Stevanato Group Q1 2024 Financial Results May 9, 2024 Exhibit 99.1

Q1 2024 Financial Results Safe Harbor Statement Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of Stevanato Group S.p.A. (“we”, “our”, “us”, “Stevanato Group” or the “Company”) and which involve known and unknown risks, uncertainties and assumptions because they relate to events and depend on circumstances that will occur in the future whether or not outside the control of the Company. These forward-looking statements include, or may include words such as “will,” ” believe,” “growth,” “driving,” “increasing,” “objectives,” “expanded,” “guidance,” “expect,” “expansion,” “advance,” “expanding,” “future,” “trends” and other similar terminology. Forward-looking statements contained in this presentation include, but are not limited to, statements about: our future financial performance, including our revenue, operating expenses and our ability to maintain profitability and operational and commercial capabilities; our ability to capitalize on opportunities, drive long term organic growth, leverage our product portfolio and build shareholder value; our expectations regarding the development of our industry and the competitive environment in which we operate; the expansion of our plants and our expectations to increase production capacity; the global supply chain and our committed orders; the continued global response to COVID-19 and our role in it; customer demand and customers’ ability to destock higher inventories accumulated during the COVID-19 pandemic; developments in demographic trends; expansions of vaccinations programs and access to healthcare in developing countries; our geographical and industrial footprint; our goals and capital expenditures projects and our strategies and investment plans. These statements are neither promises nor guarantees but involve known and unknown risks, uncertainties and other important factors and circumstances that may cause Stevanato Group’s actual results, performance or achievements to be materially different from its expectations expressed or implied by the forward-looking statements, including, but not limited to the following: (i) our product offerings are highly complex, and, if our products do not satisfy applicable quality criteria, specifications and performance standards, we could experience lost sales, delayed or reduced market acceptance of our products, increased costs and damage to our reputation; (ii) we must develop new products and enhance existing products, adapt to significant technological and innovative changes and respond to introductions of new products by competitors to remain competitive; (iii) if we fail to maintain and enhance our brand and reputation, our business, results of operations and prospects may be materially and adversely affected; (iv) we are highly dependent on our management and employees. Competition for our employees is intense, and we may not be able to attract and retain the highly skilled employees that we need to support our business and our intended future growth; (v) our business, financial condition and results of operations depend upon maintaining our relationships with suppliers and service providers; (vi) our business, financial condition and results of operations depend upon the availability and price of high-quality materials and energy supply and our ability to contain production costs; (vii) significant interruptions in our operations could harm our business, financial condition and results of operations; (viii) as a consequence of the COVID-19 pandemic, global sales of syringes and vials to and for vaccination programs had increased, resulting in a revenue growth acceleration. The demand for such products may continue to shrink if the need for COVID-19 related solutions continues to decline; (ix) our manufacturing facilities are subject to operating hazards which may lead to production curtailments or shutdowns and have an adverse effect on our business, results of operations, financial condition or cash flows; (x) our business, financial condition and results of operations may be impacted by our ability to successfully expand capacity to meet customer demand; (xi) the loss of a significant number of customers or a reduction in orders from a significant number of customers, including through destocking initiatives or lack of transparency of our products held by customers, could reduce our sales and harm our financial performance; (xii) we may face significant competition in implementing our strategies for revenue growth in light of actions taken by our competitors; (xiii) our global operations are subject to international market risks that may have a material effect on our liquidity, financial condition, results of operations and cash flows; (xiv) we are required to comply with a wide variety of laws and regulations and are subject to regulation by various federal, state and foreign agencies; (xvi given the relevance of our activities in the healthcare sector, investments by non-Italian entities in the Company, as well as certain asset disposals by the Company, may be subject to the prior authorization of the Italian Government (so called “golden powers”); (xvi) if relations between China and the United States deteriorate, our business in the United States and China could be materially and adversely affected; (xvii) cyber security risks and the failure to maintain the confidentiality, integrity and availability of our computer hardware, software and internet applications and related tools and functions, could result in damage to our reputation, data integrity and/or subject us to costs, fines or lawsuits under data privacy or other laws or contractual requirements; (xviii) our trade secrets may be misappropriated or disclosed, and confidentiality agreements with directors, employees and third parties may not adequately prevent disclosure of trade secrets and protect other proprietary information; (ixx) if we are unable to obtain and maintain patent protection for our technology, products and potential products, or if the scope of the patent protection obtained is not sufficiently broad, we may not be able to compete effectively in our markets; (xx) we depend in part on proprietary technology licensed from others. If we lose our existing licenses or are unable to acquire or license additional proprietary rights from third parties, we may not be able to continue developing our potential products; and (xxi) we are obligated to maintain proper and effective internal control over financial reporting. Our internal controls were not effective for the year ended December 31, 2023, and in the future may not be determined to be effective, which may adversely affect investor confidence in us and, as a result, the value of our ordinary shares; and any other risk described under the headings “Risk Factors”, “Operating and Financial Review and Prospects” and “Business” in our most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. This list is not exhaustive. We caution you therefore against relying on these forward-looking statements and we qualify all of our forward-looking statements by these cautionary statements. These forward-looking statements speak only as at their dates. The Company undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible to predict all of these factors. Further, the Company cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statements. For a description of certain additional factors that could cause the Company’s future results to differ from those expressed in any such forward-looking statements, refer to the risk factors discussed in our most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. Non-GAAP Financial Information This presentation contains non-GAAP financial measures. Please refer to the tables included in this presentation for a reconciliation of non-GAAP financial measures. Management monitors and evaluates its operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Income Taxes, Adjusted Net Profit, Adjusted Diluted EPS, Capital Employed, Net Cash, Free Cash Flow and CAPEX. The Company believes that these non-GAAP financial measures provide useful and relevant information regarding its performance and improve its ability to assess its financial condition. While similar measures are widely used in the industry in which the Company operates, the financial measures it uses may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. Accordingly, you should not place undue reliance on any non-IFRS financial measures contained in this presentation.

Q1 2024 Financial Results Stevanato Group First Quarter 2024 Financial Results Earnings Call Franco Stevanato Executive Chairman Franco Moro CEO Marco Dal Lago CFO Lisa Miles SVP IR

Franco Stevanato Executive Chairman Q1 2024 Financial Results

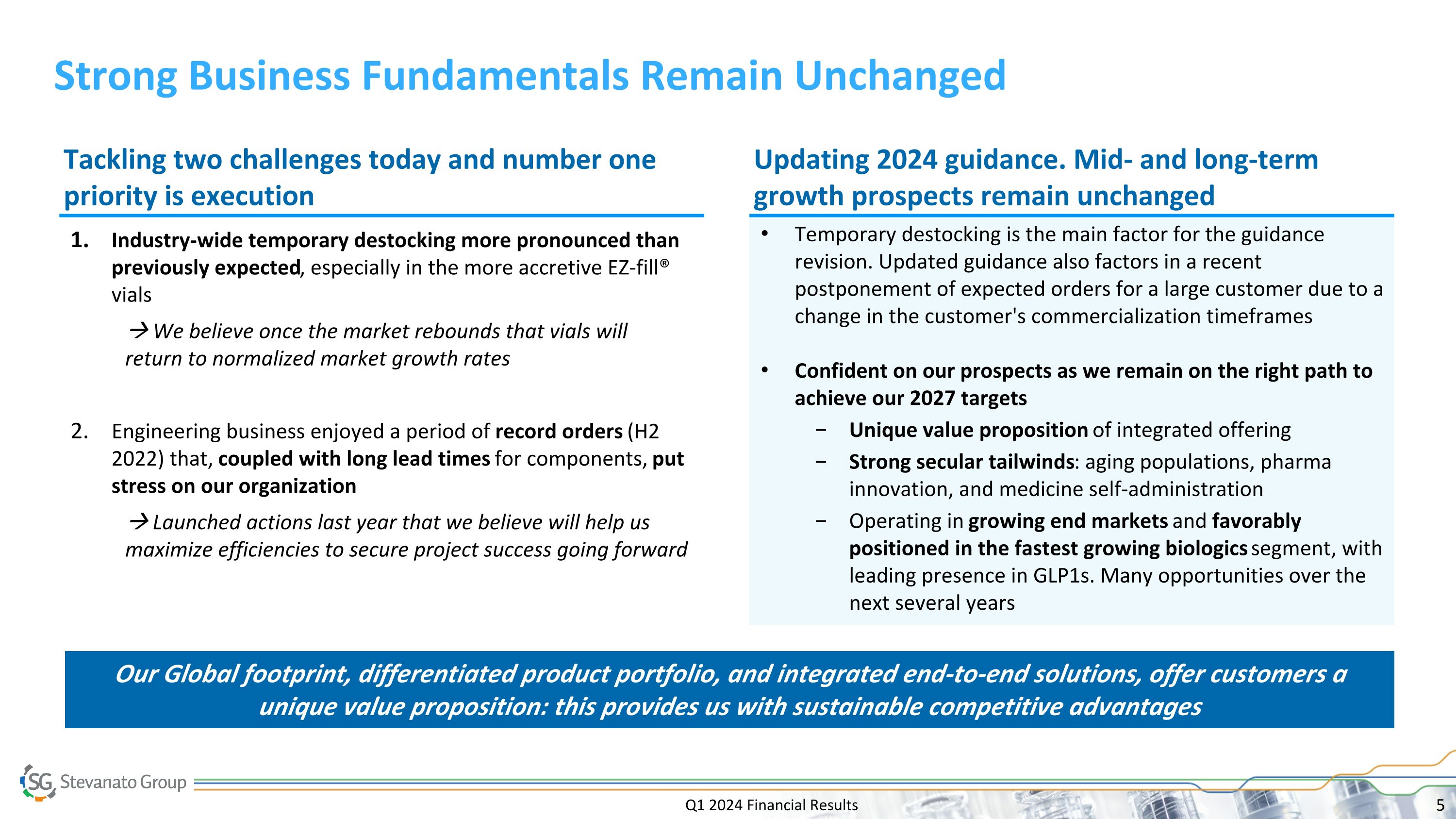

Q1 2024 Financial Results Strong Business Fundamentals Remain Unchanged Industry-wide temporary destocking more pronounced than previously expected, especially in the more accretive EZ-fill® vials We believe once the market rebounds that vials will return to normalized market growth rates Engineering business enjoyed a period of record orders (H2 2022) that, coupled with long lead times for components, put stress on our organization Launched actions last year that we believe will help us maximize efficiencies to secure project success going forward Temporary destocking is the main factor for the guidance revision. Updated guidance also factors in a recent postponement of expected orders for a large customer due to a change in the customer's commercialization timeframes Confident on our prospects as we remain on the right path to achieve our 2027 targets Unique value proposition of integrated offering Strong secular tailwinds: aging populations, pharma innovation, and medicine self-administration Operating in growing end markets and favorably positioned in the fastest growing biologics segment, with leading presence in GLP1s. Many opportunities over the next several years Our Global footprint, differentiated product portfolio, and integrated end-to-end solutions, offer customers a unique value proposition: this provides us with sustainable competitive advantages Tackling two challenges today and number one priority is execution Updating 2024 guidance. Mid- and long-term growth prospects remain unchanged

Marco Dal Lago Chief Financial Officer Q1 2024 Financial Results

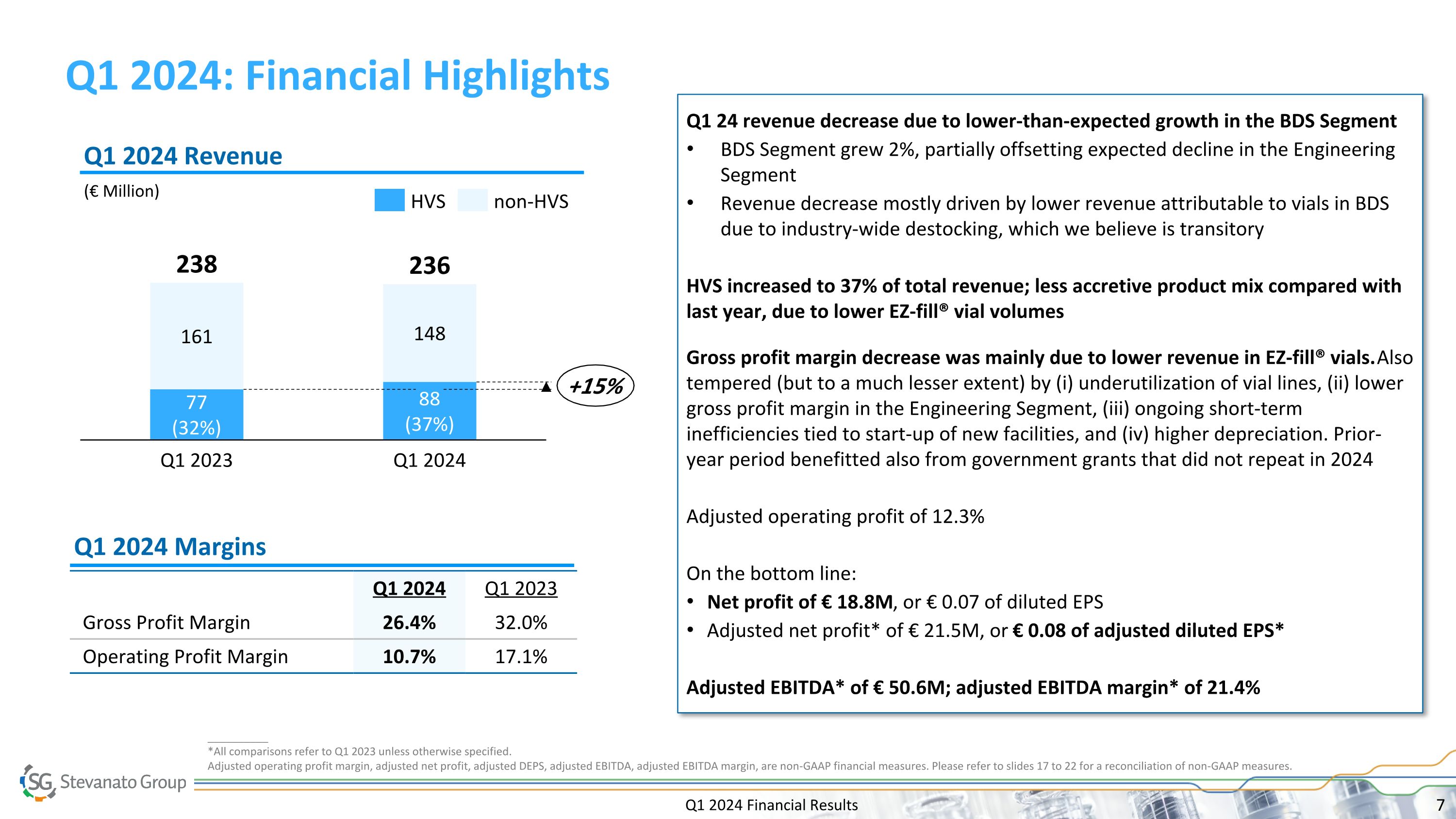

Q1 2024 Financial Results Q1 2024: Financial Highlights __________ *All comparisons refer to Q1 2023 unless otherwise specified. Adjusted operating profit margin, adjusted net profit, adjusted DEPS, adjusted EBITDA, adjusted EBITDA margin, are non-GAAP financial measures. Please refer to slides 17 to 22 for a reconciliation of non-GAAP measures. (€ Million) Q1 2024 Revenue Q1 2024 Margins Q1 2024 Q1 2023 Gross Profit Margin 26.4% 32.0% Operating Profit Margin 10.7% 17.1% Q1 24 revenue decrease due to lower-than-expected growth in the BDS Segment BDS Segment grew 2%, partially offsetting expected decline in the Engineering Segment Revenue decrease mostly driven by lower revenue attributable to vials in BDS due to industry-wide destocking, which we believe is transitory HVS increased to 37% of total revenue; less accretive product mix compared with last year, due to lower EZ-fill® vial volumes Gross profit margin decrease was mainly due to lower revenue in EZ-fill® vials. Also tempered (but to a much lesser extent) by (i) underutilization of vial lines, (ii) lower gross profit margin in the Engineering Segment, (iii) ongoing short-term inefficiencies tied to start-up of new facilities, and (iv) higher depreciation. Prior-year period benefitted also from government grants that did not repeat in 2024 Adjusted operating profit of 12.3% On the bottom line: Net profit of € 18.8M, or € 0.07 of diluted EPS Adjusted net profit* of € 21.5M, or € 0.08 of adjusted diluted EPS* Adjusted EBITDA* of € 50.6M; adjusted EBITDA margin* of 21.4% Base business 161 77 (32%) Q1 2023 148 88 (37%) Q1 2024 238 236 +15% HVS non-HVS

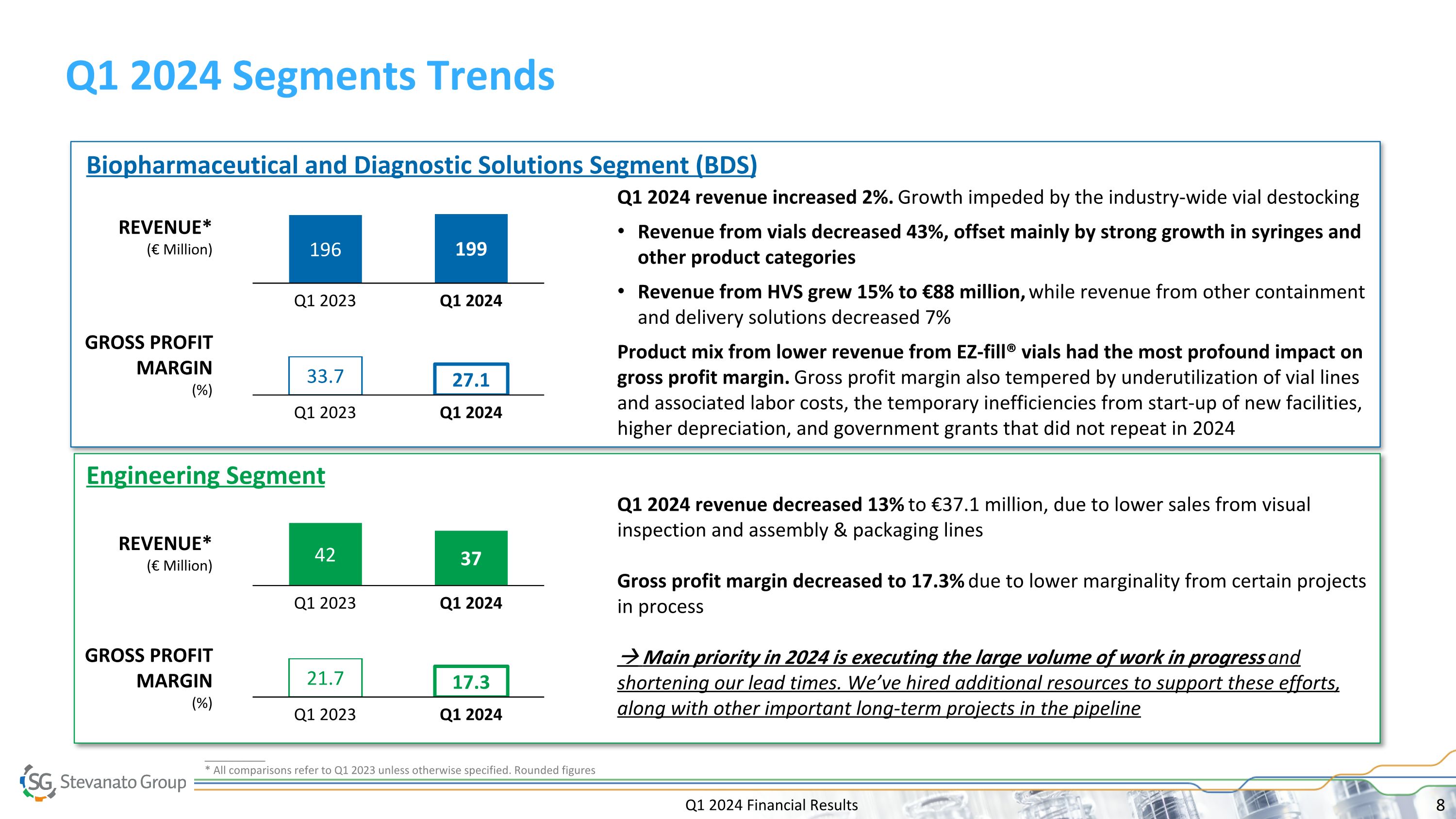

Q1 2024 Financial Results Q1 2024 Segments Trends 196 Q1 2023 Q1 2024 199 Q1 2024 revenue increased 2%. Growth impeded by the industry-wide vial destocking Revenue from vials decreased 43%, offset mainly by strong growth in syringes and other product categories Revenue from HVS grew 15% to €88 million, while revenue from other containment and delivery solutions decreased 7% Product mix from lower revenue from EZ-fill® vials had the most profound impact on gross profit margin. Gross profit margin also tempered by underutilization of vial lines and associated labor costs, the temporary inefficiencies from start-up of new facilities, higher depreciation, and government grants that did not repeat in 2024 Biopharmaceutical and Diagnostic Solutions Segment (BDS) REVENUE* (€ Million) GROSS PROFIT MARGIN (%) Engineering Segment 33.7 27.1 Q1 2023 Q1 2024 42 Q1 2023 37 Q1 2024 Q1 2024 revenue decreased 13% to €37.1 million, due to lower sales from visual inspection and assembly & packaging lines Gross profit margin decreased to 17.3% due to lower marginality from certain projects in process Main priority in 2024 is executing the large volume of work in progress and shortening our lead times. We’ve hired additional resources to support these efforts, along with other important long-term projects in the pipeline REVENUE* (€ Million) GROSS PROFIT MARGIN (%) 17.3 21.7 Q1 2023 Q1 2024 __________ * All comparisons refer to Q1 2023 unless otherwise specified. Rounded figures

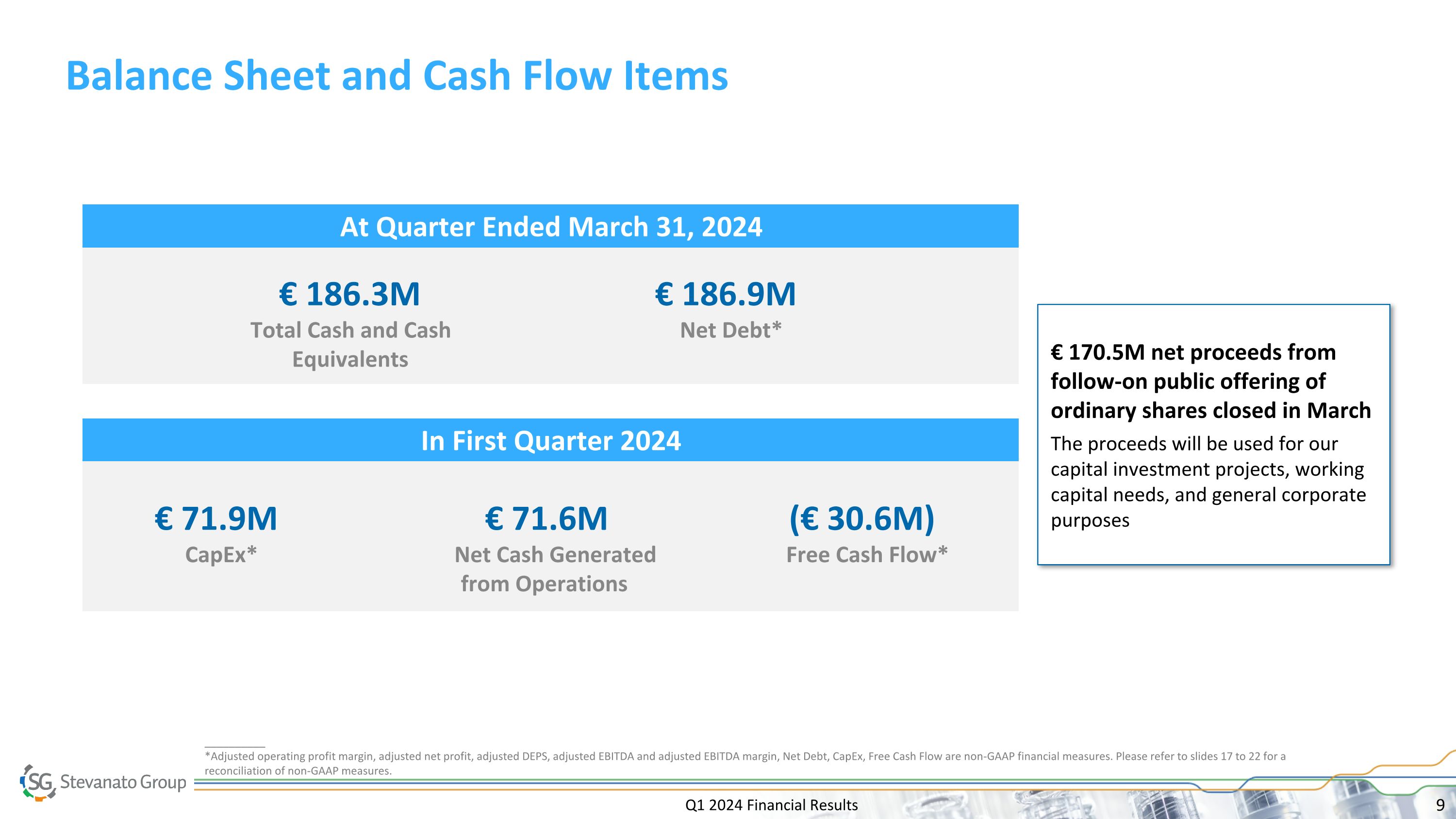

Q1 2024 Financial Results Balance Sheet and Cash Flow Items In First Quarter 2024 At Quarter Ended March 31, 2024 (€ 30.6M) Free Cash Flow* € 186.9M Net Debt* € 186.3M Total Cash and Cash Equivalents € 71.9M CapEx* € 71.6M Net Cash Generated from Operations __________ *Adjusted operating profit margin, adjusted net profit, adjusted DEPS, adjusted EBITDA and adjusted EBITDA margin, Net Debt, CapEx, Free Cash Flow are non-GAAP financial measures. Please refer to slides 17 to 22 for a reconciliation of non-GAAP measures. € 170.5M net proceeds from follow-on public offering of ordinary shares closed in March The proceeds will be used for our capital investment projects, working capital needs, and general corporate purposes

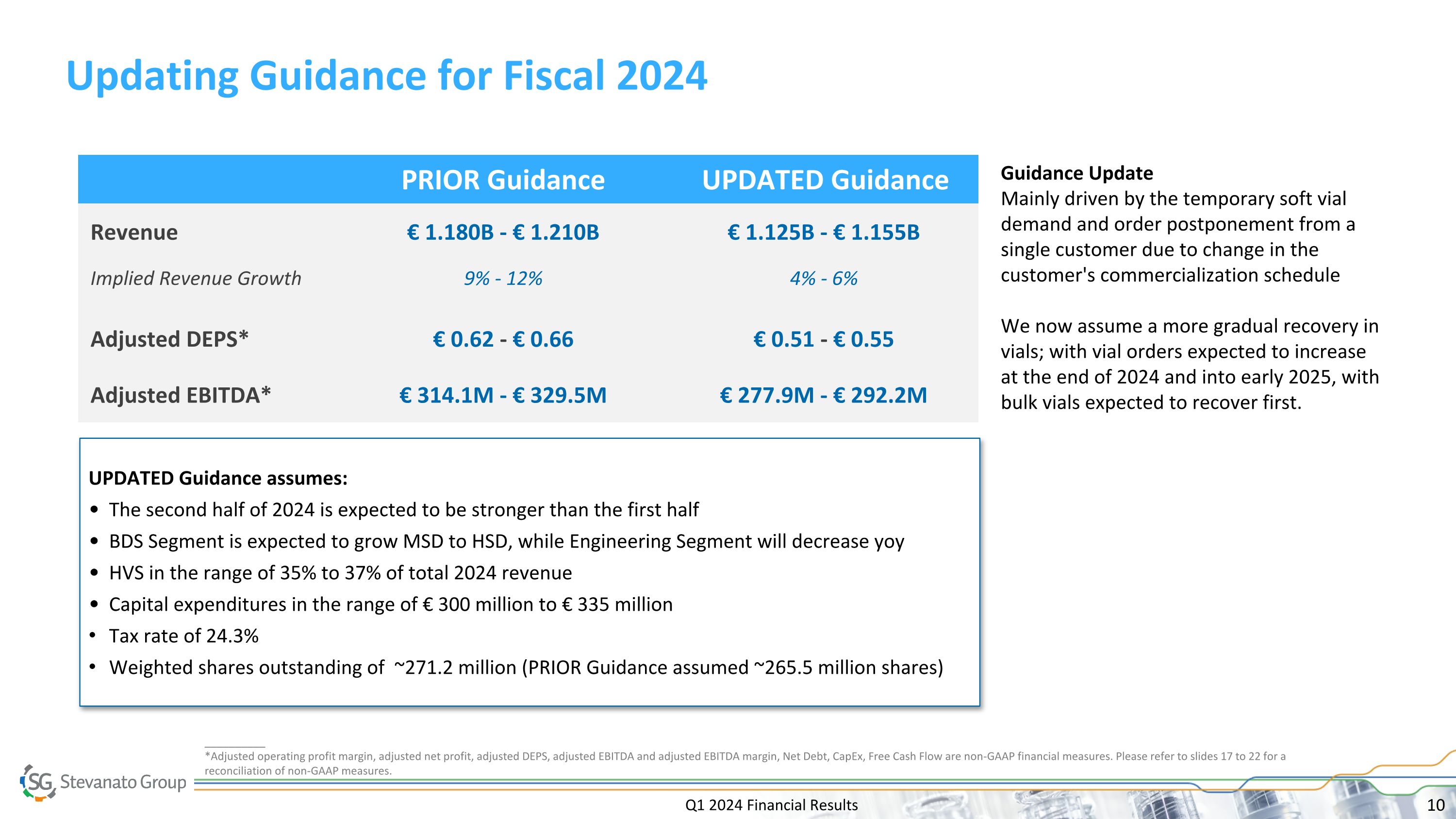

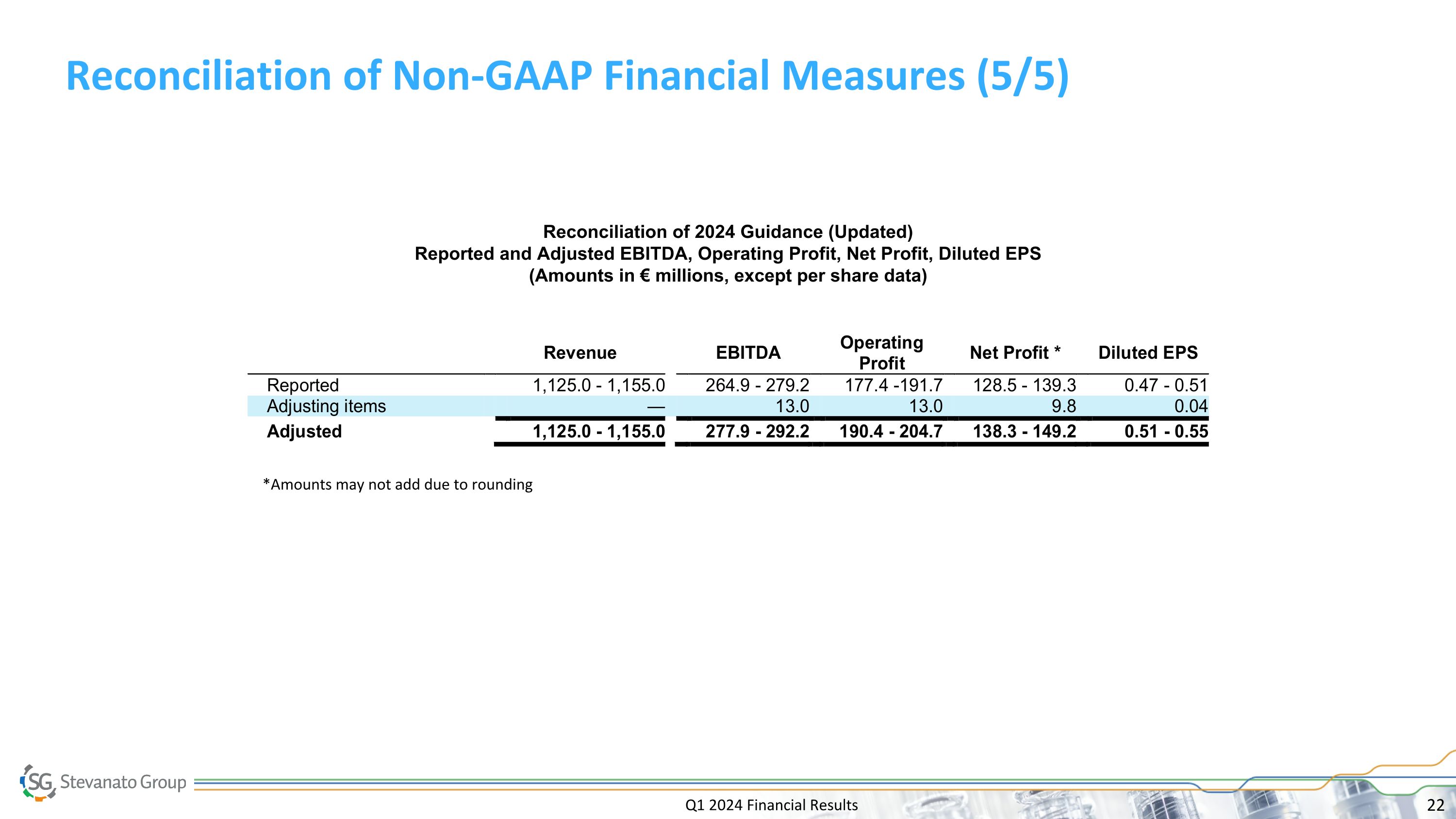

Q1 2024 Financial Results Updating Guidance for Fiscal 2024 UPDATED Guidance assumes: The second half of 2024 is expected to be stronger than the first half BDS Segment is expected to grow MSD to HSD, while Engineering Segment will decrease yoy HVS in the range of 35% to 37% of total 2024 revenue Capital expenditures in the range of € 300 million to € 335 million Tax rate of 24.3% Weighted shares outstanding of ~271.2 million (PRIOR Guidance assumed ~265.5 million shares) PRIOR Guidance UPDATED Guidance Revenue € 1.180B - € 1.210B € 1.125B - € 1.155B Implied Revenue Growth 9% - 12% 4% - 6% Adjusted DEPS* € 0.62 - € 0.66 € 0.51 - € 0.55 Adjusted EBITDA* € 314.1M - € 329.5M € 277.9M - € 292.2M __________ *Adjusted operating profit margin, adjusted net profit, adjusted DEPS, adjusted EBITDA and adjusted EBITDA margin, Net Debt, CapEx, Free Cash Flow are non-GAAP financial measures. Please refer to slides 17 to 22 for a reconciliation of non-GAAP measures. Guidance Update Mainly driven by the temporary soft vial demand and order postponement from a single customer due to change in the customer's commercialization schedule We now assume a more gradual recovery in vials; with vial orders expected to increase at the end of 2024 and into early 2025, with bulk vials expected to recover first.

Franco Moro Chief Executive Officer Q1 2024 Financial Results

Q1 2024 Financial Results Long-term Bulk Vial market est. growth : LSD1 Long-term RTU Vial market est. growth: DD1 Business Update Combination of additional resources, ongoing optimization of industrial footprint, and streamlining internal processes are helping to improve the health of the business While it will take time, we expect that ongoing actions will drive operational efficiencies and shorten lead times, benefitting the Segment’s margins Demand landscape in Engineering remains favorable. For example: trend towards self-administration of medicine (especially given the popularity of GLP1s) is generating demand for assembly & packaging lines, and we are supporting many customers as they rapidly expand their drug delivery device programs Slower-than-expected recovery in vials is tempering BDS performance in FY 2024 Engineering: ongoing actions are just starting to yield operational improvements in the business Slower recovery in vials (particularly EZ-fill® vials) will unfavorably impact our HVS mix in 2024 Temporary imbalance of supply & demand is having a pronounced impact on us since (i) RTU are a small portion (≤ 5%) of vial market today, and (ii) we are global leader in RTU vials1 Near-term, carefully managing costs and taking actions including redeploying vial production staff, and improving efficiencies on maintenance activities Expect to retain most of vial line staff despite temporary underutilization. We firmly believe this strategy best positions us for the expected recovery, and we do not want to take short-term actions that might compromise future growth Long-term Engineering Segment addressable est. market growth : MSD to HSD1 __________ 1) Sources: IQVIA; Markets & Markets; Evaluate Pharma; Roots Analysis, Prescient Strategic Intelligence, Alira Health, Analyst Reports, Expert interviews; SG Internal Data

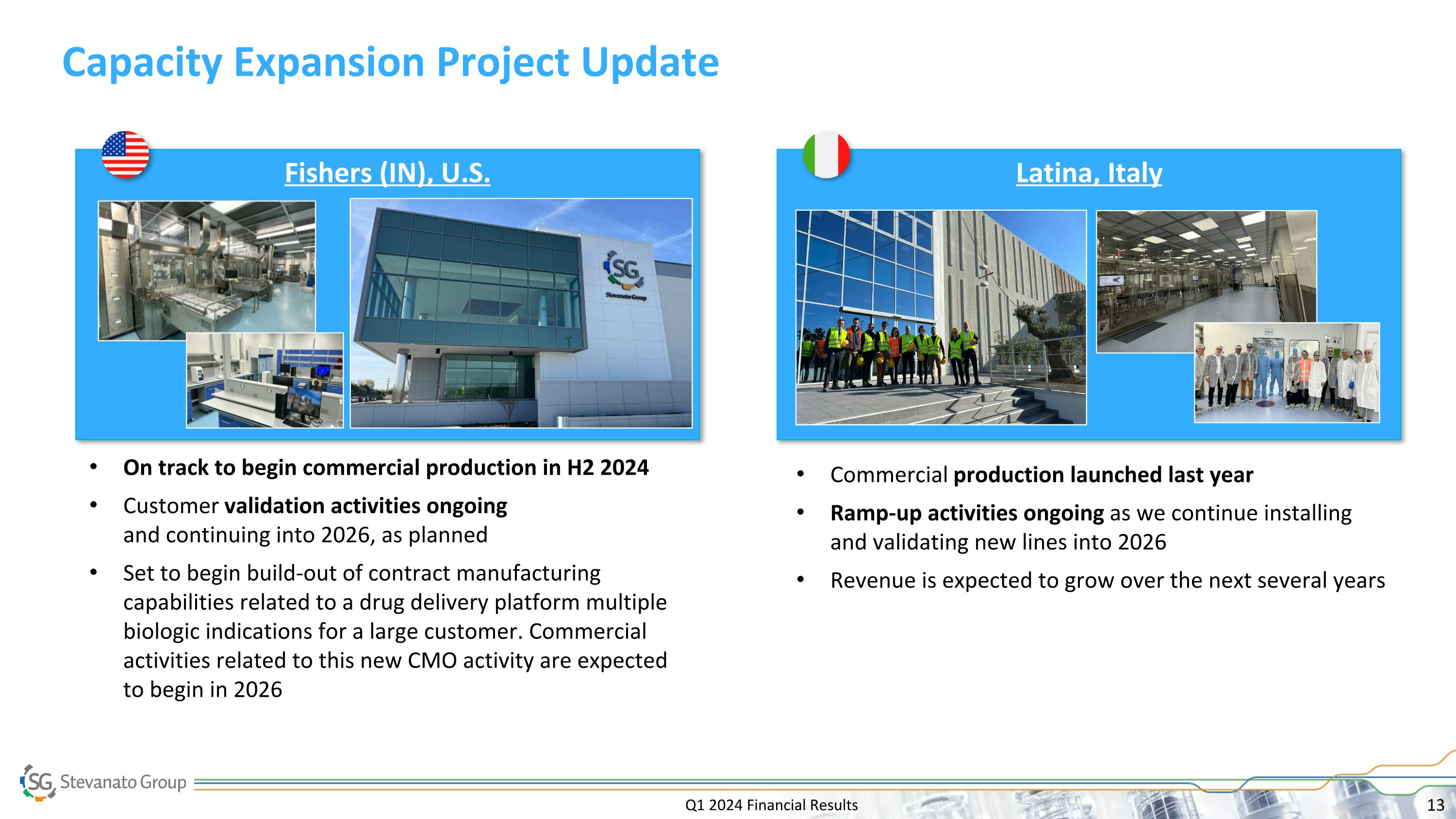

Q1 2024 Financial Results Capacity Expansion Project Update Latina, Italy Commercial production launched last year Ramp-up activities ongoing as we continue installing and validating new lines into 2026 Revenue is expected to grow over the next several years Fishers (IN), U.S. On track to begin commercial production in H2 2024 Customer validation activities ongoing and continuing into 2026, as planned Set to begin build-out of contract manufacturing capabilities related to a drug delivery platform multiple biologic indications for a large customer. Commercial activities related to this new CMO activity are expected to begin in 2026

Franco Stevanato Executive Chairman Q1 2024 Financial Results

Q1 2024 Financial Results Focus on Execution. Our Fundamentals are Strong and Unchanged. Laser-focused on ramping our new capacity to meet rising customer demand for HVS We are strengthening our processes and driving efficiencies across our global operations to best manage future growth Unique value proposition of integrated solutions and differentiated products Attractive end markets with long secular tailwinds Cemented leadership position as a mission-critical partner in the pharma supply chain Number one priority for 2024 is execution Favorably positioned to drive durable organic growth, expand margins and deliver long-term shareholder value

Stevanato Group Q1 2024 Financial Results

This presentation contains non-GAAP financial measures. Please refer to the tables included in this presentation for a reconciliation of non-GAAP measures. Management monitors and evaluates our operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Income Taxes, Adjusted Net Profit, Adjusted Diluted EPS, Capital Employed, Net Cash, Free Cash Flow, and CapEx. We believe that these non-GAAP financial measures provide useful and relevant information regarding our performance and improve our ability to assess our financial condition. While similar measures are widely used in the industry in which we operate, the financial measures we use may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. Reconciliation of Non-GAAP Financial Measures Q1 2024 Financial Results

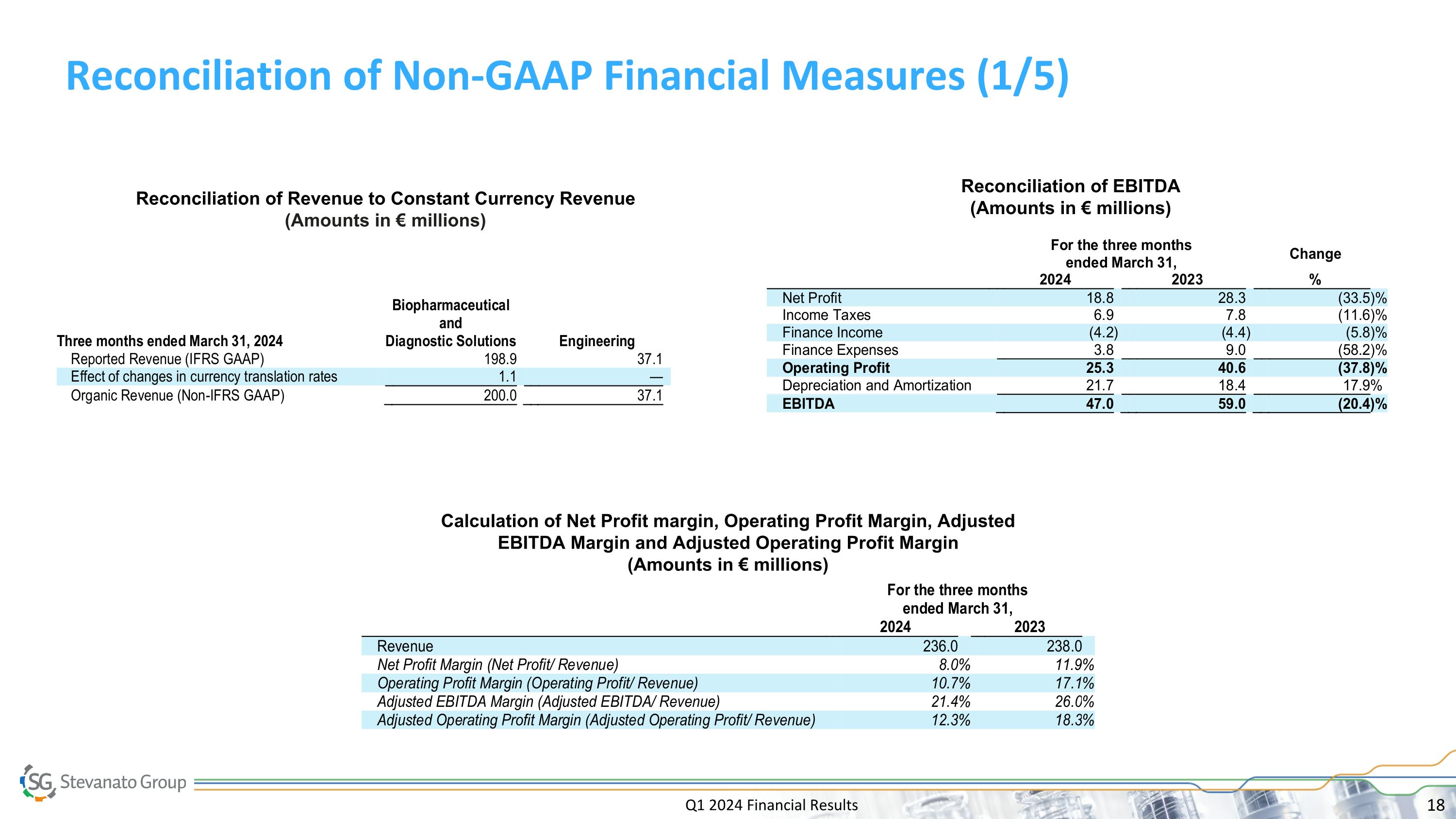

Q1 2024 Financial Results Reconciliation of Non-GAAP Financial Measures (1/5) Reconciliation of EBITDA (Amounts in € millions) Calculation of Net Profit margin, Operating Profit Margin, Adjusted EBITDA Margin and Adjusted Operating Profit Margin (Amounts in € millions) Reconciliation of Revenue to Constant Currency Revenue (Amounts in € millions)

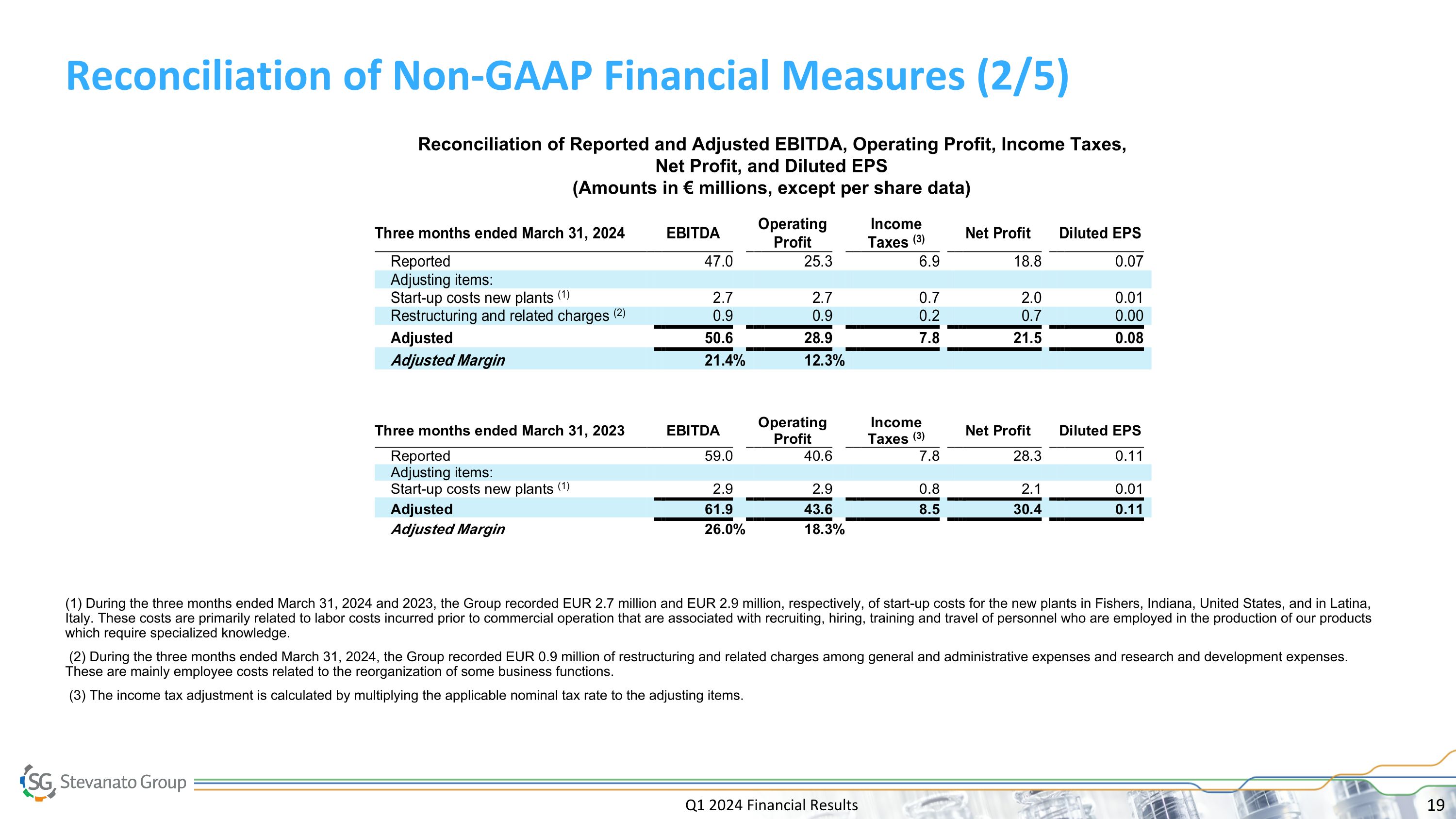

Q1 2024 Financial Results Reconciliation of Non-GAAP Financial Measures (2/5) Reconciliation of Reported and Adjusted EBITDA, Operating Profit, Income Taxes, Net Profit, and Diluted EPS (Amounts in € millions, except per share data) (1) During the three months ended March 31, 2024 and 2023, the Group recorded EUR 2.7 million and EUR 2.9 million, respectively, of start-up costs for the new plants in Fishers, Indiana, United States, and in Latina, Italy. These costs are primarily related to labor costs incurred prior to commercial operation that are associated with recruiting, hiring, training and travel of personnel who are employed in the production of our products which require specialized knowledge. (2) During the three months ended March 31, 2024, the Group recorded EUR 0.9 million of restructuring and related charges among general and administrative expenses and research and development expenses. These are mainly employee costs related to the reorganization of some business functions. (3) The income tax adjustment is calculated by multiplying the applicable nominal tax rate to the adjusting items.

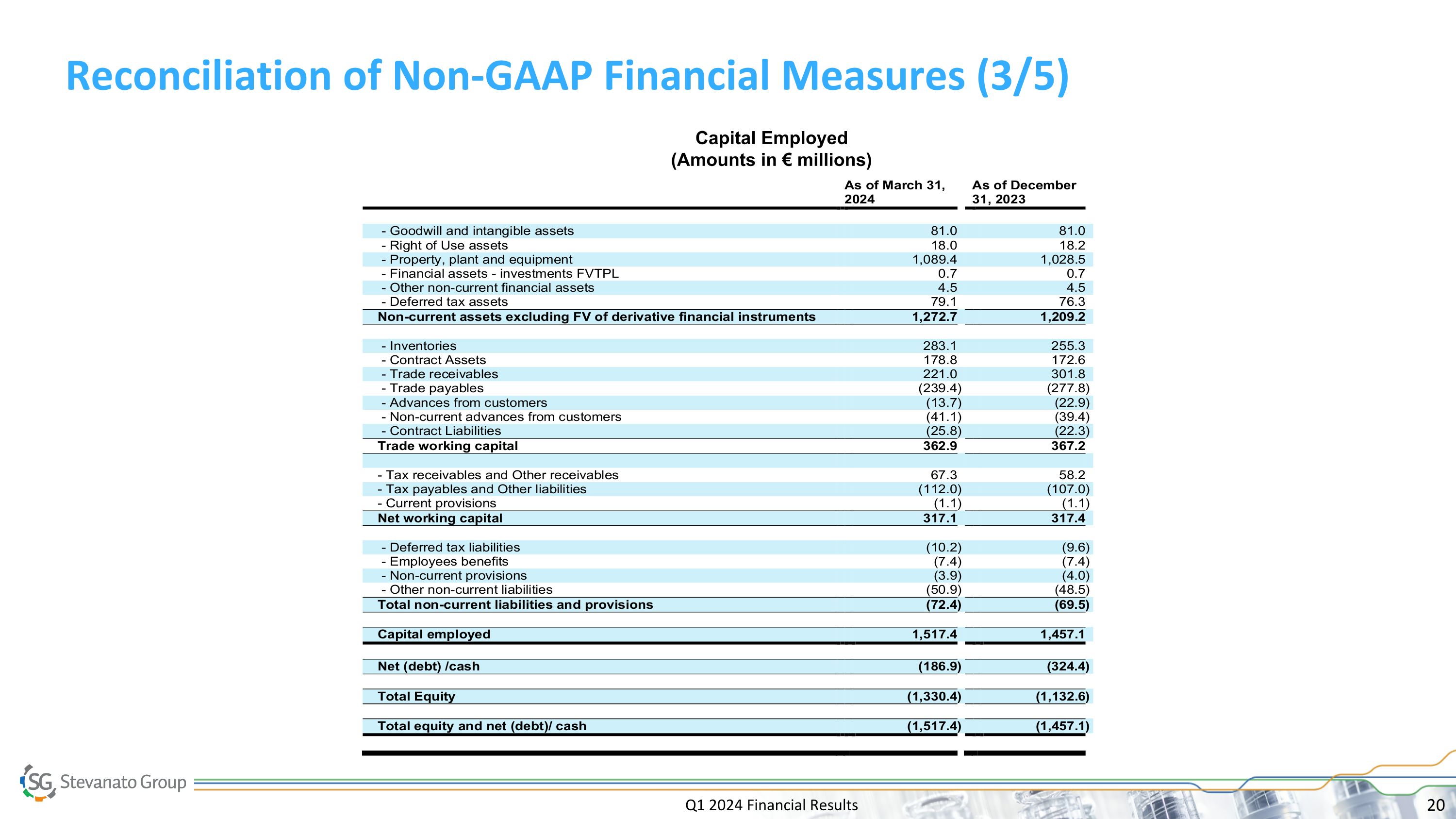

Q1 2024 Financial Results Reconciliation of Non-GAAP Financial Measures (3/5) Capital Employed (Amounts in € millions)

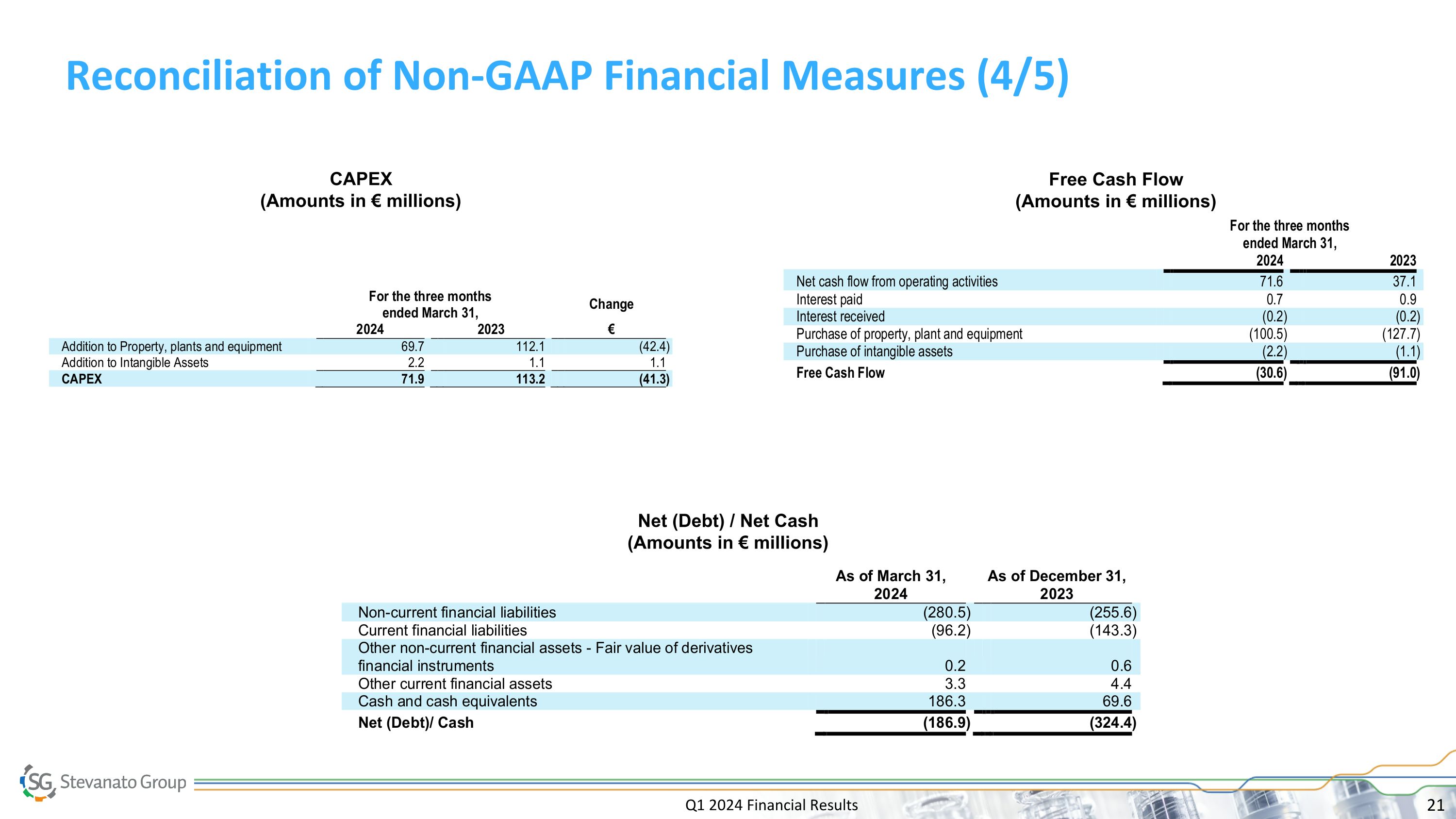

Q1 2024 Financial Results Reconciliation of Non-GAAP Financial Measures (4/5) Net (Debt) / Net Cash (Amounts in € millions) Free Cash Flow (Amounts in € millions) CAPEX (Amounts in € millions)

Q1 2024 Financial Results Reconciliation of Non-GAAP Financial Measures (5/5) Reconciliation of 2024 Guidance (Updated) Reported and Adjusted EBITDA, Operating Profit, Net Profit, Diluted EPS (Amounts in € millions, except per share data) *Amounts may not add due to rounding