First Quarter 2022 Financial Results May 10, 2022 Exhibit 99.1

Safe-Harbor Statement Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of Stevanato Group S.p.A. (“we”, “our”, “us”, “Stevanato Group” or the “Company”). These forward-looking statements include, or may include, words such as “plan”, “advancing”, “emerging”, “opportunities”, “increasing”, “trends”, “advancement”, “broadening”, “expect”, “expected”, “targeted”, “believe”, “estimate”, “poised to”, and other similar terminology. Forward-looking statements contained in this presentation include, but are not limited to, statements about: our future financial performance, including our revenue, operating expenses and our ability to maintain profitability and operational and commercial capabilities; our expectations regarding the development of our industry and the competitive environment in which we operate; the expansion of our plants and our expectations to increase production capacity; the global supply chain and our committed orders; the global response to COVID-19 and our role in it; our geographical and industrial footprint; and our goals, strategies and investment plans. These statements are neither promise nor guarantee but involve known and unknown risks, uncertainties and other important factors and circumstances that may cause Stevanato Group’s actual results, performance or achievements to be materially different from its expectations expressed or implied by the forward-looking statements, including conditions in the U.S. capital markets, negative global economic conditions, inflation, potential negative developments in the COVID-19 pandemic, the impact of the conflict between Russia and Ukraine, supply chain challenges and other negative developments in Stevanato Group’s business or unfavorable legislative or regulatory developments. The following are some of the factors that could cause our actual results to differ materially from those expressed in or underlying our forward-looking statements: (i) our product offerings are highly complex, and, if our products do not satisfy applicable quality criteria, specifications and performance standards, we could experience lost sales, delayed or reduced market acceptance of our products, increased costs and damage to our reputation; (ii) we must develop new products and enhance existing products, adapt to significant technological and innovative changes and respond to introductions of new products by competitors to remain competitive; (iii) our backlog might not accurately predict our future revenue, and we might not realize all or any part of the anticipated revenue reflected in our backlog; (iv) if we fail to maintain and enhance our brand and reputation, our business, results of operations and prospects may be materially and adversely affected; (v) we are highly dependent on our management and employees. Competition for our employees is intense, and we may not be able to attract and retain the highly skilled employees that we need to support our business and our intended future growth; (vi) our business, financial condition and results of operations depend upon maintaining our relationships with suppliers and service providers; (vii) our business, financial condition and results of operations depend upon the availability and price of high-quality materials and energy supply and our ability to contain production costs; (viii) the current conflict between Russia and Ukraine and the financial and economic sanctions imposed by the European Union, the U.S., the United Kingdom and other countries and organizations against officials, individuals, regions, and industries in Russia and Belarus may negatively impact our ability to source gas at commercially reasonable terms or at all and could have a material adverse effect on our operations; (ix) significant interruptions in our operations could harm our business, financial condition and results of operations; (x) as a consequence of the COVID-19 pandemic, sales of syringes and vials to and for vaccination programs globally increased resulting in a revenue growth acceleration. The demand for such products may shrink, if the need for COVID-19 related solutions declines; (xi) our manufacturing facilities are subject to operating hazards which may lead to production curtailments or shutdowns and have an adverse effect on our business, results of operations, financial condition or cash flows; (xii) we may face significant competition in implementing our strategies for revenue growth in light of actions taken by our competitors; (xiii) our global operations are subject to international market risks that may have a material effect on our liquidity, financial condition, results of operations and cash flows; (xiv) we are required to comply with a wide variety of laws and regulations and are subject to regulation by various federal, state and foreign agencies; (xv) if relations between China and the United States deteriorate, our business in the United States and China could be materially and adversely affected; and (xvi) Cyber security risks and the failure to maintain the confidentiality, integrity and availability of our computer hardware, software and internet applications and related tools and functions, could result in damage to our reputation, data integrity and/or subject us to costs, fines or lawsuits under data privacy or other laws or contractual requirements. This list is not exhaustive. We caution you therefore against relying on these forward-looking statements and we qualify all of our forward-looking statements by these cautionary statements. These forward-looking statements speak only as at their dates. The Company undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible to predict all of these factors. Further, the Company cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statements. For a description of certain additional factors that could cause the Company’s future results to differ from those expressed in any such forward-looking statements, refer to the risk factors discussed in our Annual Report on Form 20-F/A for the year ended December 31, 2021 filed with the U.S. Securities and Exchange Commission on April 5, 2022. Non-GAAP Financial Information This presentation contains non-GAAP measures. Please refer to the tables included in this presentation for a reconciliation of non-GAAP measures. Management monitors and evaluates our operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Net Profit, Adjusted Diluted EPS, Capital Employed, Net Cash, Free Cash Flow and CAPEX. We believe that these non-GAAP financial measures provide useful and relevant information regarding our performance and improve our ability to assess our financial condition. While similar measures are widely used in the industry in which we operate, the financial measures we use may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. First Quarter 2022 Financial Results

Franco Stevanato Executive Board Chairman Stevanato Group First Quarter 2022 Earnings Call Speakers First Quarter 2022 Financial Results Franco Moro CEO Marco Dal Lago CFO Lisa Miles SVP IR

Franco Stevanato Executive Chairman

A Strong Start to FY 2022 Fostering a track record of consistent performance First Quarter 2022 Financial Results Executing multi-year strategic plan to drive sustainable organic growth, increase penetration of HVS and expand EBITDA margins Building on strong foundation, guided by philosophy that customers and patients are at the heart of everything we do Our focus on science and technology, together with history of pioneering new trends to enhance the integrity of medicines, has helped SG become a global leader of integrated capabilities Nominated to Sanofi’s distinguished 2022 Supplier Hall of Fame in recognition of our Collaborative Mindset Stevanato Board recommended the approval of a cash dividend of approximately €13.5 million, subject to shareholder approval at the Annual General Meeting on June 1, 2022; affirms the Board’s confidence in management, the strength of the underlying fundamentals of the business, the favorable multi-year secular trends and robust demand

Franco Moro Chief Executive Officer & Chief Operating Officer

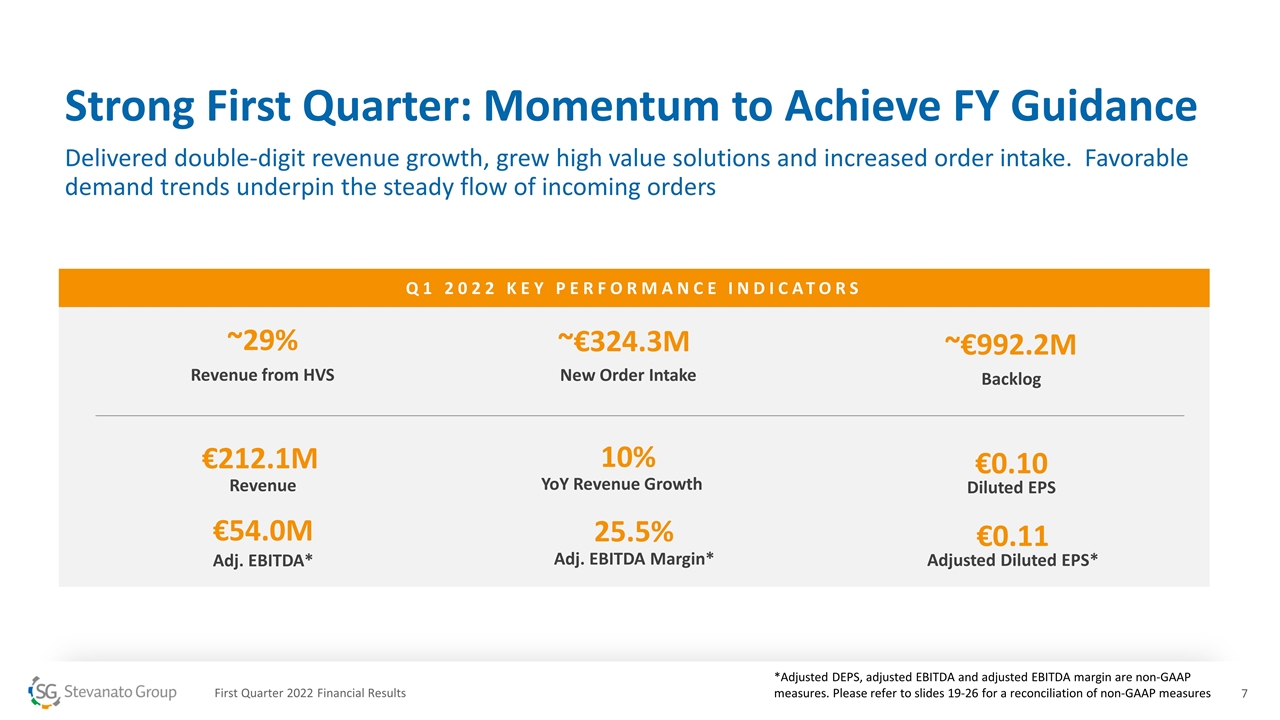

Strong First Quarter: Momentum to Achieve FY Guidance Delivered double-digit revenue growth, grew high value solutions and increased order intake. Favorable demand trends underpin the steady flow of incoming orders First Quarter 2022 Financial Results *Adjusted DEPS, adjusted EBITDA and adjusted EBITDA margin are non-GAAP measures. Please refer to slides 19-26 for a reconciliation of non-GAAP measures Q1 2022 KEY PERFORMANCE INDICATORS €212.1M Revenue 10% YoY Revenue Growth €54.0M Adj. EBITDA* 25.5% Adj. EBITDA Margin* €0.10 Diluted EPS ~€324.3M New Order Intake ~€992.2M Backlog ~29% Revenue from HVS €0.11 Adjusted Diluted EPS*

First Quarter 2022 Financial Results Regional EZ-fill® hubs in the U.S. and China broaden production footprint, increase capacity of premium products and anchor operations in strategic markets; supplemented by incremental capacity in Italy Advancing Expansions Rapidly responding to customer demand for premium containment and RTU platforms; driven by more complex treatments like biologics. Reduces customers’ TCO, increases flexibility and quality Growing HVS Efforts focused on primary packaging and DDS to accelerate market leading position, strengthen IP, and develop new technologies to advance patient care Innovating in R&D New opportunities as emerging therapies create a growing demand for HVS like Nexa® and Alba®. As patient care evolves new opportunities to increase presence in DDS Building Pipeline 2022 Strategic and Operational Priorities

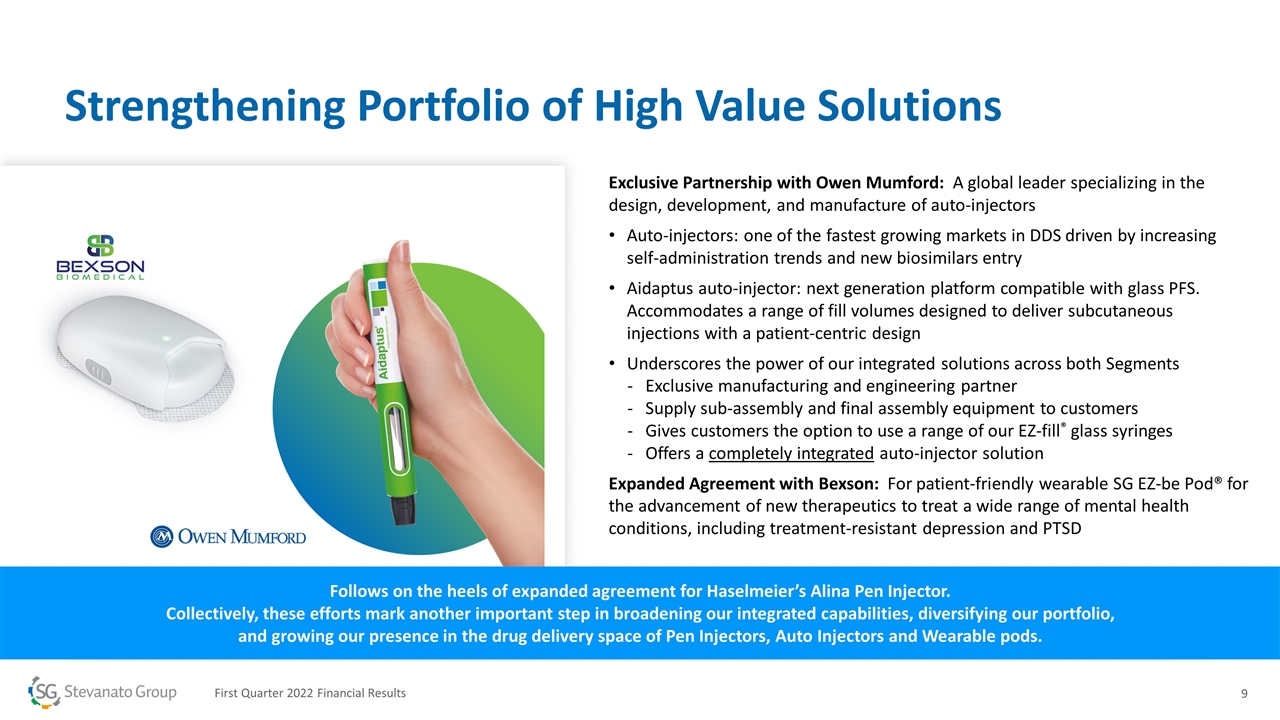

Exclusive Partnership with Owen Mumford: A global leader specializing in the design, development, and manufacture of auto-injectors Auto-injectors: one of the fastest growing markets in DDS driven by increasing self-administration trends and new biosimilars entry Aidaptus auto-injector: next generation platform compatible with glass PFS. Accommodates a range of fill volumes designed to deliver subcutaneous injections with a patient-centric design Underscores the power of our integrated solutions across both Segments Exclusive manufacturing and engineering partner Supply sub-assembly and final assembly equipment to customers Gives customers the option to use a range of our EZ-fill® glass syringes Offers a completely integrated auto-injector solution Expanded Agreement with Bexson: For patient-friendly wearable SG EZ-be Pod® for the advancement of new therapeutics to treat a wide range of mental health conditions, including treatment-resistant depression and PTSD Strengthening Portfolio of High Value Solutions First Quarter 2022 Financial Results Follows on the heels of expanded agreement for Haselmeier’s Alina Pen Injector. Collectively, these efforts mark another important step in broadening our integrated capabilities, diversifying our portfolio, and growing our presence in the drug delivery space of Pen Injectors, Auto Injectors and Wearable pods.

Advancing Progress on FY 2022 Industrial Plan Cornerstone of long-term strategic growth plan is building HVS capacity to meet robust customer demand First Quarter 2022 Financial Results Priority projects expand industrial footprint in some of the fastest growing markets, adding capacity amid rising demand. Modular approach to maximize capital investments with the flexibility to match capacity buildout to demand trends. China In design phase of new regional hub for EZ-fill® syringes and vials, and standard formats. Expect revenue generation will begin 2H 2024 Existing operations: implemented closed loop management which allowed for continued production in lockdown and today, back to normal operations North America On track with the build out of our EZ-fill® hub in Indiana where commercial operation and revenue generation are still targeted to begin sometime between late 2023 to early 2024

Unprecedented demand for electrical components, coupled with lockdowns in China, further impacted tight supply chains; While it created a disruption for manufacturing parts we use, we pivoted efforts to optimize production in HVS where demand is strong Sourcing from multiple suppliers, ordering materials much further in advance, and keeping more raw materials and inventory on hand Over the last two years, prioritized actions to reduce downstream impact from pandemic; continue to find practical solutions as challenges evolve Manufacturing innovation and operational efficiencies help to counterbalance inflation and tight supply chains Successfully managing supply chain and working closely with suppliers and customers to manage our global supply chain in this environment We believe many of these business challenges will persist throughout 2022 and our guidance considers this Effectively Navigating Inflation & Supply Chain Environment First Quarter 2022 Financial Results

Marco Dal Lago Chief Financial Officer

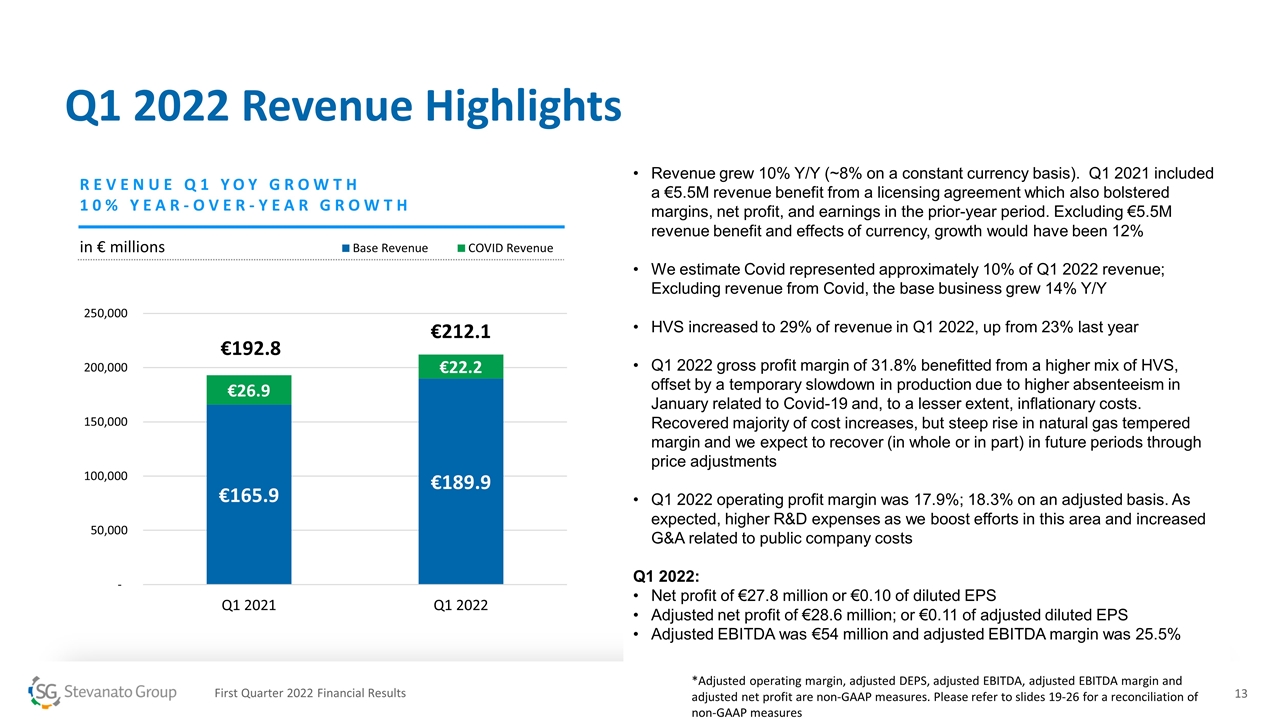

Q1 2022 Revenue Highlights First Quarter 2022 Financial Results €212.1 €192.8 Revenue grew 10% Y/Y (~8% on a constant currency basis). Q1 2021 included a €5.5M revenue benefit from a licensing agreement which also bolstered margins, net profit, and earnings in the prior-year period. Excluding €5.5M revenue benefit and effects of currency, growth would have been 12% We estimate Covid represented approximately 10% of Q1 2022 revenue; Excluding revenue from Covid, the base business grew 14% Y/Y HVS increased to 29% of revenue in Q1 2022, up from 23% last year Q1 2022 gross profit margin of 31.8% benefitted from a higher mix of HVS, offset by a temporary slowdown in production due to higher absenteeism in January related to Covid-19 and, to a lesser extent, inflationary costs. Recovered majority of cost increases, but steep rise in natural gas tempered margin and we expect to recover (in whole or in part) in future periods through price adjustments Q1 2022 operating profit margin was 17.9%; 18.3% on an adjusted basis. As expected, higher R&D expenses as we boost efforts in this area and increased G&A related to public company costs Q1 2022: Net profit of €27.8 million or €0.10 of diluted EPS Adjusted net profit of €28.6 million; or €0.11 of adjusted diluted EPS Adjusted EBITDA was €54 million and adjusted EBITDA margin was 25.5% *Adjusted operating margin, adjusted DEPS, adjusted EBITDA, adjusted EBITDA margin and adjusted net profit are non-GAAP measures. Please refer to slides 19-26 for a reconciliation of non-GAAP measures REVENUE Q1 YOY GROWTH 10% YEAR-OVER-YEAR GROWTH in € millions

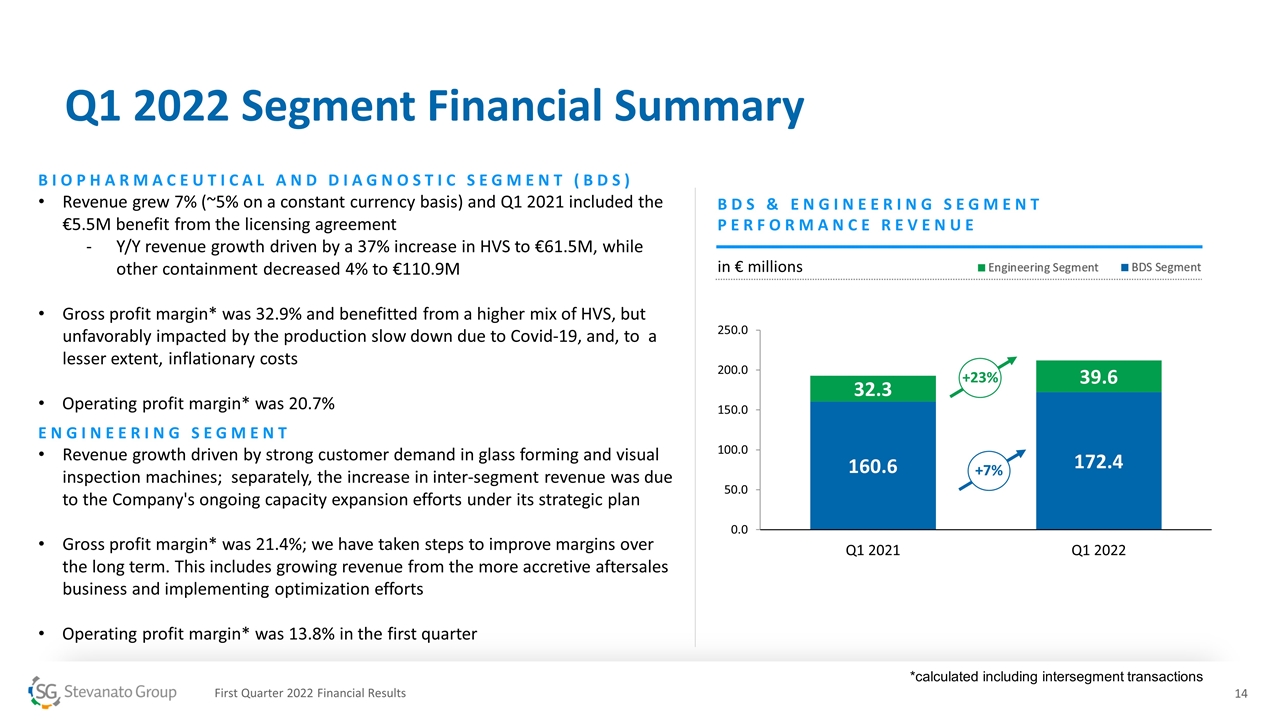

Q1 2022 Segment Financial Summary BDS & ENGINEERING SEGMENT PERFORMANCE REVENUE in € millions First Quarter 2022 Financial Results +7% +23% BIOPHARMACEUTICAL AND DIAGNOSTIC SEGMENT (BDS) Revenue grew 7% (~5% on a constant currency basis) and Q1 2021 included the €5.5M benefit from the licensing agreement Y/Y revenue growth driven by a 37% increase in HVS to €61.5M, while other containment decreased 4% to €110.9M Gross profit margin* was 32.9% and benefitted from a higher mix of HVS, but unfavorably impacted by the production slow down due to Covid-19, and, to a lesser extent, inflationary costs Operating profit margin* was 20.7% ENGINEERING SEGMENT Revenue growth driven by strong customer demand in glass forming and visual inspection machines; separately, the increase in inter-segment revenue was due to the Company's ongoing capacity expansion efforts under its strategic plan Gross profit margin* was 21.4%; we have taken steps to improve margins over the long term. This includes growing revenue from the more accretive aftersales business and implementing optimization efforts Operating profit margin* was 13.8% in the first quarter *calculated including intersegment transactions

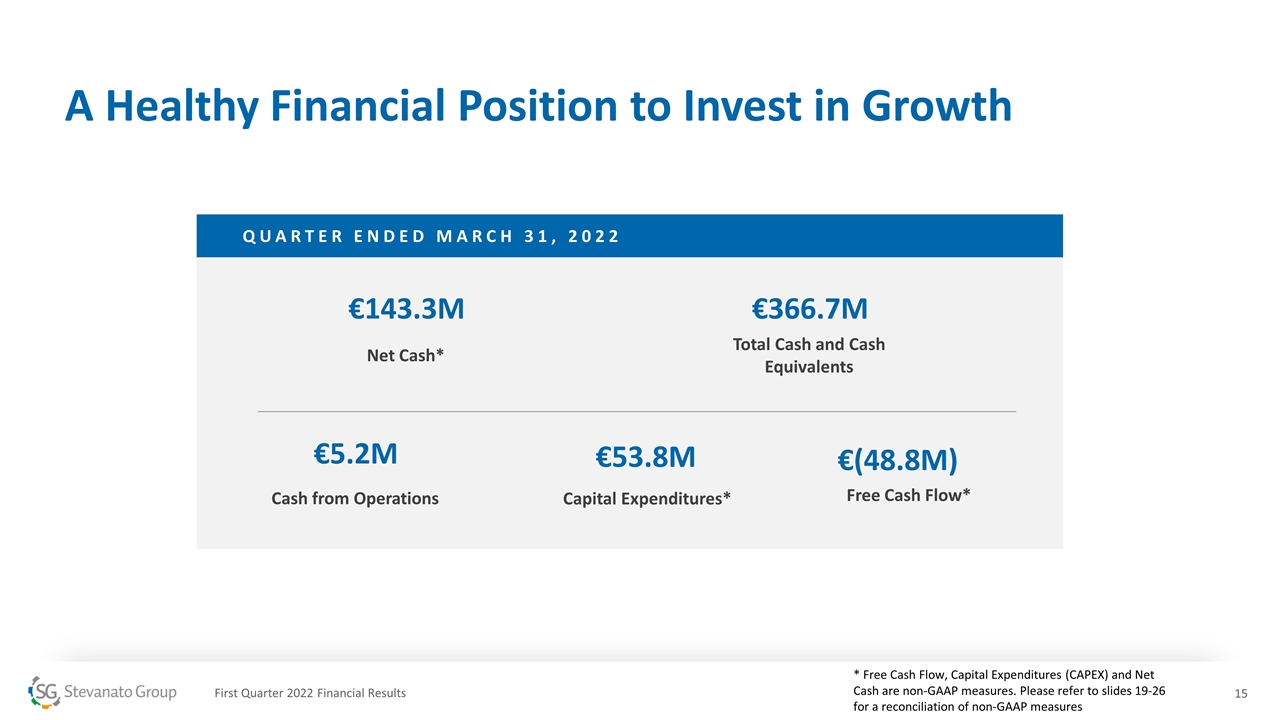

A Healthy Financial Position to Invest in Growth First Quarter 2022 Financial Results * Free Cash Flow, Capital Expenditures (CAPEX) and Net Cash are non-GAAP measures. Please refer to slides 19-26 for a reconciliation of non-GAAP measures QUARTER ENDED MARCH 31, 2022 €143.3M Net Cash* €53.8M Capital Expenditures* €5.2M Cash from Operations €(48.8M) Free Cash Flow* €366.7M Total Cash and Cash Equivalents

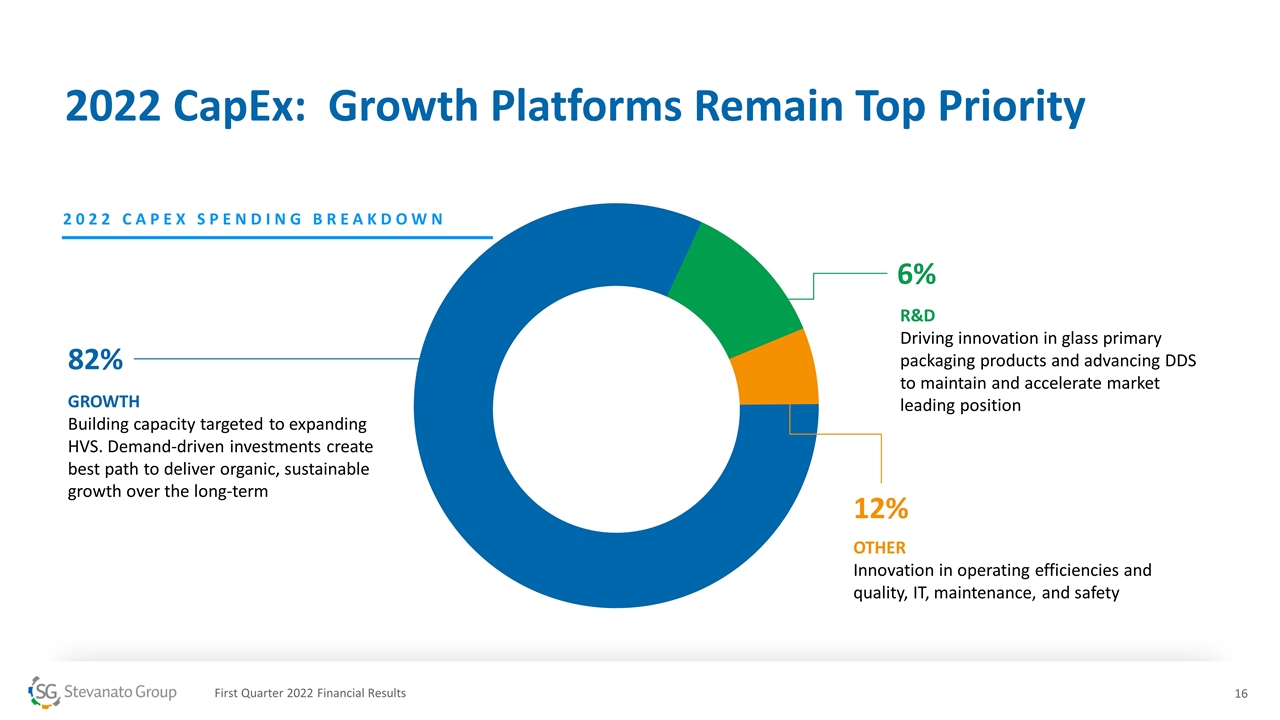

2022 CapEx: Growth Platforms Remain Top Priority First Quarter 2022 Financial Results GROWTH Building capacity targeted to expanding HVS. Demand-driven investments create best path to deliver organic, sustainable growth over the long-term OTHER Innovation in operating efficiencies and quality, IT, maintenance, and safety R&D Driving innovation in glass primary packaging products and advancing DDS to maintain and accelerate market leading position 2022 CAPEX SPENDING BREAKDOWN 82% 6% 12%

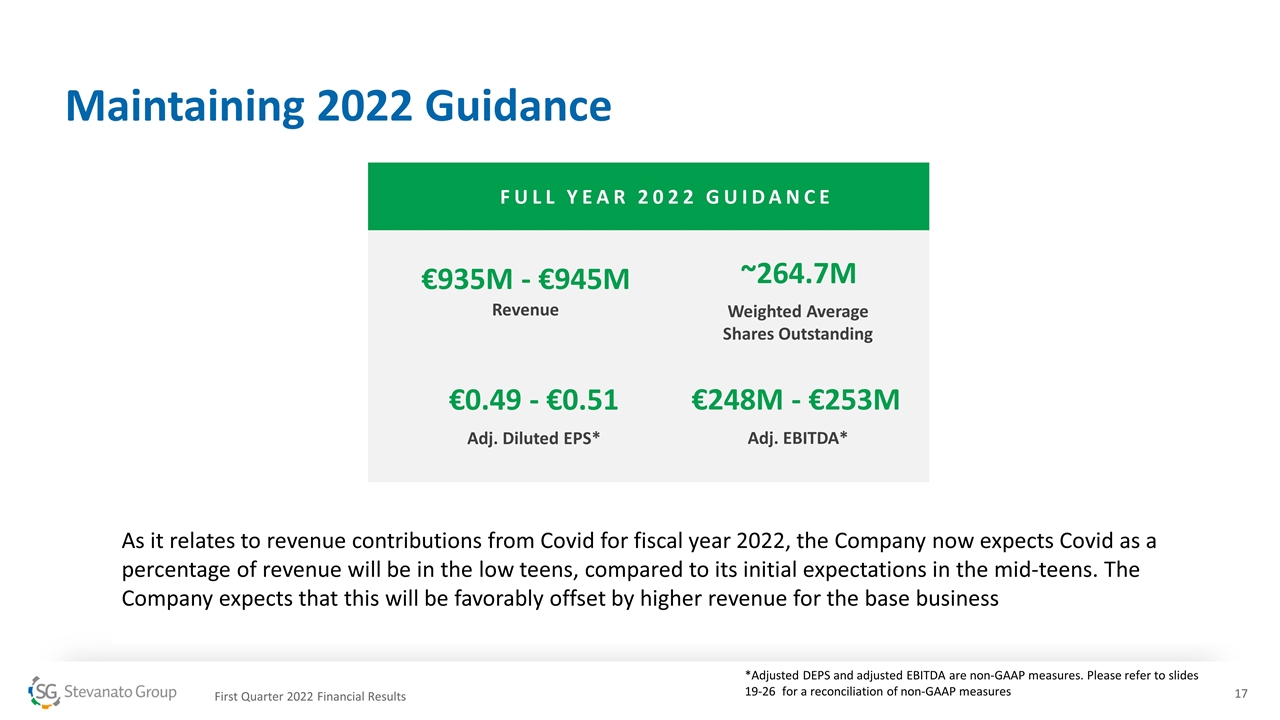

Maintaining 2022 Guidance FULL YEAR 2022 GUIDANCE €935M - €945M Revenue €0.49 - €0.51 Adj. Diluted EPS* €248M - €253M Adj. EBITDA* ~264.7M Weighted Average Shares Outstanding *Adjusted DEPS and adjusted EBITDA are non-GAAP measures. Please refer to slides 19-26 for a reconciliation of non-GAAP measures First Quarter 2022 Financial Results As it relates to revenue contributions from Covid for fiscal year 2022, the Company now expects Covid as a percentage of revenue will be in the low teens, compared to its initial expectations in the mid-teens. The Company expects that this will be favorably offset by higher revenue for the base business

Delivered solid quarter of financial results that were in-line with expectations Building a track record of consistent performance and maintaining guidance Operating in an environment of strong demand Attractive end markets that have durable, secular multi-year drivers Poised to capitalize on favorable trends as customers develop more advanced treatments that demand a more sophisticated approach to drug containment Strengthening DDS portfolio to improve patients’ lives as therapies shift from point of lab to point of care Investing in areas that ensure that Stevanato Group remains at the forefront of scientific innovation and a trusted partner to customers In Summary First Quarter 2022 Financial Results

Notes to Non-GAAP Financial Measures: This presentation contains non-GAAP measures First Quarter 2022 Financial Results Management monitors and evaluates our operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Net Profit, Adjusted Diluted EPS, Capital Employed, Net Cash, Free Cash Flow and CAPEX. We believe that these non-GAAP financial measures provide useful and relevant information regarding our performance and improve our ability to assess our financial condition. While similar measures are widely used in the industry in which we operate, the financial measures we use may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. A reconciliation of these adjusted Non-GAAP financial measures to the comparable GAAP financial measures is included in the accompanying tables.

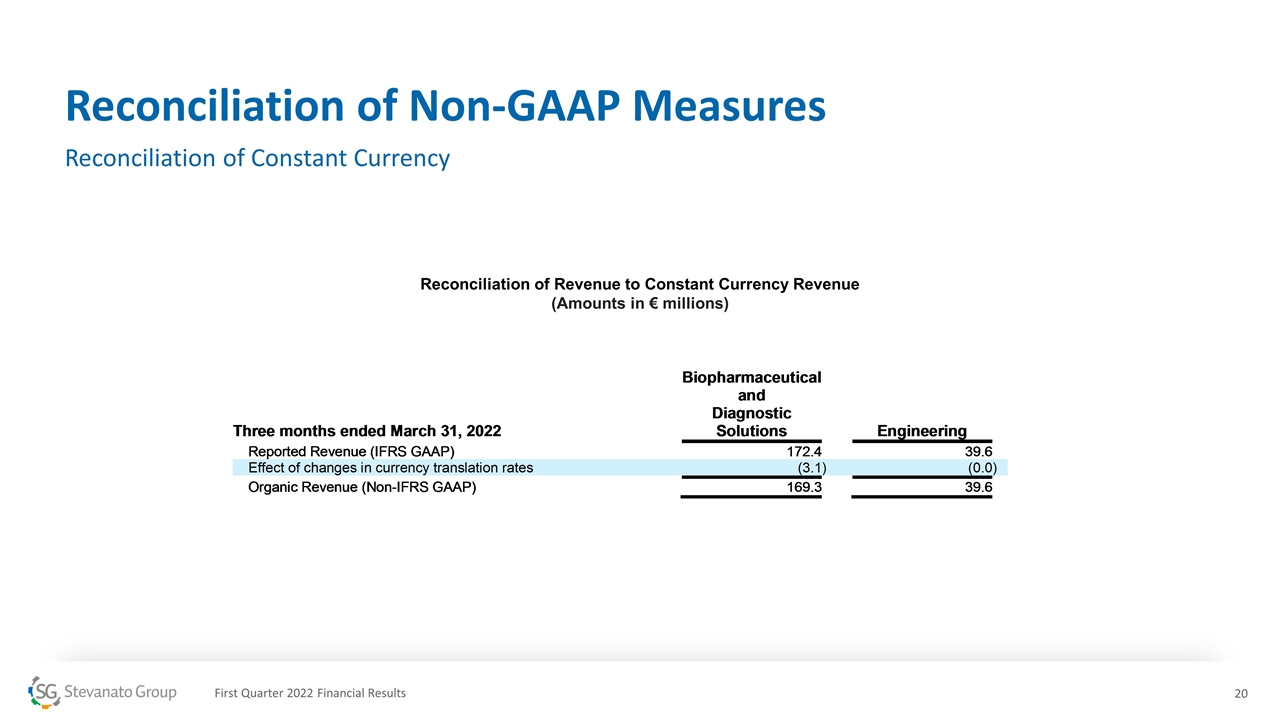

Reconciliation of Non-GAAP Measures Reconciliation of Constant Currency First Quarter 2022 Financial Results Reconciliation of Revenue to Constant Currency Revenue (Amounts in € millions)

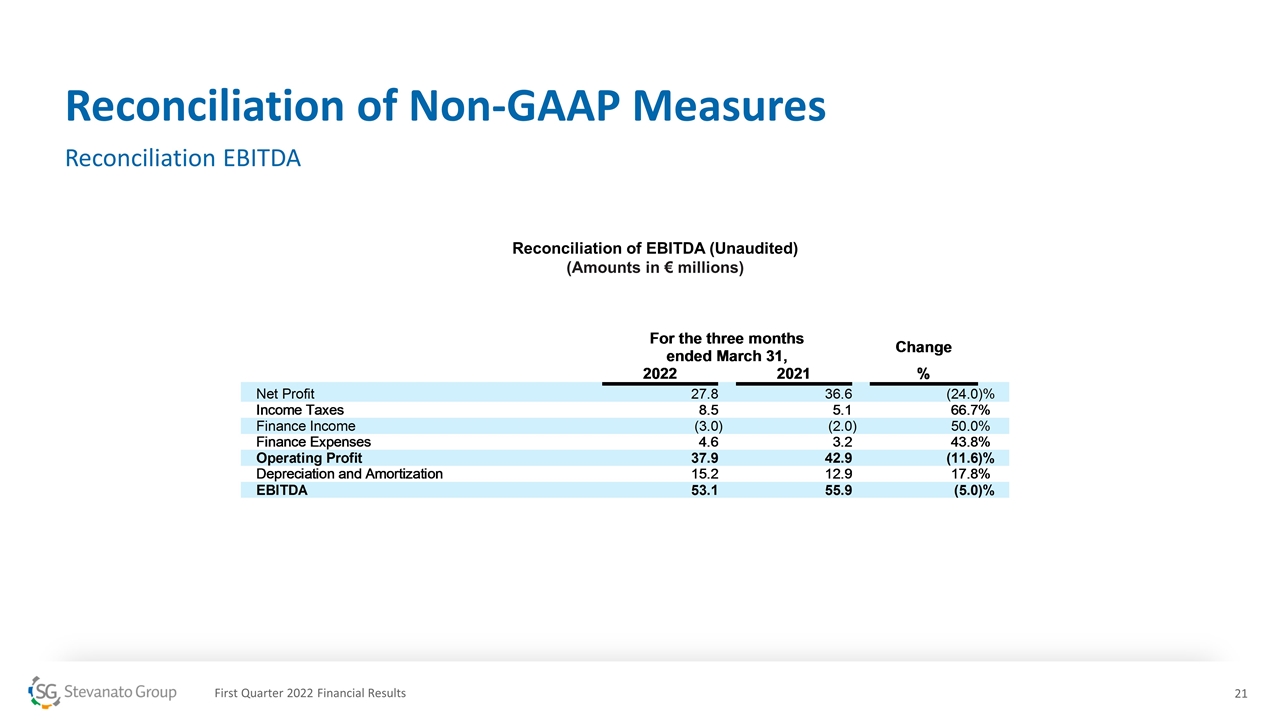

Reconciliation of Non-GAAP Measures Reconciliation EBITDA First Quarter 2022 Financial Results Reconciliation of EBITDA (Unaudited) (Amounts in € millions)

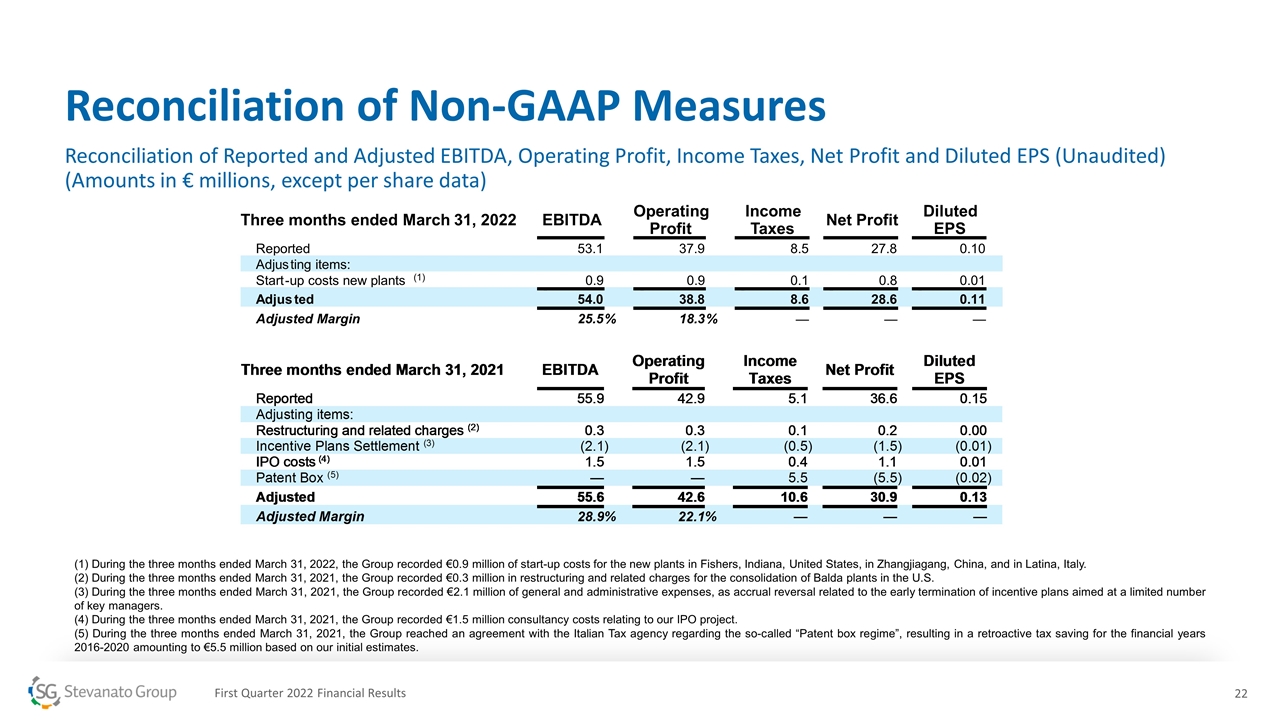

Reconciliation of Non-GAAP Measures Reconciliation of Reported and Adjusted EBITDA, Operating Profit, Income Taxes, Net Profit and Diluted EPS (Unaudited) (Amounts in € millions, except per share data) (1) During the three months ended March 31, 2022, the Group recorded €0.9 million of start-up costs for the new plants in Fishers, Indiana, United States, in Zhangjiagang, China, and in Latina, Italy. (2) During the three months ended March 31, 2021, the Group recorded €0.3 million in restructuring and related charges for the consolidation of Balda plants in the U.S. (3) During the three months ended March 31, 2021, the Group recorded €2.1 million of general and administrative expenses, as accrual reversal related to the early termination of incentive plans aimed at a limited number of key managers. (4) During the three months ended March 31, 2021, the Group recorded €1.5 million consultancy costs relating to our IPO project. (5) During the three months ended March 31, 2021, the Group reached an agreement with the Italian Tax agency regarding the so-called “Patent box regime”, resulting in a retroactive tax saving for the financial years 2016-2020 amounting to €5.5 million based on our initial estimates. First Quarter 2022 Financial Results Three months ended March 31, 2022 EBITDA Operating Profit Income Taxes Net Profit Diluted EPS Reported 53.1 37.9 8.5 27.8 0.10 Adjus ting items: Start - up costs new plants (1) 0.9 0.9 0.1 0.8 0.01 Adjus ted 54.0 38.8 8.6 28.6 0.11 Adjusted Margin 25.5 % 18.3 % — — —

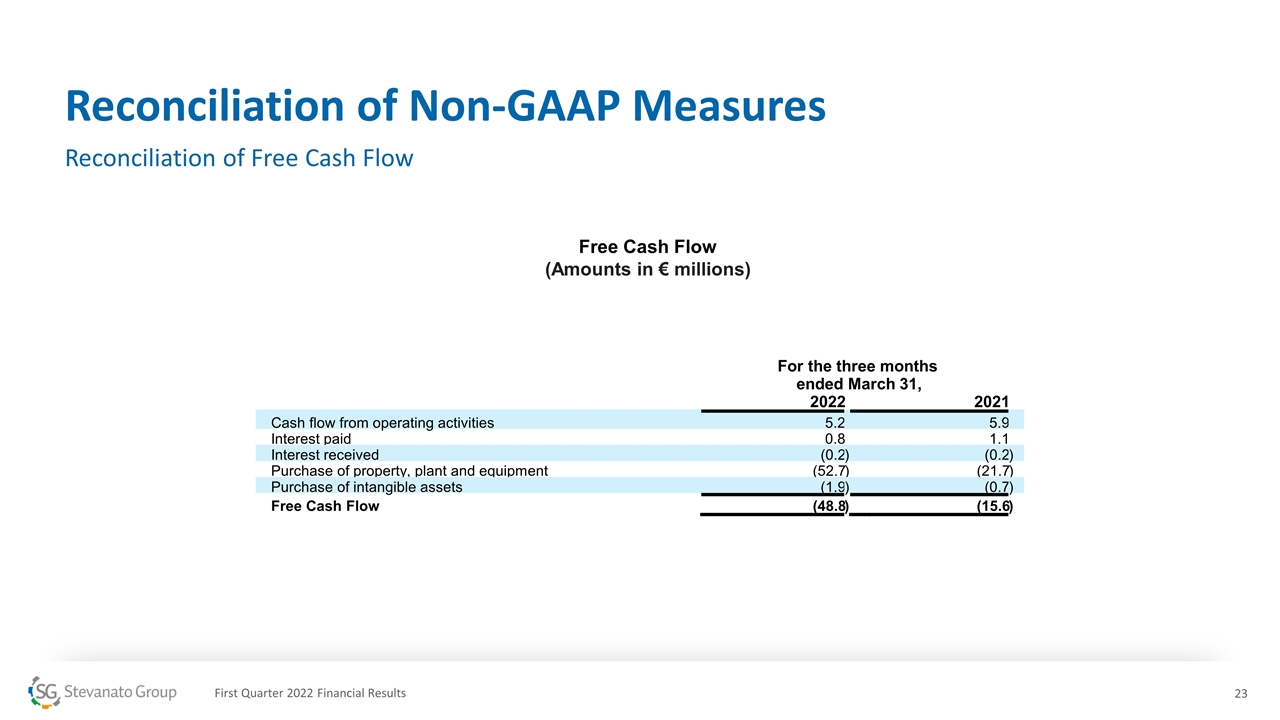

Reconciliation of Non-GAAP Measures Reconciliation of Free Cash Flow First Quarter 2022 Financial Results Free Cash Flow (Amounts in € millions) For the three months ended March 31, 2022 2021 Cash flow from operating activities 5.2 5.9 Interest paid 0.8 1.1 Interest received (0.2 ) (0.2 ) Purchase of property, plant and equipment (52.7 ) (21.7 ) Purchase of intangible assets (1.9 ) (0.7 ) Free Cash Flow (48.8 ) (15.6 )

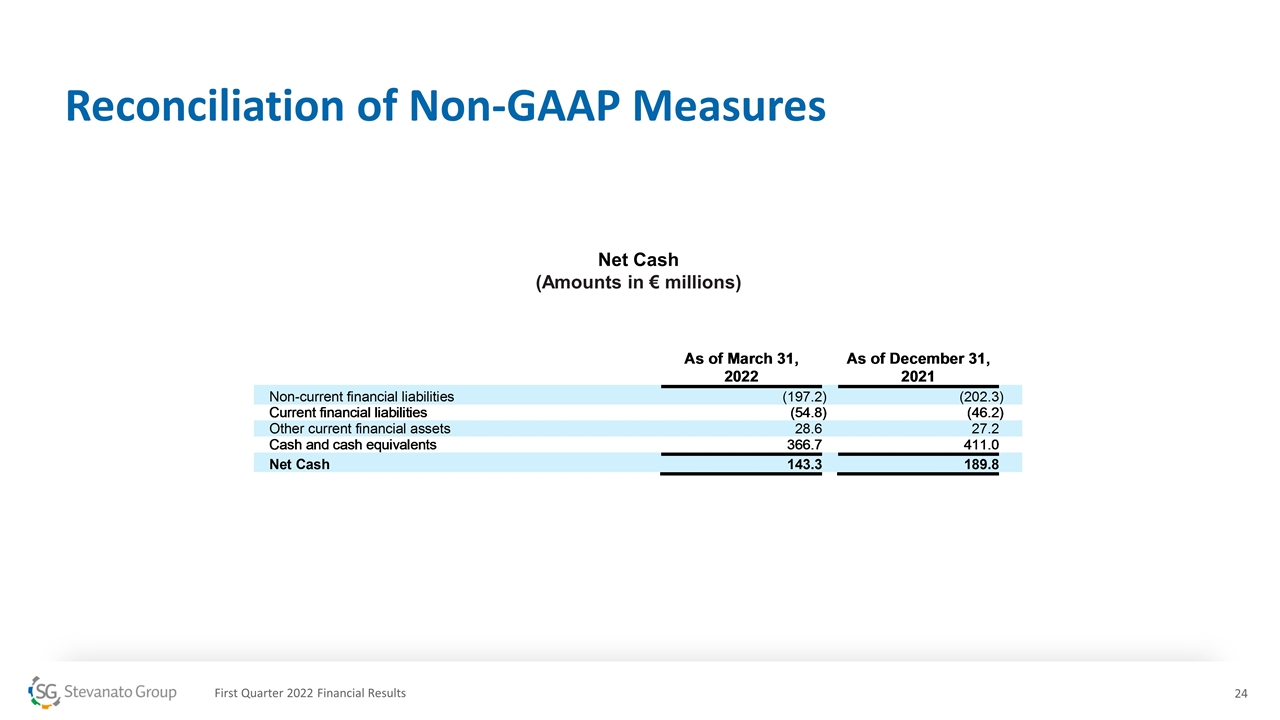

Reconciliation of Non-GAAP Measures First Quarter 2022 Financial Results Net Cash (Amounts in € millions)

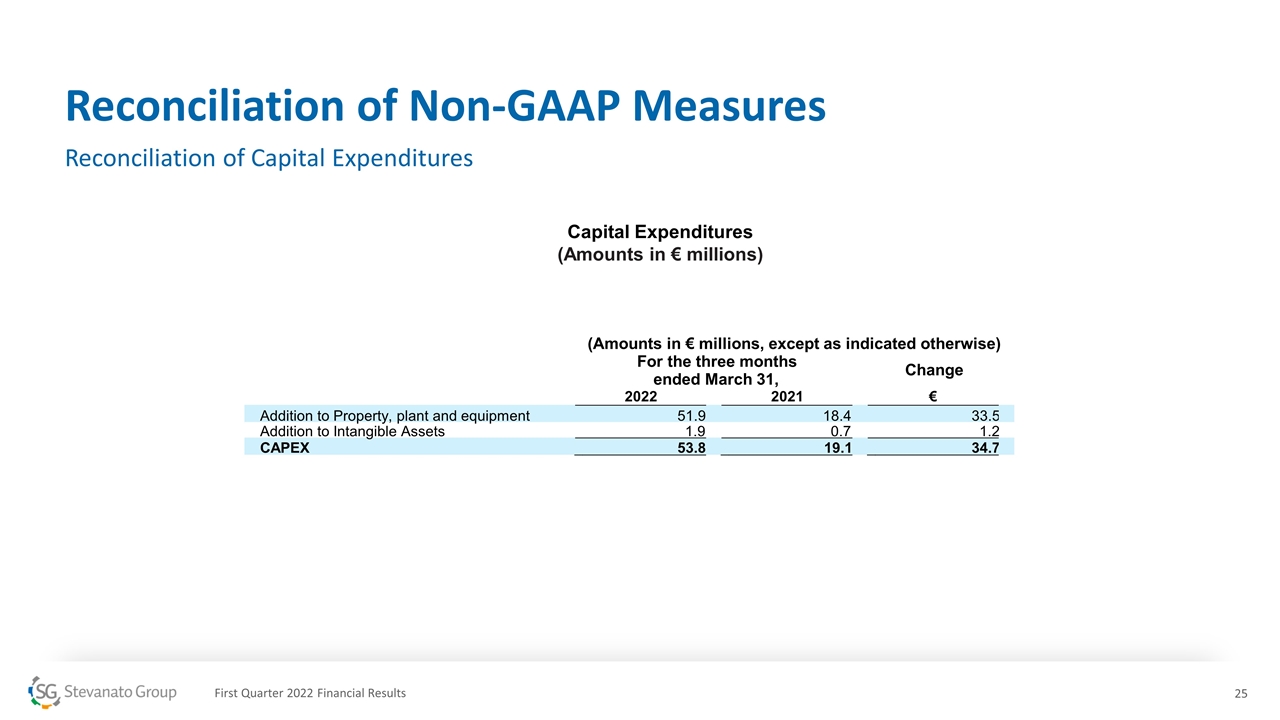

(Amounts in € millions, except as indicated otherwise) For the three months ended March 31, Change 2022 2021 € Addition to Property, plant and equipment 51.9 18.4 33.5 1.9 0.7 1.2 CAPEX 53.8 19.1 34.7 Addition to Intangible Assets Reconciliation of Non-GAAP Measures First Quarter 2022 Financial Results Capital Expenditures (Amounts in € millions) Reconciliation of Capital Expenditures

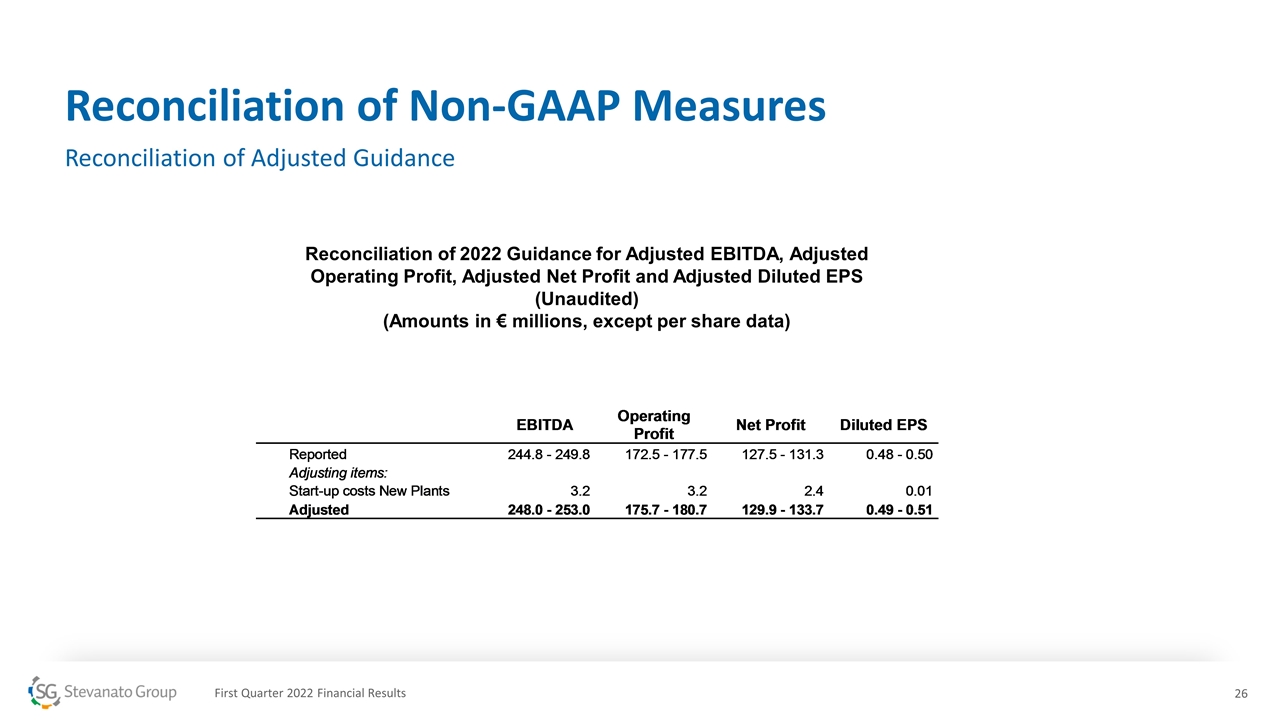

Reconciliation of Non-GAAP Measures Reconciliation of Adjusted Guidance First Quarter 2022 Financial Results Reconciliation of 2022 Guidance for Adjusted EBITDA, Adjusted Operating Profit, Adjusted Net Profit and Adjusted Diluted EPS (Unaudited) (Amounts in € millions, except per share data)

Contacts: Media Stevanato Group media@stevanatogroup.com Investor Relations Lisa Miles Lisa.miles@stevanatogroup.com