Third Quarter 2021 Financial Results November 9, 2021 Exhibit 99.1

Safe-Harbor Statement Forward-Looking Statements This presentation contains certain forward-looking statements which include, or may include, words such as "raising", "believe", "potential", "increased", "future", "remain", "growing", "expect", "foreseeable", "expected", "to be", "includes", "estimated", "assumes", "would provide", and other similar terminology. Forward-looking statements contained in this prospectus include, but are not limited to, statements about: our future financial performance, including our revenue, operating expenses, and our ability to maintain profitability and operational and commercial capabilities; our expectations regarding the development of our industry and the competitive environment in which we operate; expected high value solutions revenue; investment and expansion relating to production; trends relating to Covid guidance for FY2021, and our goals and strategies. The following are some of the factors that could cause our actual results to differ materially from those expressed in or underlying our forward-looking statements: (i) our product offerings are highly complex, and, if our products do not satisfy applicable quality criteria, specifications and performance standards, we could experience lost sales, delayed or reduced market acceptance of our products, increased costs and damage to our reputation; (ii) we must develop new products and enhance existing products, adapt to significant technological and innovative changes and respond to introductions of new products by competitors to remain competitive; (iii) our backlog might not accurately predict our future revenue, and we might not realize all or any part of the anticipated revenue reflected in our backlog; (iv) if we fail to maintain and enhance our brand and reputation, our business, results of operations and prospects may be materially and adversely affected; (v) we are highly dependent on our management and employees. Competition for our employees is intense, and we may not be able to attract and retain the highly skilled employees that we need to support our business and our intended future growth; (vi) our business, financial condition and results of operations depend upon maintaining our relationships with suppliers and service providers; (vii) our business, financial condition and results of operations depend upon the availability and price of high-quality materials and energy supply and our ability to contain production costs; (viii) significant interruptions in our operations could harm our business, financial condition and results of operations; (ix) our manufacturing facilities are subject to operating hazards which may lead to production curtailments or shutdowns and have an adverse effect on our business, results of operations, financial condition or cash flows; and (x) our business may be harmed if our customers discontinue or spend less on research, development, production or other scientific endeavors; (xi) we may face significant competition in implementing our strategies for revenue growth in light of actions taken by our competitors. This list is not exhaustive. These forward-looking statements speak only as at their dates. The Company undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible to predict all of these factors. Further, the Company cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statements. This press release also contains certain estimates regarding the Company's future prospects and performance, including, but not limited to, future revenues and earnings per share, capital deployment. All such statements and projections are based upon current expectations of the Company and involve a number of business risks and uncertainties. The Company disclaimers any current intention to update such guidance, except as required by law. For a description of certain additional factors that could cause the Company's future results to differ from those expressed in any such forward-looking statements, see Part II, Item 1A. entitled "Risk Factors" in the Company's Quarterly Report on Form 6-K for the quarterly period ended September 30, 2021 and "Risk Factors" in our registration statement on Form F-1, dated July 16, 2021 and which was filed with the U.S. Securities and Exchange Commission in accordance with Rule 424(b) of the Securities Act of 1933, as amended, on July 16, 2021. Non-GAAP Financial Information This presentation contains non-GAAP measures. Please refer to the tables included in this Q3 2021 Earnings Press Release for a reconciliation of non-GAAP measures. Management monitors and evaluates our operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, CAPEX, Adjusted Diluted EPS, and Free Cash Flow. We believe that these non-GAAP financial measures provide useful and relevant information regarding our performance and improve our ability to assess our financial condition. While similar measures are widely used in the industry in which we operate, the financial measures we use may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. Third Quarter 2021 Financial Results

Franco Stevanato Executive Board Chairman Stevanato Group Third Quarter 2021 Earnings Call Speakers Franco Moro CEO Marco Dal Lago CFO Lisa Miles SVP IR Third Quarter 2021 Financial Results

.ADVANCING PROGRESS ON: Growing industrial footprint to meet customer demand Investing in R&D to accelerate market position and increase pipeline for proprietary solutions (Alba, Nexa and DDS) Expanding in U.S. and China Building multi-year pipeline of opportunities, weighted towards biologics EMPLOYEE RECOGNITION, BONUS AWARD Awarded a €6.7M discretionary bonus to thank staff for remarkable work over the last 18 months Financial results reinforce solid fundamentals, long-term demand trends, and leading position in growing markets Creating and Driving Long-Term Shareholder Value Third Quarter 2021 Financial Results

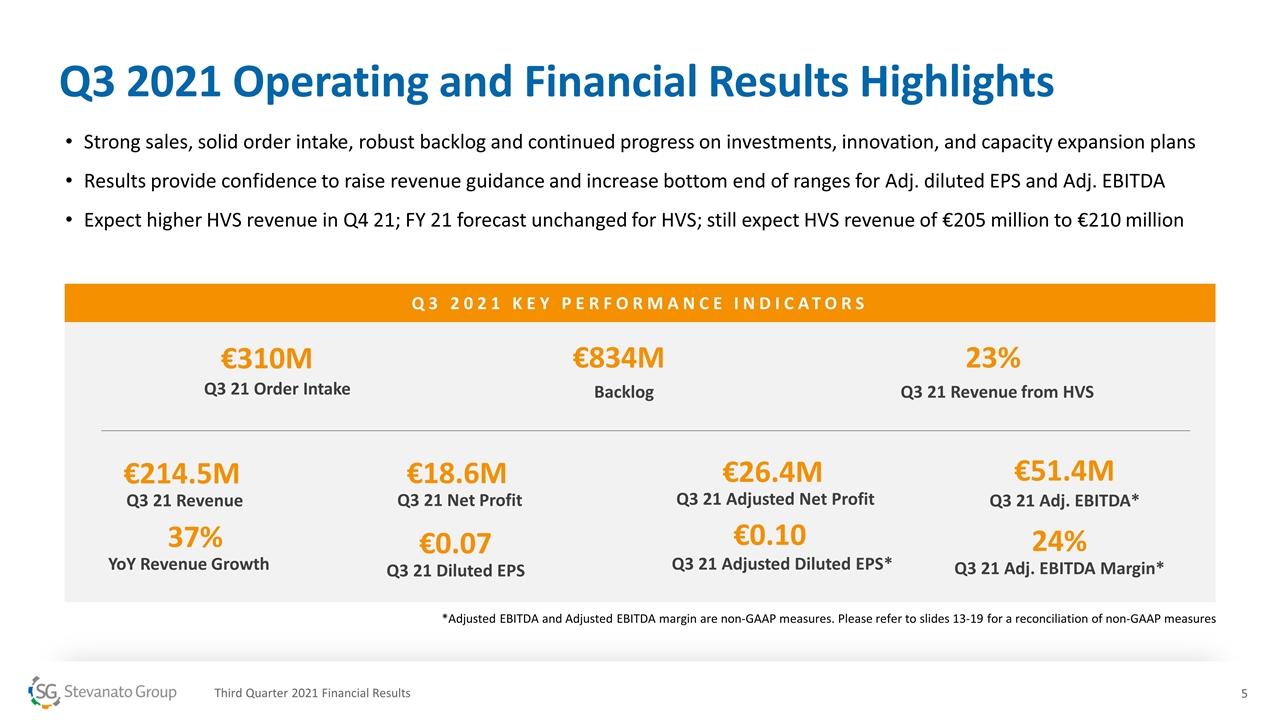

Q3 2021 KEY PERFORMANCE INDICATORS €214.5M Q3 21 Revenue 37% YoY Revenue Growth €51.4M Q3 21 Adj. EBITDA* 24% Q3 21 Adj. EBITDA Margin* €0.10 Q3 21 Adjusted Diluted EPS* €310M Q3 21 Order Intake €834M Backlog 23% Q3 21 Revenue from HVS Q3 2021 Operating and Financial Results Highlights Strong sales, solid order intake, robust backlog and continued progress on investments, innovation, and capacity expansion plans Results provide confidence to raise revenue guidance and increase bottom end of ranges for Adj. diluted EPS and Adj. EBITDA Expect higher HVS revenue in Q4 21; FY 21 forecast unchanged for HVS; still expect HVS revenue of €205 million to €210 million *Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP measures. Please refer to slides 13-19 for a reconciliation of non-GAAP measures Third Quarter 2021 Financial Results €0.07 Q3 21 Diluted EPS €18.6M Q3 21 Net Profit €26.4M Q3 21 Adjusted Net Profit

Investments in Capacity Expansions Remain On Track BOOSTING PRESENCE IN FAST GROWING U.S. MARKET Broke ground in October; recruiting, hiring, training for key managerial positions Will expand production of EZ-Fill® vials and syringes; meet performance demands of biologics EZ-Fill® hub strengthen presence in North America Will support customers from design and development through commercialization CONTINUED EXPANSION IN ITALY Recently added two new dedicated lines: EZ-Fill® syringes EZ-Fill® vials In 2022, maximizing production of HVS through expansion and optimization of industrial footprint Construction underway on new building Adding new glass forming lines to boost EZ-Fill® capacity Planned addition of two new EZ-Fill® syringe lines and one line dedicated to premium Alba® syringes to meet increasing global demand Fishers, Indiana Piombino Dese, Padova Third Quarter 2021 Financial Results

Current Global Trends Supply Chain Trends To date, no significant disruption in supply chains Taken precautionary steps; increased materials on hand and keeping more inventory available In short term, temporary pressure from logistical expenses Rising input costs are near-term challenge; managing carefully In general, contracts contain cost escalation clauses Actively monitoring; managing diligently Global Pandemic Trends Remains a tailwind Working with customers as they consider transition to single-dose vaccine formats STVN can support any format; already suppling single dose syringes and multi-dose vials New Covid pill welcome development but will play complementary role to vaccine in managing pandemic (like Influenza vaccine and Tamiflu) Key Take Away: pill is expected to supplement, not replace, vaccination efforts1 Excluding Covid, achieved double-digit revenue growth Third Quarter 2021 Financial Results 1 U.S. Coronavirus: Antiviral pill could be a game changer, but vaccines are still America’s way out of the pandemic, experts say - CNN

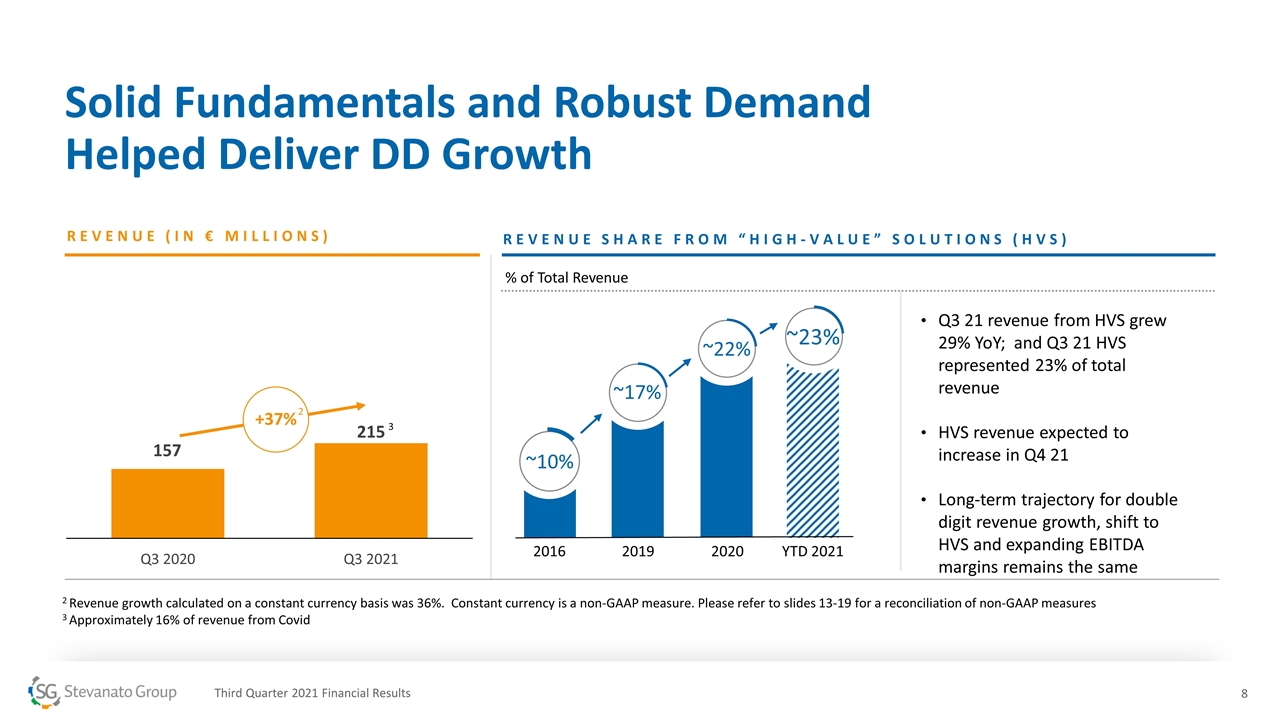

Solid Fundamentals and Robust Demand Helped Deliver DD Growth REVENUE (IN € MILLIONS) 2 Revenue growth calculated on a constant currency basis was 36%. Constant currency is a non-GAAP measure. Please refer to slides 13-19 for a reconciliation of non-GAAP measures 3 Approximately 16% of revenue from Covid REVENUE SHARE FROM “HIGH-VALUE” SOLUTIONS (HVS) +37% 2019 ~17% 2020 ~22% ~10% 2016 YTD 2021 ~23% 3 Q3 21 revenue from HVS grew 29% YoY; and Q3 21 HVS represented 23% of total revenue HVS revenue expected to increase in Q4 21 Long-term trajectory for double digit revenue growth, shift to HVS and expanding EBITDA margins remains the same 2 Third Quarter 2021 Financial Results

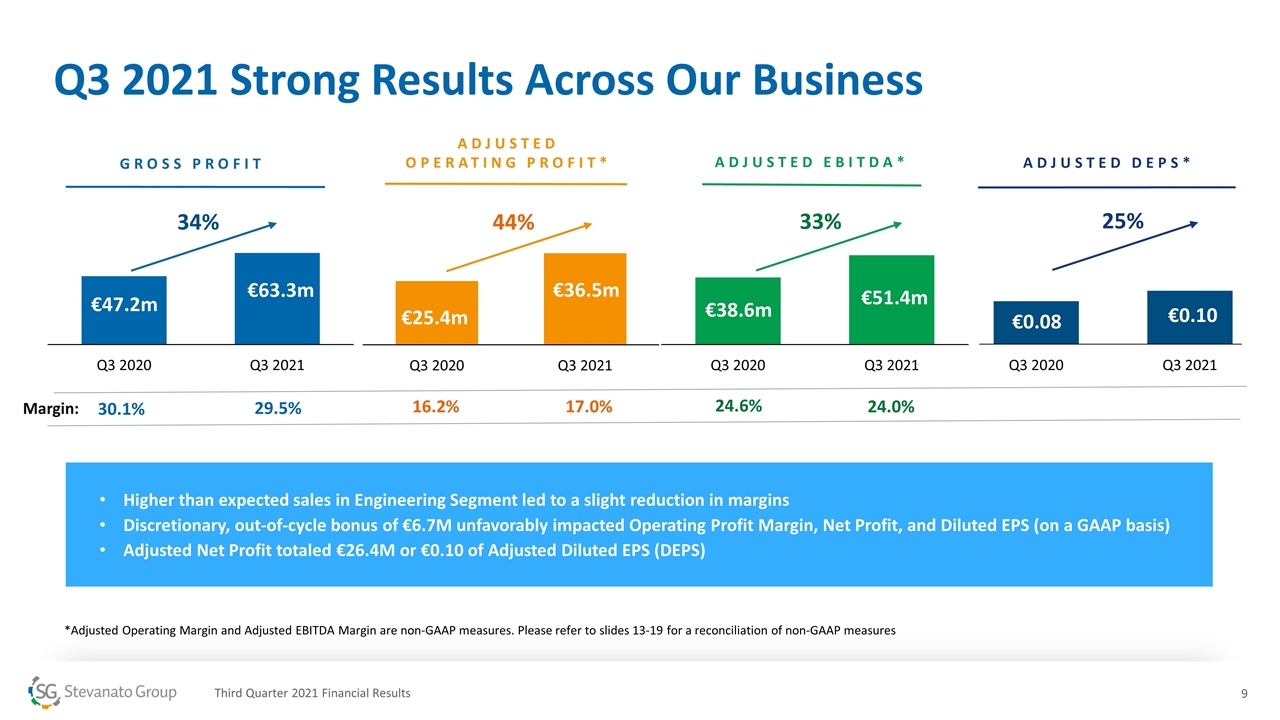

ADJUSTED EBITDA* 24.0% 24.6% 33% Q3 2021 Strong Results Across Our Business overall_0_132573506445777536 columns_7_132584762853721572 3_1_132573506445777536 6_1_132573506445777536 9_1_132573506445777536 12_1_132573506445777536 13_1_132573506445777536 14_1_132573506445777536 15_1_132573506445777536 18_1_132573506445777536 21_1_132573506445777536 *Adjusted Operating Margin and Adjusted EBITDA Margin are non-GAAP measures. Please refer to slides 13-19 for a reconciliation of non-GAAP measures Margin: Higher than expected sales in Engineering Segment led to a slight reduction in margins Discretionary, out-of-cycle bonus of €6.7M unfavorably impacted Operating Profit Margin, Net Profit, and Diluted EPS (on a GAAP basis) Adjusted Net Profit totaled €26.4M or €0.10 of Adjusted Diluted EPS (DEPS) Third Quarter 2021 Financial Results ADJUSTED DEPS* 34% 44% GROSS PROFIT ADJUSTED OPERATING PROFIT* 30.1% 29.5% 17.0% 16.2% 25%

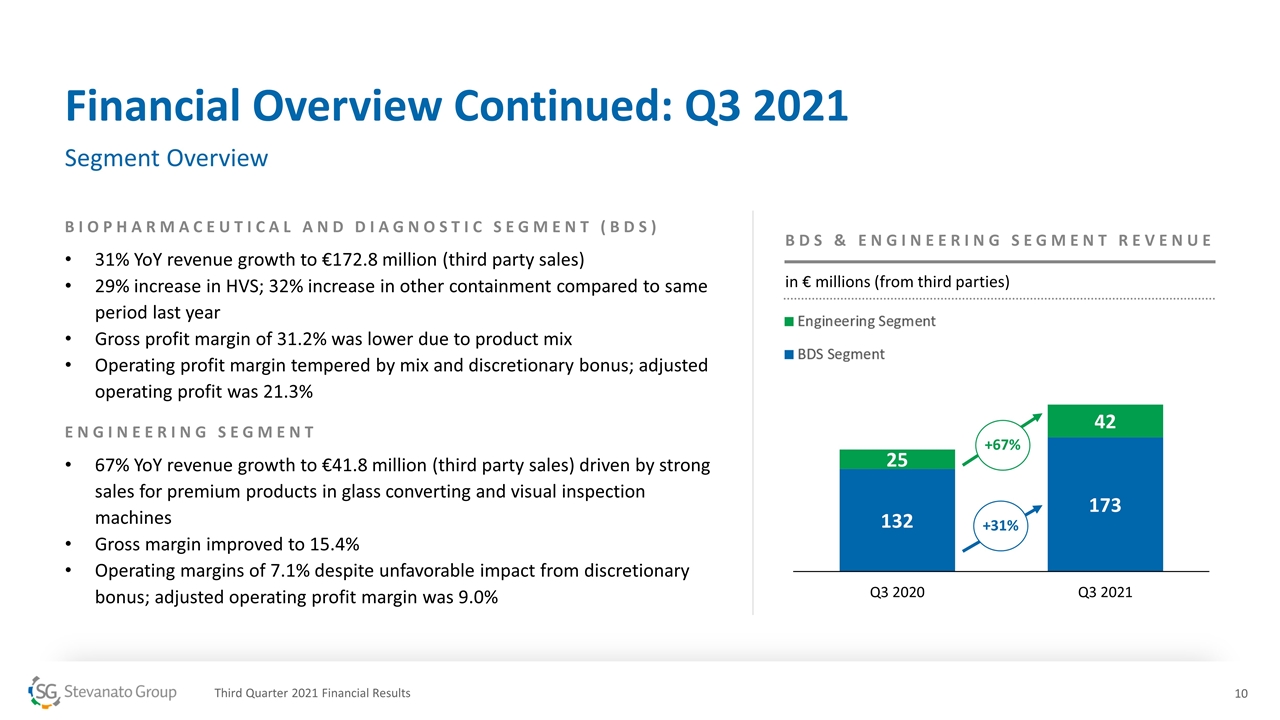

Financial Overview Continued: Q3 2021 Segment Overview BIOPHARMACEUTICAL AND DIAGNOSTIC SEGMENT (BDS) 31% YoY revenue growth to €172.8 million (third party sales) 29% increase in HVS; 32% increase in other containment compared to same period last year Gross profit margin of 31.2% was lower due to product mix Operating profit margin tempered by mix and discretionary bonus; adjusted operating profit was 21.3% ENGINEERING SEGMENT 67% YoY revenue growth to €41.8 million (third party sales) driven by strong sales for premium products in glass converting and visual inspection machines Gross margin improved to 15.4% Operating margins of 7.1% despite unfavorable impact from discretionary bonus; adjusted operating profit margin was 9.0% +31% +67% BDS & ENGINEERING SEGMENT REVENUE in € millions (from third parties) Third Quarter 2021 Financial Results

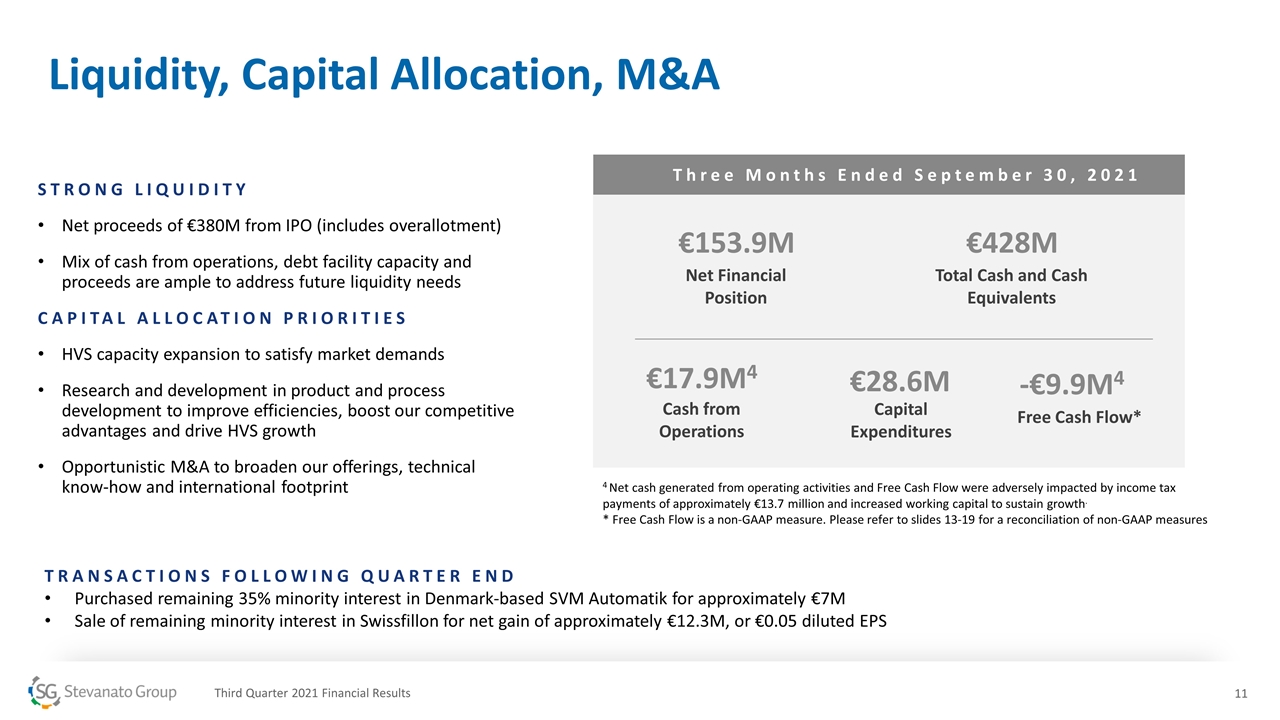

Liquidity, Capital Allocation, M&A STRONG LIQUIDITY Net proceeds of €380M from IPO (includes overallotment) Mix of cash from operations, debt facility capacity and proceeds are ample to address future liquidity needs CAPITAL ALLOCATION PRIORITIES HVS capacity expansion to satisfy market demands Research and development in product and process development to improve efficiencies, boost our competitive advantages and drive HVS growth Opportunistic M&A to broaden our offerings, technical know-how and international footprint Three Months Ended September 30, 2021 €153.9M Net Financial Position 4 Net cash generated from operating activities and Free Cash Flow were adversely impacted by income tax payments of approximately €13.7 million and increased working capital to sustain growth. * Free Cash Flow is a non-GAAP measure. Please refer to slides 13-19 for a reconciliation of non-GAAP measures €28.6M Capital Expenditures €17.9M4 Cash from Operations -€9.9M4 Free Cash Flow* €428M Total Cash and Cash Equivalents Third Quarter 2021 Financial Results TRANSACTIONS FOLLOWING QUARTER END Purchased remaining 35% minority interest in Denmark-based SVM Automatik for approximately €7M Sale of remaining minority interest in Swissfillon for net gain of approximately €12.3M, or €0.05 diluted EPS

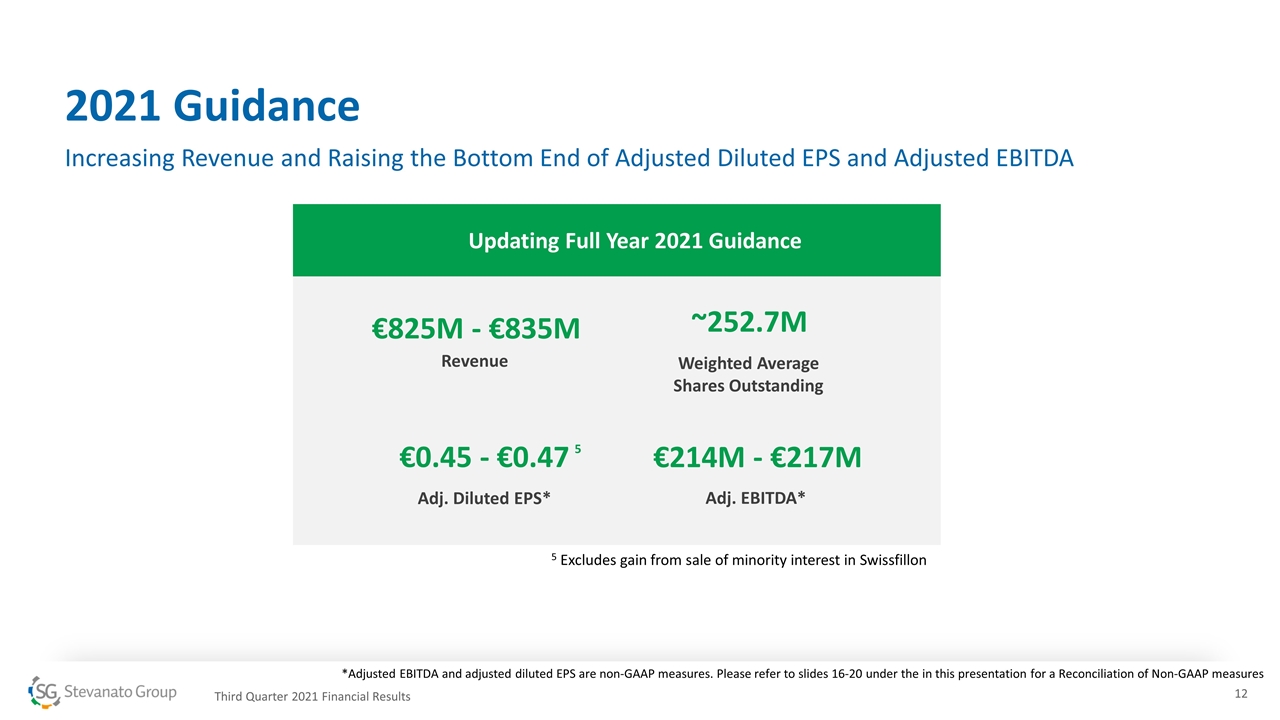

2021 Guidance Increasing Revenue and Raising the Bottom End of Adjusted Diluted EPS and Adjusted EBITDA Updating Full Year 2021 Guidance €825M - €835M Revenue €0.45 - €0.47 Adj. Diluted EPS* €214M - €217M Adj. EBITDA* ~252.7M Weighted Average Shares Outstanding 5 *Adjusted EBITDA and adjusted diluted EPS are non-GAAP measures. Please refer to slides 16-20 under the in this presentation for a Reconciliation of Non-GAAP measures Third Quarter 2021 Financial Results 5 Excludes gain from sale of minority interest in Swissfillon

Notes to Non-GAAP Financial Measures: This presentation contains non-GAAP measures. Management monitors and evaluates our operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, CAPEX, Adjusted Diluted EPS, and Free Cash Flow. We believe that these non-GAAP financial measures provide useful and relevant information regarding our performance and improve our ability to assess our financial condition. While similar measures are widely used in the industry in which we operate, the financial measures we use may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. A reconciliation of these adjusted Non-GAAP financial measures to the comparable GAAP financial measures is included in the accompanying tables. Third Quarter 2021 Financial Results

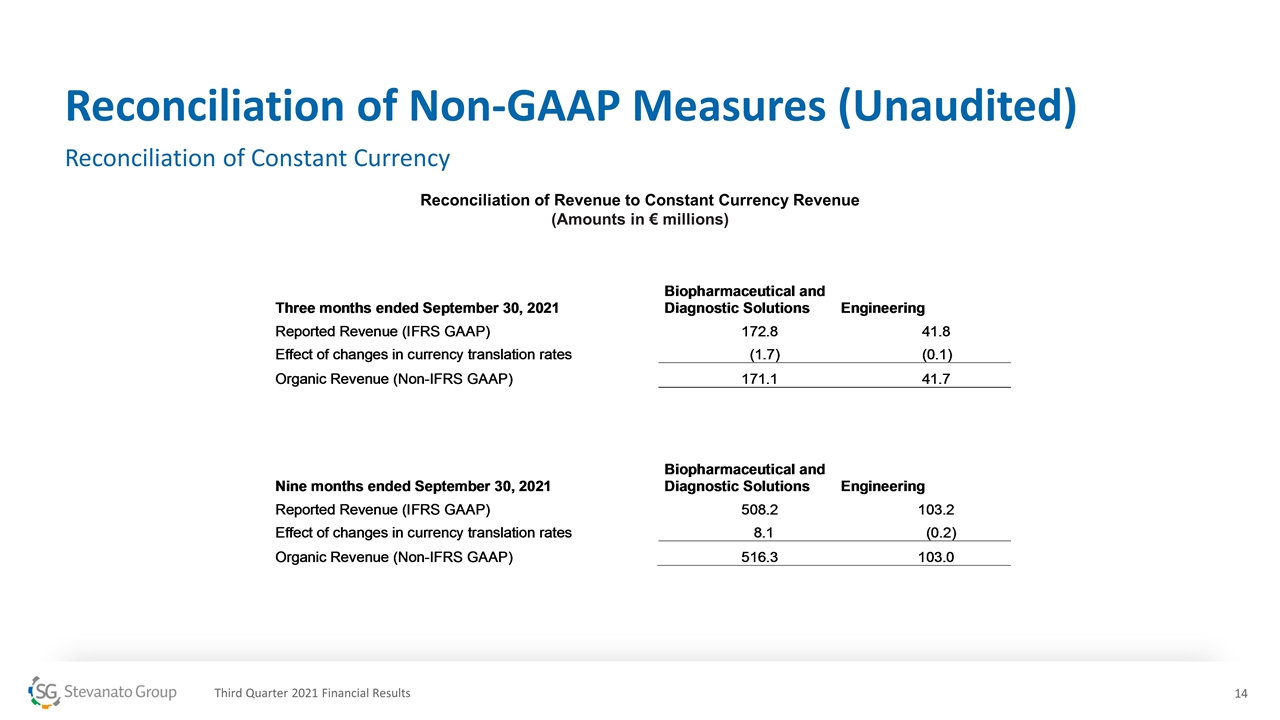

Reconciliation of Non-GAAP Measures (Unaudited) Reconciliation of Constant Currency Reconciliation of Revenue to Constant Currency Revenue (Amounts in € millions) Third Quarter 2021 Financial Results

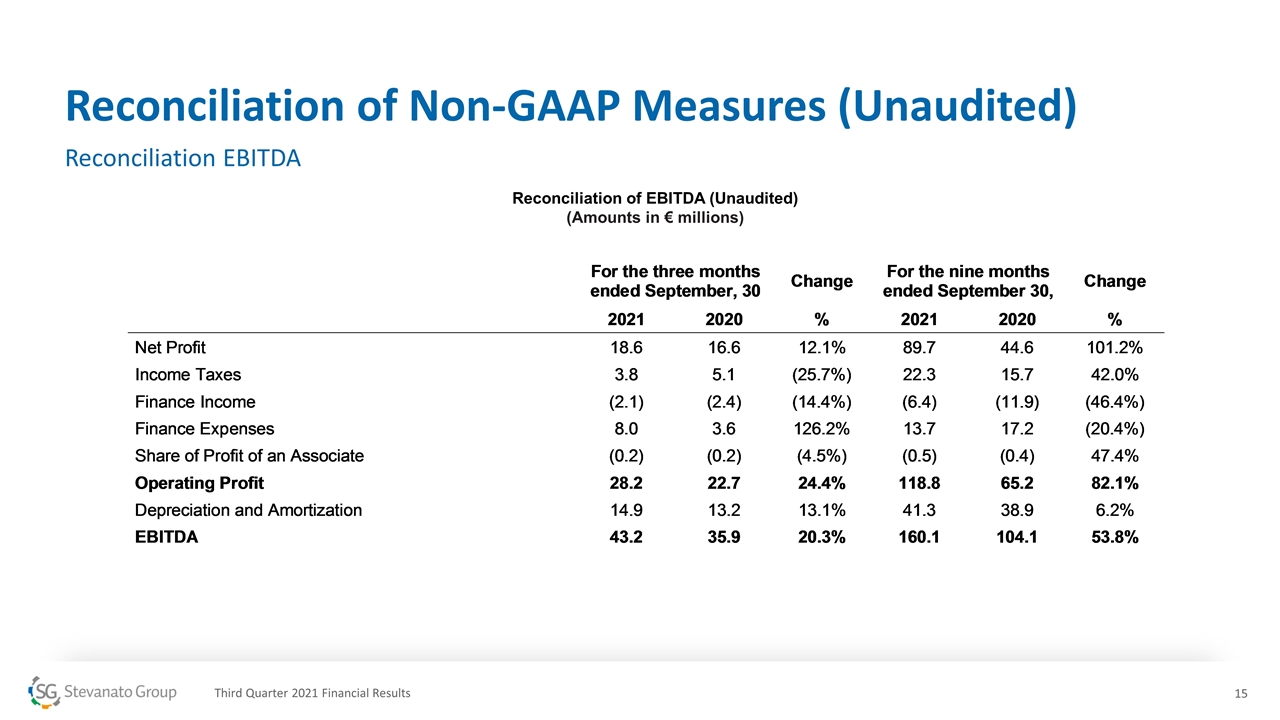

Reconciliation of Non-GAAP Measures (Unaudited) Reconciliation EBITDA Reconciliation of EBITDA (Unaudited) (Amounts in € millions) Third Quarter 2021 Financial Results

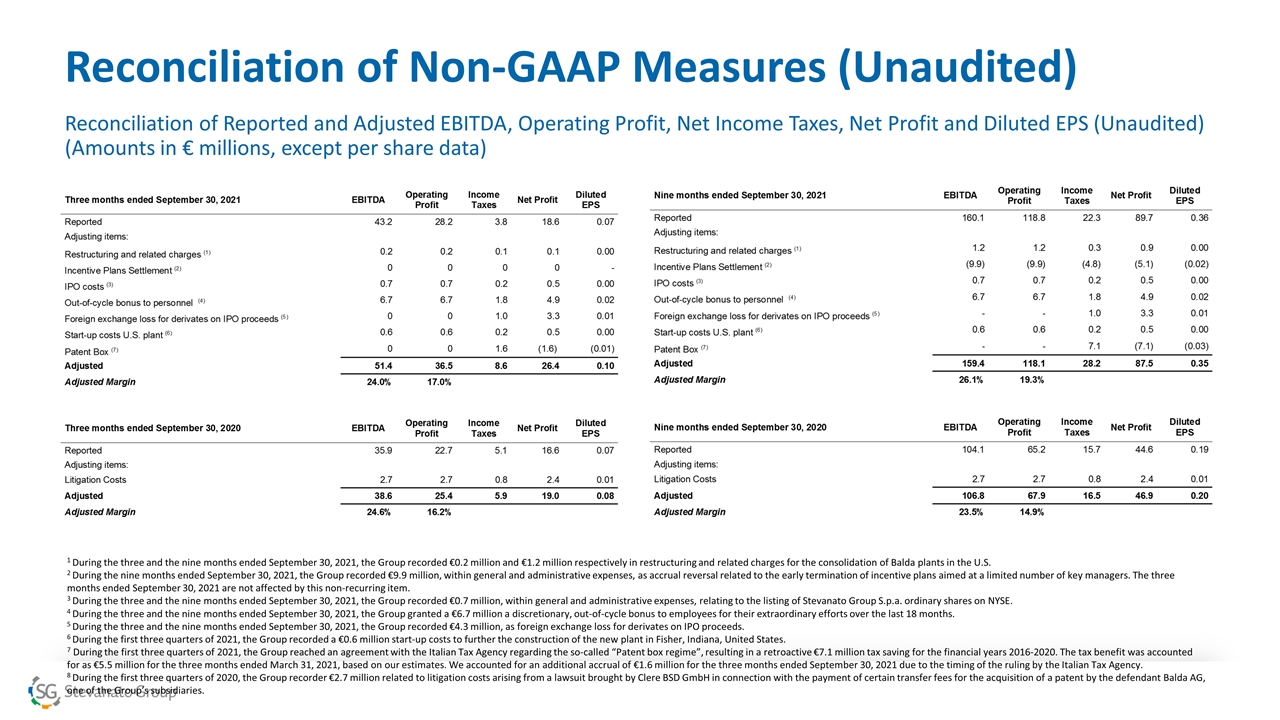

Reconciliation of Non-GAAP Measures (Unaudited) Reconciliation of Reported and Adjusted EBITDA, Operating Profit, Net Income Taxes, Net Profit and Diluted EPS (Unaudited) (Amounts in € millions, except per share data) 1 During the three and the nine months ended September 30, 2021, the Group recorded €0.2 million and €1.2 million respectively in restructuring and related charges for the consolidation of Balda plants in the U.S. 2 During the nine months ended September 30, 2021, the Group recorded €9.9 million, within general and administrative expenses, as accrual reversal related to the early termination of incentive plans aimed at a limited number of key managers. The three months ended September 30, 2021 are not affected by this non-recurring item. 3 During the three and the nine months ended September 30, 2021, the Group recorded €0.7 million, within general and administrative expenses, relating to the listing of Stevanato Group S.p.a. ordinary shares on NYSE. 4 During the three and the nine months ended September 30, 2021, the Group granted a €6.7 million a discretionary, out-of-cycle bonus to employees for their extraordinary efforts over the last 18 months. 5 During the three and the nine months ended September 30, 2021, the Group recorded €4.3 million, as foreign exchange loss for derivates on IPO proceeds. 6 During the first three quarters of 2021, the Group recorded a €0.6 million start-up costs to further the construction of the new plant in Fisher, Indiana, United States. 7 During the first three quarters of 2021, the Group reached an agreement with the Italian Tax Agency regarding the so-called “Patent box regime”, resulting in a retroactive €7.1 million tax saving for the financial years 2016-2020. The tax benefit was accounted for as €5.5 million for the three months ended March 31, 2021, based on our estimates. We accounted for an additional accrual of €1.6 million for the three months ended September 30, 2021 due to the timing of the ruling by the Italian Tax Agency. 8 During the first three quarters of 2020, the Group recorder €2.7 million related to litigation costs arising from a lawsuit brought by Clere BSD GmbH in connection with the payment of certain transfer fees for the acquisition of a patent by the defendant Balda AG, one of the Group’s subsidiaries.

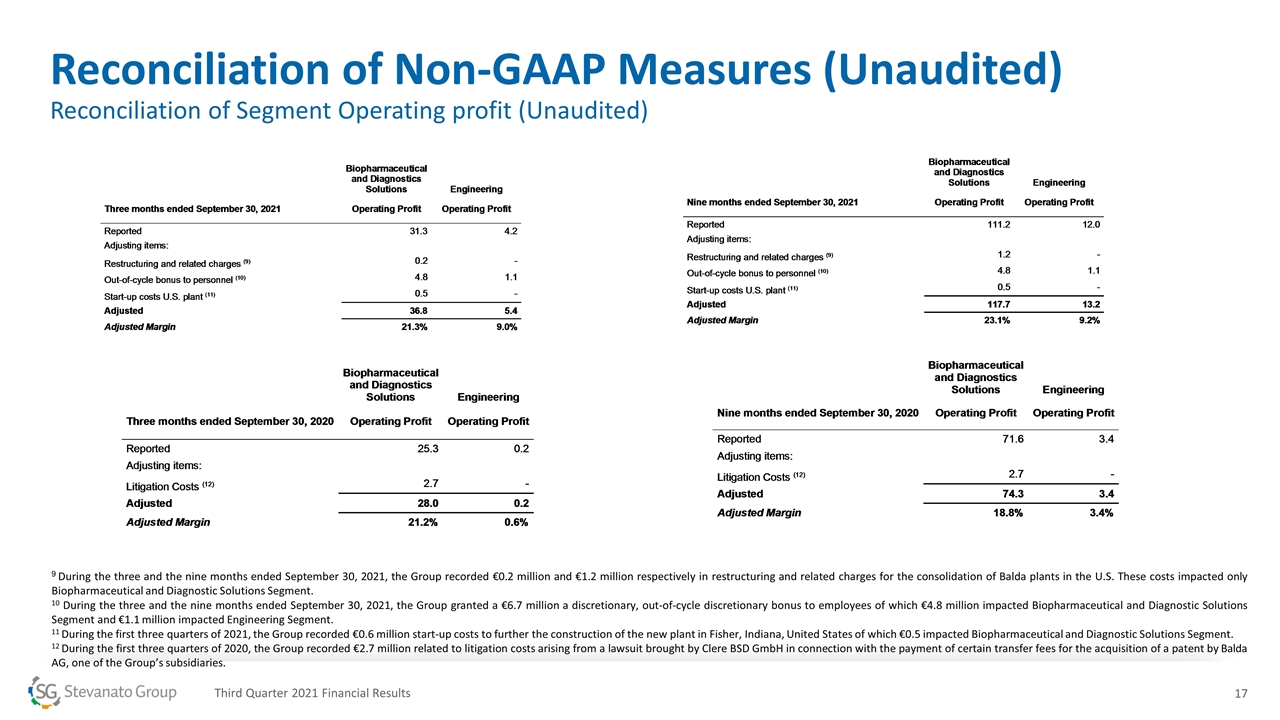

9 During the three and the nine months ended September 30, 2021, the Group recorded €0.2 million and €1.2 million respectively in restructuring and related charges for the consolidation of Balda plants in the U.S. These costs impacted only Biopharmaceutical and Diagnostic Solutions Segment. 10 During the three and the nine months ended September 30, 2021, the Group granted a €6.7 million a discretionary, out-of-cycle discretionary bonus to employees of which €4.8 million impacted Biopharmaceutical and Diagnostic Solutions Segment and €1.1 million impacted Engineering Segment. 11 During the first three quarters of 2021, the Group recorded €0.6 million start-up costs to further the construction of the new plant in Fisher, Indiana, United States of which €0.5 impacted Biopharmaceutical and Diagnostic Solutions Segment. 12 During the first three quarters of 2020, the Group recorded €2.7 million related to litigation costs arising from a lawsuit brought by Clere BSD GmbH in connection with the payment of certain transfer fees for the acquisition of a patent by Balda AG, one of the Group’s subsidiaries. Reconciliation of Non-GAAP Measures (Unaudited) Reconciliation of Segment Operating profit (Unaudited) Third Quarter 2021 Financial Results

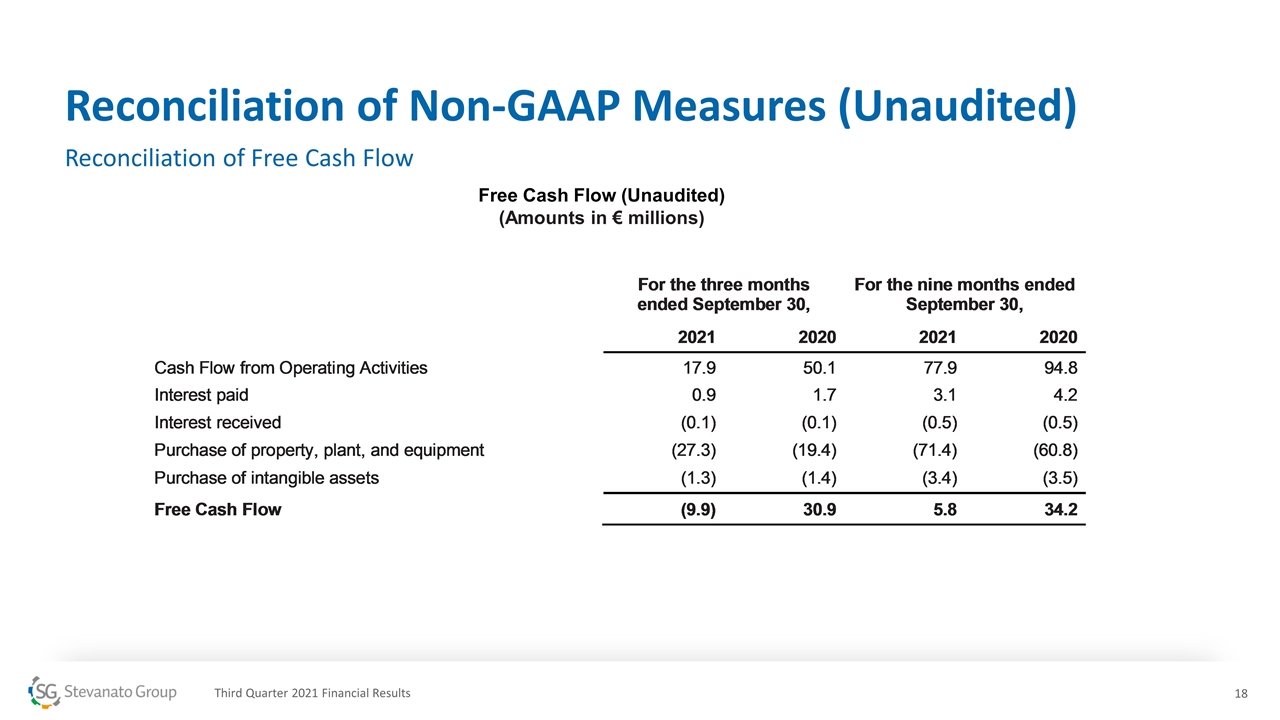

Reconciliation of Non-GAAP Measures (Unaudited) Reconciliation of Free Cash Flow Free Cash Flow (Unaudited) (Amounts in € millions) Third Quarter 2021 Financial Results

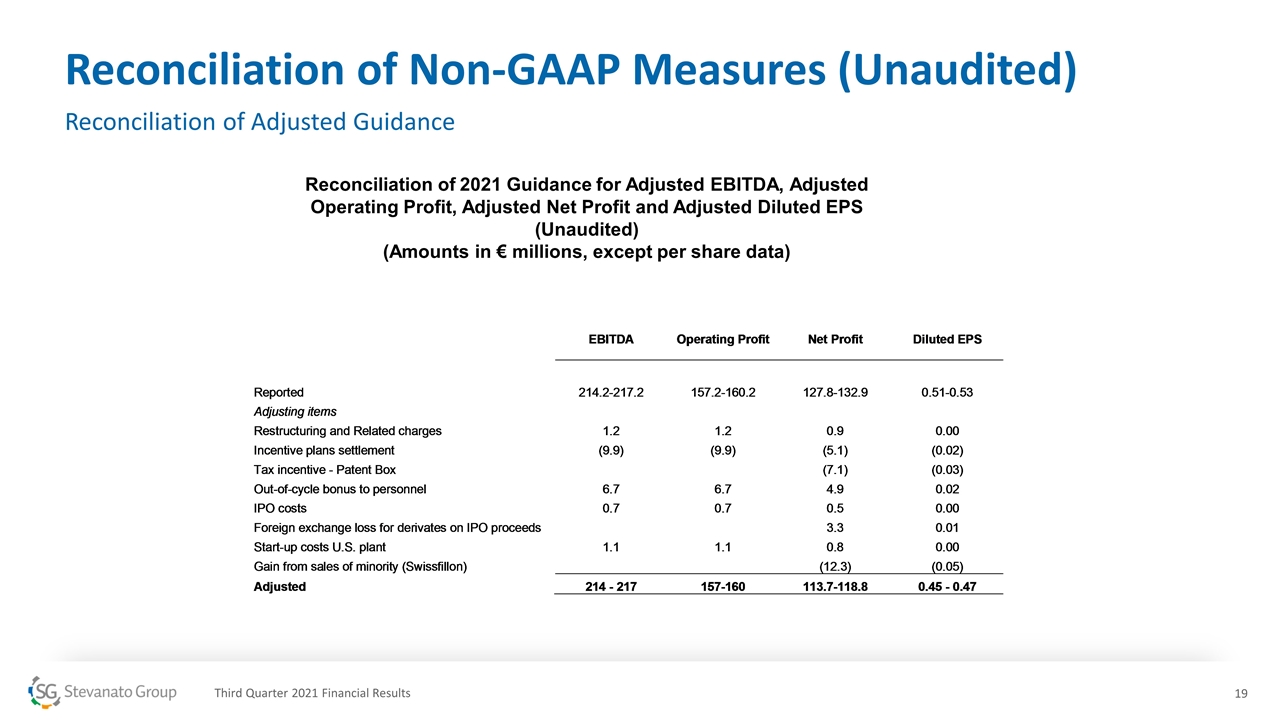

Reconciliation of Non-GAAP Measures (Unaudited) Reconciliation of Adjusted Guidance Reconciliation of 2021 Guidance for Adjusted EBITDA, Adjusted Operating Profit, Adjusted Net Profit and Adjusted Diluted EPS (Unaudited) (Amounts in € millions, except per share data) Third Quarter 2021 Financial Results

Contacts: Media Stevanato Group media@stevanatogroup.com Investor Relations Lisa Miles Lisa.miles@stevanatogroup.com