Exhibit 99.5

STEVANATO GROUP S.P.A.

REPORT ON REMUNERATION POLICY

AND PRACTICES

Exhibit 99.5

STEVANATO GROUP S.P.A.

REPORT ON REMUNERATION POLICY

AND PRACTICES

|

|

|

2 |

|

Stevanato Group S.p.A.

Report on remuneration policy and practices |

Introduction

To attract and retain people fully committed to the vision and purpose of Stevanato Group and able to support the success of our customers, it is fundamental to pay appropriately and fairly, balancing the interests of shareholders and employees, as well as all other stakeholders.

Remuneration policies and practices contribute to the long-term interests of Stevanato Group (“Group”) and enable the Group to reward performance in line with the Mission, Vision and Values.

The Group’s ambition is to motivate and develop people of the highest caliber and potential, and to build the Best Team, creating added value and delivering the best result for the customer. In this perspective, the remuneration policy, through dedicated compensation and welfare programs, aims at fostering a culture that values diversity, innovation and excellence.

The object of this year’s report is to describe the framework and the approach that will drive the development of the compensation policy and practices of Stevanato Group as a listed company, from 2022 onwards. To this purpose, the Compensation Committee, established on June 16, 2021, is currently working, in close cooperation with Group management, on the development of a remuneration policy that will continuously evolve to ensure its adherence to market best practices, Group’s life cycle and strategic priorities.

From 2023, the Compensation Committee will be ready to share with Company’s shareholders the overall set-up of Group remuneration policy and practices. In particular, information will be provided that outlines how our remuneration program aligns with our guiding principles and will discuss the balance between fixed and variable compensation, key metrics included in our incentive programs, alignment of pay and performance and how our commitment to DE&I is supported in our short-term incentive program.

The Committee, in line with market best practices, has availed itself of the services of the external advisor Mercer, a global leader of HR consulting, with extensive experience in Executive Remuneration.

Approach to Remuneration Policy

The purpose of Stevanato Group’s Remuneration Policy is to support successful business performance through an engaged and motivated team, attracted to the organization by a consistent and differentiated employment offering delivered at an affordable and sustainable cost, in line with business goals and long-term company’s objectives.

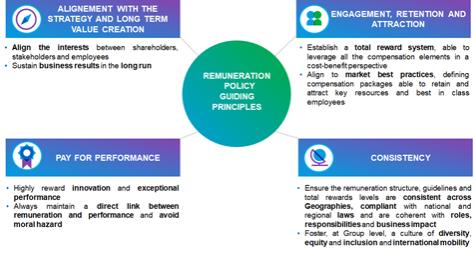

Stevanato’s Remuneration Policy is based on the following key pillars:

|

3 |

|

Stevanato Group S.p.A.

Report on remuneration policy and practices |

Stevanato Group Remuneration Practices

The remuneration structure envisages an appropriate combination and balance of all the incentive levers and components (base salary, short term incentive plan, long term incentive plan, benefits), to design compensation packages consistent with different clusters of the population, roles and complexity of the positions.

Total remuneration packages are subject to periodical review to ensure internal consistency, as well as adequacy and competitiveness compared to the markets for positions of similar levels of responsibility and complexity.

Base Salary (Fixed Remuneration)

Base Salary is determined and allocated based on pre-defined criteria.

It reflects the role and the responsibilities assigned, taking into consideration skills, contribution and experience required for the position.

The overall amount and weight of Base Salary must be sufficient and appropriate to remunerate the role and is periodically reviewed with respect to a predefined reference market.

Variable Remuneration

The variable component of Stevanato’s remuneration framework consists of:

| ● | Short Term Incentive Plan |

| ● | Long Term Incentive Plan |

Short Term Incentive Plan is a cash-based plan that aims at motivating and rewarding the achievement of annual financial and non-financial objectives, within the framework of long-term sustainable performance.

Key performance indicators, foreseen in the annual bonus scheme, vary depending on organizational layer and responsibilities of the participants. There is a mix of financial metrics at Group level (such as revenues, ebitda or ebitda margin, net working capital, free cash flow) and non-financial metrics (such as strategic objectives linked to business plan priorities, ESG performance areas, and operating metrics in the areas of safety, quality, production, sales, customer satisfaction). It is expected that the heaviest weighting for senior executives will be on financial metrics.

Short Term Incentive Plan envisages a cap to the maximum award and pre-defined performance and payout curves.

Target bonus opportunity for eligible positions is defined according to the level of accountabilities, contribution to company results and consistent with practices of the reference market.

Long Term Incentive Plan aims at strengthening the link between variable compensation, company performance and shareholder return over a multi-year period. The current Plan is a Stock Grant Plan, subject to claw-back clause.

Stock Grant Plan provides for the right of the beneficiaries to be granted a pre-defined number of shares of the Company, free of any charges, that will be awarded at the end of the vesting period, subject to the achievement of specific financial performance objectives at Group level. Furthermore, at the end of the vesting period, the Plan provides for a lock-up period, during which beneficiaries shall maintain the shares awarded.

|

4 |

|

Stevanato Group S.p.A.

Report on remuneration policy and practices |

The Plan envisages pre-defined pay for performance curves and a cap to the maximum award that can be earned in terms of number of shares.

The number of shares individually granted at the beginning of the vesting period is defined according to the level of accountabilities and business impact of each eligible position and consistent with practices of the reference market.

Benefits

As an Employer of Choice, Stevanato provides comprehensive and competitive Employee Benefits (such as pension schemes, healthcare plans, company car) as part of the Total Rewards package. Benefits provide substantial guarantees for the well-being of staff during their active career, as well as their retirement.

Stevanato Group’s Commitment on Diversity, Equity & Inclusion (DE&I)

Stevanato Group is committed to ensure fair treatment in terms of compensation and benefits, as well as in terms of opportunities and career development, regardless of gender, age, ethnicity, disability, sexual orientation, religion, as well as any other traits.

One important ambition of the Group is to foster a culture that values DE&I in all the locations in which the Group operates, promoting staff well-being through dedicated compensation and welfare programs to be competitive globally.

Stevanato Group confirms this commitment also through the inclusion of specific targets on DE&I within the Short Term Incentive goal card of the top management and where progress is regularly monitored.

|

5 |