E. |

112 |

|

F. |

112 |

|

ITEM 10. |

112 |

|

A. |

112 |

|

B. |

114 |

|

C. |

135 |

|

D. |

135 |

|

E. |

136 |

|

F. |

148 |

|

i

G. |

148 |

|

H. |

148 |

|

I. |

149 |

|

J. |

149 |

|

ITEM 11. |

149 |

|

ITEM 12. |

149 |

|

A. |

149 |

|

B. |

149 |

|

C. |

149 |

|

D. |

149 |

|

150 |

||

ITEM 13. |

150 |

|

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

150 |

ITEM 15. |

150 |

|

ITEM 16. |

152 |

|

ITEM 16A. |

152 |

|

ITEM 16B. |

153 |

|

ITEM 16C. |

153 |

|

ITEM 16D. |

153 |

|

ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

154 |

ITEM 16F. |

154 |

|

ITEM 16G. |

154 |

|

ITEM 16H. |

155 |

|

ITEM 16I. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

155 |

item 16.J. |

155 |

|

item 16.k. |

155 |

|

157 |

||

ITEM 17. |

157 |

|

ITEM 18. |

157 |

|

ITEM 19. |

157 |

|

ii

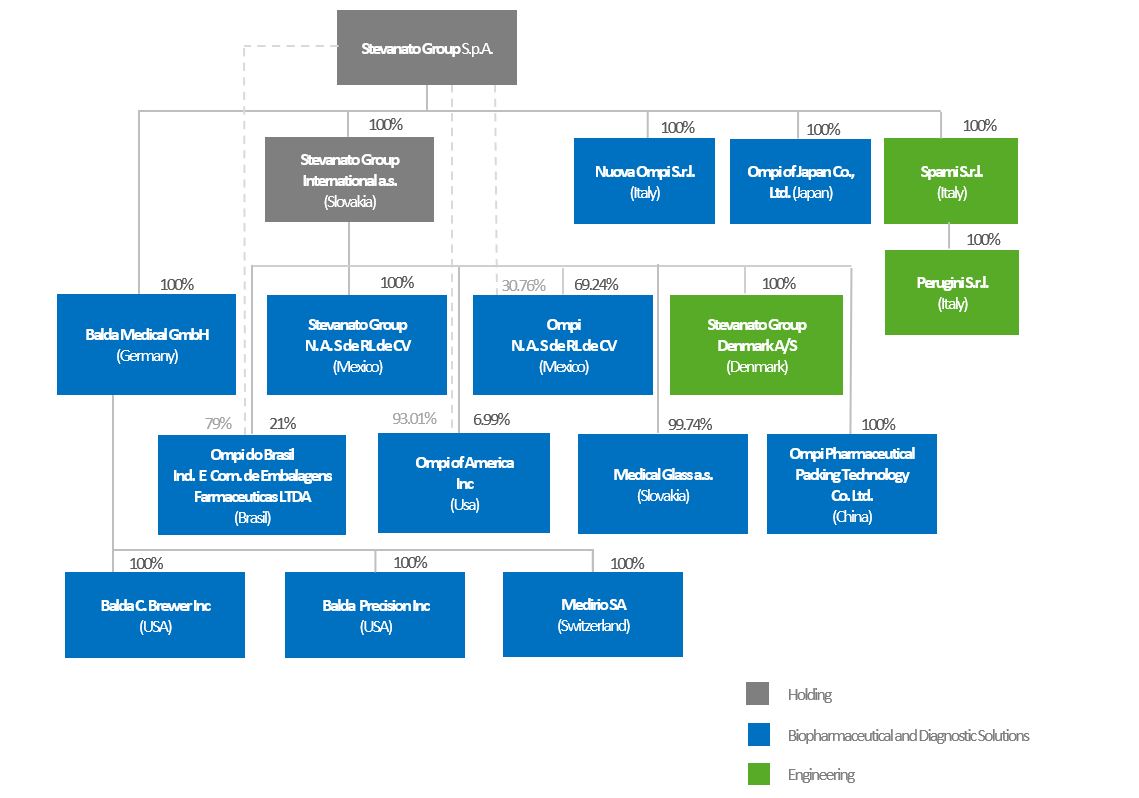

Throughout this annual report, unless the context otherwise requires, references to “Stevanato Group S.p.A.”, “Stevanato”, the “Company”, “we”, “us”, “Group”, “our” and words of similar import refer to Stevanato Group S.p.A. and its consolidated subsidiaries.

Unless otherwise indicated, all references to “€”, “EUR” and “Euro” in this annual report are to, and amounts are presented in, euros. All references to “US$” and “$” are to U.S. Dollars.

Financial Statements

We present in this annual report the audited consolidated financial statements as of December 31, 2023 and 2022, and for the years ended December 31, 2023, 2022 and 2021. These financial statements were prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (IFRS). The consolidated financial statements and the notes to the consolidated financial statements are referred to collectively as the “Consolidated Financial Statements”.

All references herein to “our financial statements” or “our consolidated financial statements”, are the Consolidated Financial Statements included elsewhere in this annual report.

Our fiscal year ends on December 31. References in this annual report to a fiscal year, such as “fiscal year 2023,” relate to our fiscal year ended on December 31 of that calendar year.

As of the date of this annual report, our authorized share capital is €21,698,480.00 divided into 295,540,036 shares without par value, including 34,870,467 ordinary shares and 260,669,569 Class A shares, of which 30,073,093 shares are held in treasury. On March 4, 2021, the shareholders’ meeting approved a share split following which the then existing 20,002 shares have been split into a total of 100,010,000 ordinary shares with no par value, without changing the amount of the share capital. On July 1, 2021 the shareholders’ meeting approved a further share split following which all the existing 100,010,000 shares have been split into a total of 272,427,240 shares in the ratio of 2.724 new shares post-split for each share outstanding prior to the share split. In connection with the split that occurred on July 1, 2021, all of the ordinary shares held by Stevanato Holding S.r.l. and the ordinary shares held in treasury were converted into Class A shares.

On July 20, 2021 we completed our initial public offering, at completion of which 22,400,000 ordinary shares were offered by us and 9,600,000 ordinary shares were offered by Stevanato Holding S.r.l.. On August 18, 2021 the underwriters further purchased 712,796 newly issued ordinary shares from us and 305,484 ordinary shares from Stevanato Holding S.r.l.

On August 30, 2023, for the purpose of granting of ordinary shares to the beneficiaries of the Restricted Stock Grant Plan Stevanato Group S.p.A. 2021-2022, 364,139 Class A shares held in treasury were converted into ordinary shares and, thereafter, granted to the relevant beneficiary; as a result of such conversion, our share capital (divided into a total of 295,540,036 Shares) included 34,467,144 ordinary shares and 261,072,892 Class A shares.

On September 7, 2023, for the purpose of granting of ordinary shares to directors and employees of the Company or of its subsidiaries as compensation in kind or as benefit, bonus or other premium or incentive (also in execution of the Restricted Stock Grant Plan Stevanato Group S.p.A. 2021-2022), 403,323 Class A shares held in treasury were converted into ordinary shares and, thereafter, granted to the relevant beneficiary; as a result of such conversion, our share capital (divided into a total of 295,540,036 Shares) included 34,870,467 ordinary shares and 260,669,569 Class A shares.

On October 4, 2023, pursuant to an extraordinary shareholders’ meeting, the board of directors, pursuant to Article 2443 of the Italian Civil Code, was delegated the authority to increase the share capital in cash, on one or more occasions, also on a divisible basis pursuant to Article 2439 of the Italian Civil Code, within the term of October 4, 2028, for a maximum amount of €350,000,000.00, including any share premium, by issuing ordinary shares, with no par value, carrying full dividend rights, in one or more tranches, to be offered by excluding the existing shareholders’ pre-emptive right pursuant to Article 2441, Paragraph 4, second sentence, of the Italian Civil Code (and, therefore, within the limit of 10% (ten per cent) of the overall number of Company’s Shares currently outstanding).

iii

Market Share and Other Information

This annual report contains data related to economic conditions in the market in which we operate. The information contained in this annual report concerning economic conditions is based on publicly available information from third-party sources that we believe to be reasonable. Market data and certain industry forecast data used in this annual report were obtained from internal reports and studies, where appropriate, as well as estimates, market research, publicly available information and industry publications. We obtained the information included in this annual report relating to the industry in which we operate, as well as the estimates concerning market shares, through internal research, public information and publications on the industry prepared by official public sources.

There are a number of studies that address either specific market segments, or regional markets, within our industry.

We have reviewed and analyzed data collected by, among others, IQVIA, Alira Health, Roots Analysis, Markets and Markets Research Pvt Ltd., Grand View Research and Evaluate MedTech and Global Data UK Ltd (“Global Data”). However, given the rapid changes in our industry and the markets in which we operate, no industry research that is generally available covers all of the trends we view as key to understanding our industry and our place in it as providers of drug containment, drug delivery and diagnostic solutions for the pharmaceutical, biotechnology and life sciences industries.

Due to the evolving nature of our industry and competitors, we believe that it is difficult for any market participant, including us, to provide precise data on the market or our industry. However, we believe that the market and industry data we present in this annual report provide accurate estimates of the market and our place in it. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as other forward-looking statements in this annual report. We have no reason to believe any of this information or these reports are inaccurate in any material respect and believe and act as if they are reliable. In addition, the data that we compile internally and our estimates have not been verified by an independent source. None of the publications, reports or other published industry sources referred to in this annual report were commissioned by us or prepared at our request. Except as disclosed in this annual report, we have not sought or obtained the consent of any of these sources to include such market data in this annual report.

Rounding

Certain numerical figures, including financial data presented in millions and thousands, have been subject to rounding adjustments and, as a result, the totals of the data may vary slightly from the actual arithmetic totals of such information. In addition, as a result of such rounding, the totals of certain financial information presented in tabular form may differ from the information that would have appeared in such totals using the unrounded financial information.

The financial data in the "ITEM 5. Operating and Financial Review and Prospects" is presented in millions of Euro, while the percentages presented are calculated using the underlying figures in Euro.

Trademarks, Service Marks and Trade Names

We have proprietary rights to trademarks used in this annual report that are important to our business, many of which are registered under applicable intellectual property laws. Solely for convenience, the trademarks, service marks, logos and trade names referred to in this annual report are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names. This annual report contains additional trademarks, service marks and trade names of others, which are the property of their respective owners. All trademarks, service marks and trade names appearing in this annual report are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

iv

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical or present facts or conditions. These forward-looking statements are contained principally in the sections entitled “Risk Factors”, “Operating and Financial Review and Prospects” and “Business.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements which reflect our current views with respect to future events and financial performance. The words “believe,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “plan,” “potential,” “may,” “should,” “expect”, “envisage”, and similar expressions identify forward-looking statements. Forward-looking statements contained in this annual report include, but are not limited to, statements about:

The forward-looking statements in this document are based upon various assumptions, many of which are based, in turn, upon further assumptions, including, without limitation, management’s examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions are reasonable, because these assumptions are inherently subject to significant uncertainties and contingencies that are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections.

In addition to these important factors and matters discussed elsewhere in this annual report, important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include:

v

We caution readers of this annual report not to place undue reliance on these forward-looking statements, which speak only as at their dates. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict all of these factors. Further, we cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement.

vi

PART I

ITEM 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Not applicable.

Not applicable.

ITEM 2. Offer Statistics and Expected Timetable

Not applicable.

Not applicable.

ITEM 3. Key Information

Not applicable.

Not applicable.

Our business, financial condition, results of operations and liquidity can suffer materially as a result of any of the risks described below. While we have described all of the risks we consider material, these risks are not the only ones we face. We are also subject to the same risks that affect many other companies, such as technological obsolescence, labor relations, geopolitical events, climate change and risks related to the conducting of international operations. Additional risks not known to us or that we currently consider immaterial may also adversely impact our businesses. Our businesses routinely encounter and address risks, some of which may cause our future results to be different—sometimes materially different—than we presently anticipate.

Summary

The following summarizes some, but not all, of the risks provided below. Please carefully consider all of the information discussed in this Item 3.D. “Risk Factors” in this annual report on Form 20-F for a more thorough description of these and other risks.

Risks Relating to our Business and Industry

1

2

Risks Relating to our Intellectual Property

Risks Relating to our Shares

3

Risk Factors

Risks Relating to our Business and Industry

Our product offerings are highly complex, and, if our products do not satisfy applicable quality criteria, specifications and performance standards, we could experience lost sales, delayed or reduced market acceptance of our products, increased costs and damage to our reputation.

Most of our products are highly exacting and complex due to their use for containment and injection of biologic drugs and vaccines. Providing high-quality products that deliver specificity, sensitivity and consistency, together with extensive product validation data is a fundamental driver of customer loyalty and our reputation with life sciences researchers. Our operating results depend on our ability to execute and, when necessary, improve our global quality control systems, including our ability to effectively train and maintain our employees with respect to quality control. A failure of our global quality control systems could result in problems with facility operations or preparation or provision of defective or non-compliant products which could ultimately cause harm to the final user. In each case, such problems could arise for a variety of reasons, including equipment malfunction, failure to follow specific protocols and procedures, problems with critical materials and components, failure by one or more of our suppliers to meet our quality requirements, or environmental factors and damage to, or loss of, manufacturing operations. Such problems could affect production of a particular batch or series of batches of products, requiring the destruction of such products or a halt of facility production altogether. Although we currently hold an insurance policy that covers liabilities for defective products and product recalls in amounts we believe to be adequate for our business, our coverage may not be adequate to insure against all product liability claims that may arise which may be particularly high in case failure of our products to meet the appropriate quality standards which may cause product recalls or damages to our customers or ultimate users. As a result of this, product defect claims or product recalls may have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our success depends on our customers’ confidence that we can provide reliable, consistently high-quality products, which also requires us to provide validated data to support our customers’ use of our products. We believe that customers are likely to be sensitive to our products failing to meet the specifications shown on our data sheets. Our reputation and the public perception of our products and technologies may be impaired if our products fail to perform as expected or fail to meet applicable quality criteria, specifications or performance standards. If our products experience, or are perceived to experience, a material defect or error, this could result in loss or delay of sales, damaged reputation, diversion of development resources and increased insurance or warranty costs, any of which could harm our business. These risks may be amplified by our new product lines as we implement appropriate quality control criteria. We are reliant, to an extent, on customer feedback on the quality of our products, and it may take additional time for new products to meet the desired quality standards. Any defects or errors could also result in our inability to timely deliver products to our customers, which could cause disruptions to our customers’ ability to obtain results, narrowing the scope of the use of our products and ultimately hindering our or their success in relevant markets. Even after any underlying concerns or problems are resolved, any lingering concerns regarding our technology, product defects or performance standards could continue to result in lost sales, delayed market acceptance and damaged reputation, among other things. If problems in preparation or manufacture of a product, failure to meet required quality standards for that product or other product defects are not discovered before such product is released to our customers, we may be subject to adverse legal or regulatory actions, including halting of manufacturing and distribution, restrictions on our operations, civil sanctions (including monetary sanctions), and criminal actions. In addition, such problems or failures subject us to other litigation claims, including claims from our customers for reimbursement of the cost of lost or damaged materials. Our customers also require specific information regarding our products and their uses, and any inaccuracies in this information could lead to products being sold for the wrong uses and may result in

4

our having to refund or replace the products in question. Any of the above problems may adversely affect our reputation, business, financial condition and results of operations.

We must develop new products and enhance existing products, adapt to significant technological and innovative changes and respond to introductions of new products by competitors in order to remain competitive.

We sell our products in industries that are characterized by significant technological changes, frequent new product and technology introductions and enhancements and evolving regulatory requirements and industry standards. As a result, our customers’ needs continue to evolve and our products may be superseded by new technologies (for instance, if certain drugs are no longer administered through injection) or their demand may decline. For instance, as our sales and profitability are largely dependent on the sale of products delivered by injection, if our customers reconfigure their drug product or develop new drug products requiring less frequent dosing, our sales and profitability may suffer. Likewise, if we do not appropriately innovate and invest in new products and technologies, and be open to broadening the scope of our offerings, our product offerings may become less desirable in the markets we serve, and, although changing providers is a lengthy process for our customers, they could move to new technologies offered by our competitors, especially if such competitors are able to react more directly and effectively to a customer’s specific demand. Though we believe customers in our markets display a significant amount of loyalty to a particular product, we also believe that because of the initial time investment required by many of our customers to reach a purchasing decision for a new product, it may be difficult to regain a customer once that customer purchases a product from a competitor.

Moreover, there is a risk that significant amounts of time and resources that we invest in research, development and identification of new products may not result in the expected positive results for our business. If we invest our resources into a new product or product enhancements that fail to meet our high-quality standards and market expectations or do not perform as intended, this could adversely affect our business. Our current customers may decide not to purchase these new products or product enhancements and / or purchase a product from a competitor or cease doing business with us altogether. It can take significant time to identify an unmet customer need and develop a product to meet that need, and to the extent we fail to obtain desired levels of market acceptance, our business, financial condition or results of operations could be adversely affected.

Our estimates of our addressable market include several key assumptions based on our industry knowledge, industry publications, third-party research and other surveys, which may be based on a small sample size and may fail to accurately reflect market opportunities. While we believe that our internal assumptions are reasonable, no independent source has verified such assumptions. Industry publications, research, surveys, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable.

If any of our assumptions or estimates, or these publications, research, surveys or studies prove to be inaccurate, then the actual market for our products may be smaller than we expect, and as a result, our product revenue may be limited and our business, financial condition or results of operations could be adversely affected.

Our backlog might not accurately predict our future revenue, and we might not realize all or any part of the anticipated revenue reflected in our backlog.

Our backlog represents, as of a point in time, estimated future revenue for work not yet completed under (i) specific purchase orders, with regards to our Biopharmaceutical and Diagnostic Solution segment, and (ii) certain one-off agreements, with regards to our Engineering segment, where we typically recognize direct revenue over the life of the contract based on our performance of services under the contract. Contracts may be terminated or delayed by our customers or regulatory authorities for reasons beyond our control. To the extent projects are delayed, the timing of our revenue could be affected. In the event a customer terminates a contract, we are generally entitled to be paid for services rendered through the termination date and for services provided in winding down the project. However, we are generally not entitled to receive the full amount of direct revenue reflected in our backlog in the event of a contract termination. The duration of the projects in our backlog, and the related revenue recognition, generally ranges from several months to many years. For orders that are placed inside a contractual firm period, we generally have a contractual right to payment in the event of cancellation. Fluctuations in our reported backlog levels also result from the timing and order pattern of our customers who often seek to manage their level of inventory on hand. Because of customer ordering patterns, our backlog reported for certain periods may fluctuate and may not be indicative of future results. A number of factors may affect backlog and the direct revenue generated from our backlog, including:

5

Our backlog at December 31, 2023 was approximately €944.9 million compared to €957.0 million as of December 31, 2022. Although an increase in backlog will generally result in an increase in future direct revenue to be recognized over time (depending on future contract modifications, contract cancellations and other adjustments), an increase in backlog at a particular point in time does not necessarily correspond to an increase in direct revenues during a particular period. The timing and extent to which backlog will result in direct revenue depends on many factors, including the production and timing expected by our customers, the timing of the commencement of work, the rate at which we perform services, scope changes, cancellations, delays, receipt of regulatory approvals and the nature, duration, size, complexity and phase of the project. In addition, the uncompleted portion of delayed projects remain in backlog until they are canceled or completed. As a result of these factors, our backlog is not necessarily a reliable indicator of future direct revenue and we might not realize all or any part of the direct revenue from the authorizations in backlog as of any point in time.

If we fail to maintain and enhance our brand and reputation, our business, results of operations and prospects may be materially and adversely affected.

We believe that maintaining and enhancing our brand and reputation are of significant importance to the success of our business. We work to set a very high standard for the quality of our products and our ethical business practices, and we believe that this has been crucial to our success. We have employed and will continue to employ different types of consumer experience and interaction engagements designed to gauge consumer satisfaction with our products, and we also engage in rigorous product validation in order to continue to improve our product quality. We cannot assure you, however, that these activities will be successful or that we will be able to continue to maintain our brand and reputation as we expect. If our brand strength deteriorates, or if our brand is no longer associated with high-quality products, it could lead to fewer publication citations for our products, which could in turn further weaken our brand recognition and reputation. In addition, our competitors may increase the intensity of their consumer interactions or customer feedback processes, which may force us to increase our advertising spend to engage with our customer base and maintain brand and reputational awareness.

In addition, any negative publicity relating to our products or services, regardless of its veracity, could harm our brand and the perception of our brand in the market. With an increasing global focus on ethical business practices and good corporate behavior, and with such issues directly influencing consumer behavior, any failure to achieve or maintain the levels of corporate governance, social and environmental impact and corporate behaviors expected of us, including demonstrating dedication to the benefits of diversity, could negatively impact our brand and reputation.

If our brand is harmed, we may not be able to gain new customers or continue to maintain positive relationships with our customers, and our business, prospects, financial condition and results of operations could be materially and adversely affected.

Part of our growth strategy is to increase direct customer interactions in multiple countries. Failure to anticipate and react to particular geographic requirements and sensitivities may have a negative impact on our brand and reputation, which may result in a decrease in sales or sales growth in such countries, which may adversely affect our business, prospects, financial condition and results of operations.

We are highly dependent on our management and employees. Competition for our employees is intense, and we may not be able to attract and retain the highly skilled employees that we need to support our business and our intended future growth.

Our success largely depends on the skills, experience and continued efforts of our management, including our Executive Chairman, our Chief Executive Officer and our senior leadership, as well as of our research and development and highly skilled employees. The replacement of certain members of our global leadership team would likely involve the expenditure of significant time and financial resources, and the loss of any such individual may significantly delay or prevent the achievement of our business objectives. Likewise, the members of our research and development team and our highly skilled employees, whom our customers and competitors often seek to engage, may be difficult to replace in light of their sophisticated skills and experience and a shortage of such employees could

6

disrupt our operations. As we continue to grow, our success also depends on our ability to attract, motivate and retain highly qualified individuals who will also fit within our culture. Competition for senior management and other personnel in our industry is intense, and the pool of suitable candidates is limited. If qualified personnel become scarce or difficult to attract or retain in our industry for compensation-related or other reasons, we could experience higher labor, recruiting or training costs. Further, new hires may require significant training and time before they achieve full productivity and may not become as productive as we expect. The failure to attract, retain and properly motivate members of our senior management team and other employees, to find suitable replacements for them in the event of death, illness or their desire to pursue other professional opportunities, or to maintain our corporate culture as we continue to grow, could have a negative effect on our operating results.

Our business, financial condition and results of operations depend upon maintaining our relationships with suppliers and service providers.

Our results of operations have been, and will continue to be, dependent in part on our ability to obtain favorable terms from our suppliers and services providers, including logistics service providers. These terms may change from time to time, and such changes could adversely affect our gross margins over time. In addition, our cash flows could be adversely impacted by the acceleration of payment terms to our suppliers and/or the imposition of more restrictive credit terms and other contractual requirements. Further, if for any reason we enter into a contract with a supplier on unfavorable terms, it may harm our ability to negotiate our future contracts with that supplier or with other suppliers.

The loss of one or more of our large suppliers including as a result of consolidation, a material reduction in their supply of products or provision of services to us, extended disruptions or interruptions in their operations or material changes in the terms we obtain from them, could have a material adverse effect on our business, financial condition and results of operations.

Our business, financial condition and results of operations depend upon the availability and price of high-quality materials and energy supplies and our ability to contain production costs.

Our operations depend upon our ability to obtain high-quality materials and energy supplies at reasonable prices, therefore maintaining low production costs. Our ability to maintain an adequate supply of such materials and energy could be impacted by the availability and price of those materials and energy, the failure to maintain relationships with suppliers and any of such materials being proven to be toxic or otherwise inadequate to be used for the intended purpose. While we may seek to minimize the impact of price increases and potential shortages by, among other things, entering into long-term supply agreements, maintaining commercial relationships with multiple suppliers when possible, increasing our own prices and implementing cost-saving measures, our result of operations and cash flows could be adversely affected in the event these measures are insufficient to cover our costs. With respect to energy supplies, the current conflict between Russia and Ukraine and the financial and economic sanctions imposed by the European Union, the U.S., the United Kingdom and other countries and organizations against officials, individuals, regions, and industries in Russia and Belarus have caused significant fluctuations in gas and energy prices, and may further negatively impact our ability to source gas at commercially reasonable terms, or at all. Moreover, while we aim to maintain a large network of product suppliers, we are unable to predict any interruption or disruption in service from our key suppliers. In particular, for some of the materials we use in our production cycles we have a limited number of (or a single-source) suppliers worldwide, and selecting new suppliers would be a lengthy and time consuming process. Any interruption or disruption in service from particular suppliers of materials could lead to interruptions or stoppages in such deliveries which could, in turn, adversely affect our operations until arrangements with alternative suppliers are put into place. If this occurs, we could expend substantial resources and time in re-establishing relationships with third-party suppliers that meet the appropriate quality, cost and regulatory requirements needed for commercially viable manufacturing of our products. If we are unable to obtain the materials we need at reasonable prices or at all, we may not be able to produce certain of our products at a marketable price or at all. If our supply of materials and components is adversely affected, including as a result of the conflict between Russia and Ukraine and the conflicts in the Middle East, we could damage our relationship with current and prospective customers and our operating results and financial condition could be adversely affected.

Moreover, we are dependent upon the ability of our suppliers to provide materials that meet our quality standards, as well as delivery schedules. Our suppliers’ failure to provide expected materials that meet such criteria could adversely affect production schedules and contract profitability.

7

The continued supply of high-quality third-party materials and energy from our suppliers is subject to a number of risks, including:

Moreover, global cost inflation trends have had an effect on and could continue to unfavorably impact pricing from our suppliers, which in turn could impact our gross margins to the extent we are unable to pass along price differences to our customers.

If we experience problems with suppliers, we may not be able to find acceptable alternatives, and any such alternatives could result in increased costs for us and possible forward losses on certain contracts. Even if acceptable alternatives are found, the process of locating and securing such alternatives might be disruptive to our business, might lead to termination of our supply agreements with our customers and might disrupt the operations of our customers leading to potential claims, any of which could adversely affect our business, financial condition and results of operations.

Significant interruptions in our operations could harm our business, financial condition and results of operations.

Manufacturing, distribution, service and logistics problems can and do arise, particularly in light of geopolitical conflicts, and any such problems could have a significant impact on our business, financial condition and results of operations. Accordingly, any significant disruptions to the operations of our manufacturing or distribution centers or logistics providers for any reason, including labor relations issues, power interruptions, severe weather, fire or other circumstances beyond our control could cause our cost of sales and operating expenses to increase without coverage or compensation or seriously harm our ability to fulfill our customers’ orders or deliver products on a timely basis, or both. Likewise, our ability to meet our customers’ needs and expectations may be frustrated by delays, issues or interruptions in ramping up new production lines or plants. We must also maintain sufficient production capacity in order to meet anticipated customer demand, which carries fixed costs that we may not be able to offset if orders slow, which would adversely affect our operating margins. If we are unable to manufacture our products consistently, in sufficient quantities and on a timely basis, our revenue, gross margins and our other operating results will be materially and adversely affected. Prompt shipment of our products is also very important to our business. If we experience significant delays in our manufacturing, shipping or logistics processes, this could cause disruption to our customers and damage our current and future customer relationships and may adversely affect our business. Such delays may also adversely impact our new product development. For example, if we were to lose one of our sites where new product development is undertaken, we may not be able to transfer or replicate that product development at another site, with the result of lost time and financial costs of developing the new product. We may also use high-risk chemicals in the manufacture of certain of our products, which are subject to handling risks, and any disruption in our ability to source or appropriately store these chemicals could adversely affect our manufacturing operations.

8

As a consequence of the COVID-19 pandemic, sales of syringes and vials to and for vaccination programs had globally increased resulting in a revenue growth acceleration. The demand for such products related to COVID-19 may continue to shrink, if the need for COVID-19 related solutions continues to decline.

During COVID-19, we increased production capacity to support our customers’ efforts in rapidly responding to COVID-19. In this context we have provided: (i) glass vials and syringes to approximately 90% of marketed vaccine programs, according to our estimates based on public information (WHO, EMA, FDA); and (ii) plastic diagnostic consumables for the detection and diagnosis of COVID-19. COVID-19 generated increased demand for our products and services. We expect demand for COVID-19 related products to continue to reduce as a result of the transition from pandemic to endemic status.

There remains some uncertainty around the magnitude of the long-term impact of COVID-19 on demand for our products, but we anticipate that COVID-19 contributions will continue to decrease and potentially transition into a part of our traditional vaccination business.

A lower rate of increase or a decline in sales of syringes and vials to and for vaccination programs, plastic diagnostic consumables for COVID-19 testing, and related products and services could adversely affect our business, financial condition and results of operations.

Our manufacturing facilities are subject to operating hazards which may lead to production curtailments or shutdowns and have an adverse effect on our business, results of operations, financial condition or cash flows.

Certain of our manufacturing processes involve heating glass to extremely high temperatures, forming plastic and operating heavy machinery and equipment, which entail a number of risks and hazards, including industrial accidents, leaks and ruptures, explosions, fires, mechanical failures and environmental hazards, such as spills, storage tank leaks, discharges or releases of toxic or hazardous substances and gases, including into the environment. Any of these events, which are generally more likely to occur as our machines approach time for refurbishment, could lead to requirements for environmental remediation and civil, criminal and administrative sanctions and liabilities. These hazards may cause unplanned business interruptions (also as a consequence of remediation actions), unscheduled downtime, transportation interruptions, personal injury and loss of life, severe damage to or the destruction of property and equipment, environmental contamination and other environmental damage, civil, criminal and administrative sanctions and liabilities and third-party claims, any of which may have a material adverse effect on our business, financial condition, results of operations and cash flows.

In addition, under applicable local laws, including Italian law, our directors and officers may be subject to criminal liability, in connection with injuries occurred to our employees, as a result of workplace health and safety violations by reason of their position as employers (posizione di garanzia). Convictions of our directors and officers could negatively impact our reputation. Moreover, due to the long industrial history of our manufacturing facilities and the subsequent lack of detailed information regarding historical waste and chemical storage and disposal, the risk of soil, water or groundwater contamination and related civil, administrative and criminal liabilities cannot be eliminated.

We may face significant competition in implementing our strategies for revenue growth in light of actions taken by our competitors.

In each business segment in which we operate, we face significant competition, with many competitors focusing on specific regions, customers and/or specific product segments. Competitors range from smaller, specialized companies, which may be able to more quickly respond to customers’ specific needs, to large multinational companies who provide a full suite of products, which may have greater financial, marketing, operational and research and development resources than we do. Such greater resources may allow our competitors to respond more effectively with new, alternative or emerging technologies. Failure to anticipate and respond to our competitors’ actions may impact our future sales and earnings, in particular failure to react to competitors strengthening their brand, marketing or customer experience may negatively impact our ability to attract and retain customers.

We are pursuing a number of strategies to maintain and improve our revenue growth, including:

9

We may not be able to successfully implement these strategies, and these strategies may not result in the desired growth of our business. Failure to anticipate and respond to our competitors’ actions may adversely affect our business, financial condition and results of operations.

Our business may be harmed if our customers discontinue or spend less on research, development, production or other scientific endeavors.

Our customer base includes leading pharmaceutical, biologic, diagnostic and medical device companies worldwide. Many factors, including public policy spending priorities, available resources and product and economic cycles, have a significant effect on the capital spending policies of these entities. For instance, any change in the international healthcare systems, including the Patient Protection and Affordable Care Act (the “PPACA”) in the U.S., resulting in a reduced ability of pharmaceutical companies and healthcare providers to receive reimbursements by government authorities, private insurers and other third-party payers for the costs of our products, could result in reduced demand for our products.

More recently, the Inflation Reduction Act (the "IRA") was signed into law. Among other things, the IRA requires manufacturers of certain drugs to engage in price negotiations with Medicare (beginning in 2026) with prices that can be negotiated subject to a cap; imposed rebates under Medicare Part B and Medicare Part D to penalize price increases that outpace inflation (first due in 2023); and replaces the Part D coverage gap discount program with a new discounting program (beginning in 2025), all factors which could impact our business by affecting our ability to achieve value-based price, maintaining an acceptable return on our investments in R&D of our products, creating a potential financial impact to the Company to the extent our products are used in connection with drugs that are impacted by the IRA pricing provisions under the IRA and impacting our ability to research and develop new products.

Fluctuations in the research and development budgets of our customers could have a significant effect on the demand for our products. Our customers determine their research and development budgets based on several factors, including the need to develop new products, continued availability of governmental funding and other incentives, competition and the general availability of resources. Any reduction in research and development budgets or a shift of any funding source currently allocated to our business sector to different areas of research, could adversely affect our business, financial condition and results of operations.

The loss of a significant number of customers or a reduction in orders from a significant number of customers could reduce our sales and harm our financial performance.

Our operating results could be negatively affected by the loss of revenue from a significant number of our customers. Our revenue is fairly well distributed, with 45.5% of our revenues deriving from our top ten customers and one individual customer representing 11.4% of revenues in 2023. However, consolidation within our customer base,

10

including, in particular, among pharmaceutical companies, may give larger customers greater bargaining and buying power and operational sophistication, which can enable them to operate with reduced inventories. In addition, consolidation among our customers may lead them to rely on a reduced number of suppliers, with no assurance that they will continue using our products.

We maintain close business relationships with certain customers, working closely to build the specific custom tools they need, which will then become part of our product portfolio. Our operating results could be adversely affected by the loss of a significant number of these customers, particularly during the product development phase.

Our customer contracts generally do not contain minimum purchase requirements, and a significant portion of our sales are on a purchase order basis. Therefore, our customers are generally not obligated to purchase any fixed quantities of products, and they may stop placing orders with us at any time. If a significant number of customers purchase fewer of our products, defer orders or fail to place additional orders with us for any reason, our sales could decline, and our operating results may not meet our expectations. In addition, if those customers order our products, but fail to pay on time or at all, our liquidity and operating results could be adversely affected.

The level and timing of orders placed by our customers vary for different reasons, including individual customer strategies, the introduction of new technologies, the desire of our customers to reduce their exposure to any single supplier and general economic conditions. If for example customers vary or decrease the level of inventories they are holding of our products at their sites by engaging in de-stocking or new ordering patterns, or if we otherwise have decreased visibility of our products held by or on behalf of our customers, our business could be adversely affected.

If we are unable to anticipate and respond to the demands of our customers, if we have an inadequate supply of products, insufficient capacity in our sites or if we experience any disruptions to our supply chain or distribution network, we may lose customers. Alternatively, we may have excess inventory or excess capacity, and either of these factors may have a material adverse effect on our business, financial condition and results of operations.

Our business may suffer if we do not successfully manage our current and potential future growth.

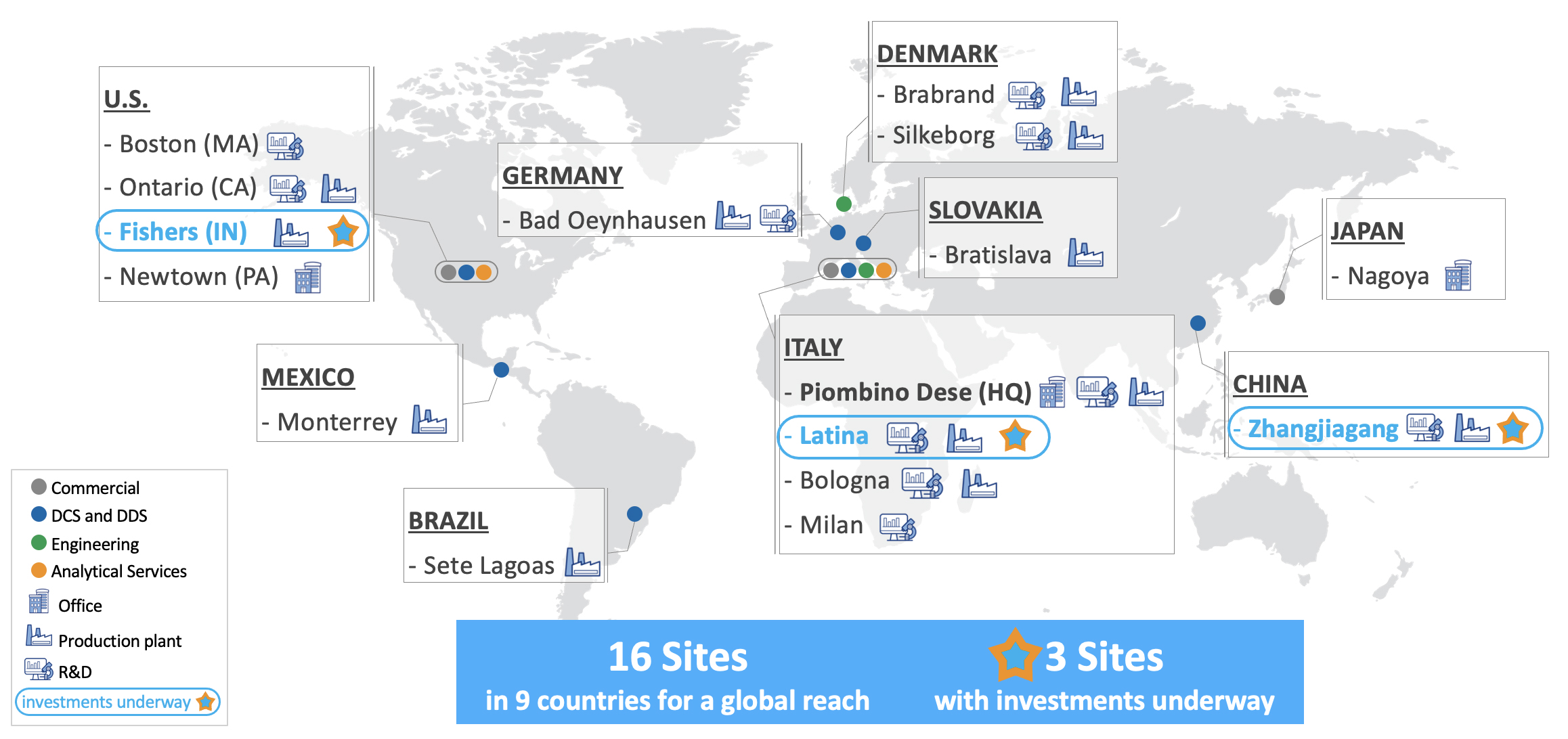

Over the last 70 years we have consistently expanded our operations and anticipate expanding further as we pursue our long-term growth strategy. The key elements of our growth strategy include, among other things, the expansion of our global market position in drug containment solutions and drug delivery systems, accelerating penetration in life sciences systems, increasing our investments in research and development, building on our expertise in manufacturing, assembly and inspection systems for drug containers and complex, multi-component systems, leveraging our scientific and engineering capabilities, increasing our penetration in the North American and APAC regions and selectively pursuing acquisitions and technology partnerships to augment and expand our product and service portfolio. We have further expanded our manufacturing facilities in Piombino Dese (Italy) and established new plants primarily for EZ-Fill® products, with strong focus on biologics and vaccines, in Fishers (Indiana, U.S.), and Latina (Italy) and evaluated strategic acquisitions to broaden our offering, our technical know-how and our international footprint. In November 2021, we entered into an investment agreement with the Zhangjiagang Economic and Technological Development Zone Administration Committee. Under said investment agreement, we agreed to invest through one of our subsidiaries, in the Zhangjiagang Economic and Technological Development Zone ("ZETDZ"), to be used for the manufacture of ready to use syringes and vials, bulk vials and cartridges, and for the SG Engineering business. In March 2023, we we decided to delay the timing of our investment in China in order to focus on the execution of our new manufacturing facilities in the United States and Italy.

In December 2021, we entered into an Early Development Agreement (“EDA”) with the City of Fishers – Indiana, Fishers Town Hall Building Corporation and City of Fishers Redevelopment Commission envisaging the acquisition of an area of approximately 35.75 acres to be used for the construction of a new plant in Indiana (U.S.). The new manufacturing plant is expected to launch commercial production in 2024.

In addition, on May 27, 2022, Nuova Ompi acquired a brownfield in Latina (Italy) in proximity to other Stevanato Group facilities for a total consideration of approximately €16.0 million. The facility, after renovation, is expected to produce EZ-fill® syringes and cartridges. The new manufacturing plant launched commercial production in the fourth quarter of 2023.

11

On November 8, 2023, we acquired all of the business operations of Perugini S.r.l., an Italian company specialized in the manufacturing of consumables and mechanical components for industrial machines for a total consideration of approximately €6.4 million. The acquisition of Perugini will support the Group's efforts in the ongoing integration of critical technologies and processes into the Group’s production process.

Establishing new production plants for EZ-Fill® products represents a priority in light of the risks associated with our Piombino Dese (Italy) manufacturing facilities currently being the only ones devoted to the production of EZ-Fill® products which, in turn, exposes our business to risks of material disruption should any event affect the operation of such facilities. In general, such growth strategy and in particular the facilities expansion and the external acquisitions increase the complexity of our business and place a significant strain on our management, operations, technical systems, financial resources and internal control over financial reporting functions. Our current and planned personnel, systems, procedures and controls may not be adequate to support and effectively manage our future operations, especially as we employ personnel and maintain manufacturing facilities and distribution networks in several geographic locations.

We are also continuously expanding our product portfolio, and establishing and developing new products require significant management time and attention. If these products do not achieve the anticipated success or require greater levels of time and investment to reach the expected levels, it could adversely affect our business, financial condition and results of operations. Failure to appropriately integrate new products and business lines into our existing operations and systems can also affect the success of these products, and failure to adequately anticipate and plan for this integration could affect the success of these products and may also negatively impact our existing product offerings.

We may not successfully identify or integrate acquired businesses or assets into our operations or be able to fully recognize the anticipated benefits of businesses or assets that we acquire.

We consider acquisitions a useful instrument to complement our organic growth. We opportunistically explore acquiring other businesses and assets, and we have several acquisitions over the last few years, including: the acquisition of a 65% stake in the Danish SVM Automatik in February 2016 and of the remaining 35% in October 2021, the acquisition of the operating unit of Balda Group in March 2016, the acquisition of Medirio in May 2016 and the acquisition of the remaining 49% of our subsidiary Ompi of Japan Co. Ltd in July 2023.

On November 8, 2023, we acquired all of the business operations of Perugini S.r.l., an Italian company specialized in the manufacturing of consumables and mechanical components for industrial machines for a total consideration of approximately €6.4 million. The acquisition of Perugini will support the Group's efforts in the ongoing integration of critical technologies and processes into the Group’s production process.

However, we may be unable to identify or complete promising acquisitions for many reasons, including any misjudgment of the key elements of an acquisition, competition among buyers, the high valuations of businesses in our industry, the need for regulatory and other approvals, lack of internal resources to successfully pursue all attractive opportunities and availability of capital.

When we do identify and complete acquisitions, we may face financial, managerial and operational challenges, including diversion of management attention and resources needed for existing operations, difficulties with integrating acquired businesses, integration of different corporate cultures, increased expenses, potential dilution of our brand, assumption of unknown liabilities, potential disputes with the sellers and the need to evaluate the financial systems of and establish internal controls for acquired entities. Further, we seek out acquisitions of companies that maintain the same high quality standards that we maintain, and if we misjudge or overestimate a company’s product quality standards, we may not be able to use these products or implement the strategies that were the primary reason for the acquisition, which would lead to a significant loss both financially and in time spent by our teams trying to integrate the product or implement the strategy. There can be no assurance that we will engage in any additional acquisitions or that we will be able to do so on terms that will result in any expected benefits.

In addition, our ability to realize the benefits we anticipate from our acquisition activities, including any anticipated sales growth, cost synergies and other anticipated benefits, will depend in large part upon whether we are able to integrate such businesses efficiently and effectively. Integration is an ongoing process, and we may not be able to fully integrate such businesses smoothly or successfully, and the process may take longer than expected. Further, the integration of certain operations and the differences in operational culture following such activity will continue to

12

require the dedication of significant management resources, which may distract management’s attention from day-to-day business operations.

There may also be unasserted claims or assessments that we failed or were unable to discover or identify in the course of performing due diligence investigations of target businesses. While we normally negotiate representation and warranties and related indemnification in relation to such acquisitions, these may not be enough to cover our exposure if a significant liability arises in connection with any acquisition agreement. We cannot assure you that these indemnification provisions will protect us fully or at all, and as a result we may face unexpected liabilities that could adversely affect our business, financial condition and results of operations.

If we are unable to successfully integrate the operations of acquired businesses into our business, we may be unable to realize the sales growth, cost synergies and other anticipated benefits of such transactions, and our business, results of operations and cash flow could be adversely affected.

Our reputation, ability to do business and results of operations may be impaired by improper conduct by any of our employees, agents or business partners.

We cannot provide assurance that our internal controls and compliance systems will always protect us from acts committed by employees, agents or business partners of ours (including third-party suppliers, distributors or of businesses we acquire or partner with) that would violate U.S. and/or other national laws, including the laws governing payments to government officials, bribery, fraud, kickbacks and false claims, pricing, sales and marketing practices, conflicts of interest, competition, export and import compliance, money laundering and data privacy. In particular, the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments for the purpose of obtaining or retaining business. Any improper actions by our employees, suppliers and distributors or allegations of such acts could damage our reputation and subject us to civil or criminal investigations in Italy, under Italian Legislative Decree No. 231 of June 8, 2001 (the “Decree 231”) pursuant to which a legal entity can be held liable to pay fines in connection with certain criminal offenses committed, inter alia, by its directors, officers or employees, the United States and in other jurisdictions, and any related shareholder lawsuits could lead to substantial civil and criminal, monetary and nonmonetary penalties and could cause us to incur significant legal and investigatory fees. In particular, pursuant to Decree 231, a defense can be established by an entity involved in a Decree 231 investigation, if such entity can prove, among others, that it adopted and properly implemented an organization, management and control model aimed at effectively preventing the commission of the criminal acts involved prior to such unlawful conduct having taken place. We approved and adopted the current (fourth) version of our organization, management and control model provided by Decree 231 (“Model 231”) by means of a resolution of the board of directors dated November 4, 2022, and appointed the current supervisory body (the “Supervisory Body”) that supervises the functioning of and compliance with Model 231, and monitors and assesses the implementation status of preventive measures, with regular yearly reports to the board of directors. The adoption of organization and management models does not by itself exclude applicability of the penalties provided by Decree 231. In fact, upon commission of an offense resulting in administrative liability of the Company pursuant to Decree 231, the court will evaluate the models and their actual implementation.

Failure to comply with Decree 231 could result in the imposition of administrative sanctions such as monetary sanctions and other types of sanctions, if applicable (e.g., interdictory sanctions, including prohibitions such as participation in public tenders or the termination of a public contract already awarded, confiscation of the price or profits deriving from the crime and publication of the judgment) and loss of confidence of our customer base, which could have a material adverse effect on the business, financial condition, results of operations and prospects of the Group.

In addition, a government may seek to hold us liable as a successor for violations committed by companies in which we invest or that we acquire.

We also rely on our suppliers to adhere to our supplier standards of conduct, and material violations of such standards of conduct could occur that could have a material effect on our business, reputation, financial condition and results of operations.

13

Our global operations are subject to international market risks that may have a material effect on our liquidity, financial condition, results of operations and cash flows.

We operate manufacturing facilities in Italy, Slovakia, Denmark, Germany, United States, Mexico, China and Brazil, and sell and distribute our products in more than 70 countries. As part of our business strategy, we will continue to seek to expand our sales and market share in various international markets in which we currently operate and evaluate expansion opportunities into additional international markets. The economies of some of these markets differ from the economies of our core markets factors in Europe and in some cases present new and greater risks. Our financial results and operations are substantially dependent upon macro-economic and political conditions, particularly in Italy, Slovakia, Denmark, Germany, United States, Mexico, China and Brazil, where we operate manufacturing facilities. High levels of sovereign debt in certain countries (including Italy), combined with increasing inflation, weak growth, political instability and high unemployment rates, could lead to additional fiscal reforms (including austerity measures), sovereign debt restructurings, currency instability, increased counterparty credit risk, high levels of volatility and, potentially, disruptions in the credit and equity markets, as well as other outcomes, each of which, alone or combined with other factors, could have a material adverse effect on our business, results of operations, access to credit and capital markets and, therefore, our ability to implement our growth strategy.

Global conflicts, including the recent developments in the Middle East and the ongoing military actions undertaken by Russian military forces against Ukraine have created and are likely to continue creating substantial disruptions. In particular, military actions against Ukraine, as well as the measures adopted, or that may be adopted, by other countries in response to these events, including new and stricter sanctions by the European Union, the U.S., the United Kingdom and other countries and organizations against officials, individuals, regions, and industries in Russia and Belarus (or other countries that were to become involved), have unfavorably affected our operations primarily due to fluctuations in gas and electricity prices, and could have a material adverse effect on our operations going forward. We are monitoring the conflict and continue to attempt to mitigate the effects of such conflict on our operations to the extent possible, but do not and cannot know if this situation may result in additional broader economic and security conditions or in material implications for our business. Currently, the Group's operations in Italy have the highest gas consumption across its European operations. In 2022 and continuing in 2023 the Italian government has taken steps to shore up its natural gas supplies and lower its dependence on Russian supplies. Italy has signed agreements with several other countries to diversify the country's natural gas sources, and Algeria is now the largest supplier of natural gas to Italy. In addition, the Group believes it may be eligible for priority status since its business operations are devoted to the delivery of mission-critical pharmaceutical products.

Macro-economic difficulties and political instability remain particularly evident in Italy. The Italian economy, along with certain other European economies, has from time to time experienced significant financial market volatility and economic adversity due to concerns about economic downturn, political instability and rising government debt levels. Interest rates on Italy's sovereign debt may rise to levels that may make it difficult for it to service high debt levels without significant financial help from the EU and could potentially lead to default. These events have in the past adversely impacted the Italian economy, causing credit agencies to lower Italy’s sovereign debt rating, and could decrease outside investment in Italian companies. Any further downgrade of the Italian sovereign debt rating could create additional economic uncertainty and negatively impact Italy’s growth, which could in turn affect consumer confidence, discretionary spending and, consequently, demand for our products.

Furthermore, policies, measures, controls or other actions implemented by the governments of emerging markets or countries which we target for increased sales may restrict our business operations or harm our financial results.

As a result, our revenue is exposed to risks inherent to the country where we operate or intend to operate including risks related to differing political, legal, regulatory and economic conditions and regulations.

As a multinational corporation, we are exposed to fluctuations in currency exchange rates and interest rates, which could adversely affect our cash flows and results of operations.

International markets contribute a substantial portion of our revenue, and we intend to continue expanding our presence globally. The exposure to fluctuations in currency exchange rates takes on different forms. Revenue and costs are subject to the risk that fluctuations in exchange rates could adversely affect our reported revenue and profitability when translated into Euro for financial reporting purposes. These fluctuations could also adversely affect the demand for products and services provided by us. As a multinational corporation, our businesses often invoice

14

third-party customers in currencies other than the one in which they primarily do business (the “functional currency”), especially U.S. Dollars and the Mexican Pesos. Movements in the invoiced currency relative to the functional currency could adversely impact our cash flows and our results of operations. As our international sales grow, exposure to fluctuations in currency exchange rates could have a larger effect on our financial results. Similarly, the current conflict between Russia and Ukraine has created extreme volatility in the capital markets and is expected to have further global economic consequences.

The deterioration of the sovereign debt of several countries, together with the risk of contagion to other, more stable, countries, has exacerbated the global economic crisis. In particular, a deterioration in general economic conditions caused by instability in the Eurozone could have a material adverse effect on our business, financial condition, results of operations and prospects.

We are required to comply with a wide variety of laws and regulations and are subject to regulation by various federal, state and foreign agencies.

In all the jurisdictions in which we operate, we are subject to a number of laws, regulations and practices concerning, inter alia, the health and safety of our employees, the use, manufacture and importing of chemicals and the protection of the environment and natural resources.

In the event that the applicable laws and regulations were to change such that our products or our production processes were subject to greater regulatory control or restrictions, it could have a significant impact on our ability to market and sell our products and could require us to spend significant amounts to ensure and monitor compliance with such laws and regulations such that our business, financial condition and results of operations could be adversely affected. For instance, both the EU and the United States are considering to further restrict in the next years the use of ethylene oxide, the main sterilizing agent used in our production processes. If the use of ethylene oxide is further restricted, or completely banned, this would require us to identify new sterilizing agents and would have a negative impact on our financial condition and results of operations.

We are also subject to a variety of federal, state, local and international laws and regulations that govern, among other things, the importation and exportation of products, the handling, transportation and manufacture of substances that could be classified as hazardous, laws governing government contracts and our business practices such as anti-corruption and antitrust laws. Although we believe that we comply in all material respects with applicable laws and regulations, there can be no assurance that a regulatory agency or tribunal would not reach a different conclusion concerning the compliance of our operations with applicable laws and regulations.

In addition, there can be no assurance that we will be able to maintain or renew existing permits, licenses or other regulatory approvals or obtain, without significant delay, future permits, licenses or other approvals needed for the operation of our businesses. Furthermore, loss of a permit, license or other approval in any one portion of our business may have indirect consequences in other portions of our business if regulators or customers, for example, cease doing business with such other portion due to fears that such loss is a sign of broader concerns about our ability to deliver products or services of sufficient quality.

Any noncompliance by us with applicable laws and regulations or the failure to maintain, renew or obtain necessary permits and licenses could have an adverse effect on our business, financial condition and results of operations.

Failure to comply with these laws and regulations can lead to agency action, including warning letters, product recalls, product seizures, monetary sanctions, injunctions to halt manufacturing or distribution, restrictions on our operations, withdrawal of existing or denial of future approvals, permits or registrations, including those relating to products or facilities and civil and criminal sanctions. To the extent these agencies were to take enforcement action, such action may be made publicly available, and such publicity could harm our ability to sell these regulated products globally and may harm our reputation. In addition, such actions could limit the ability of our customers to obtain regulatory clearance or approval for their products in the United States or abroad and/or our customers may incur significant costs in obtaining or maintaining such regulatory clearances or approvals in the United States or abroad. In addition, any such failure relating to the products we provide exposes us to direct and third-party product liability claims as well as contractual claims from our customers, including claims for reimbursement for lost or damaged products, as well as potential recall liability, which could be significant. Customers may also claim loss of profits due

15