Second Quarter 2022 Financial Results August 4, 2022 Exhibit 99.1

Safe-Harbor Statement Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of Stevanato Group S.p.A. (“we”, “our”, “us”, “Stevanato Group” or the “Company”). These forward-looking statements include, or may include, words such as “plan”, “advancing”, “emerging”, “opportunities”, “increasing”, “trends”, “advancement”, “broadening”, “expect”, “expected”, “targeted”, “believe”, “estimate”, “poised to”, and other similar terminology. Forward-looking statements contained in this presentation include, but are not limited to, statements about: our future financial performance, including our revenue, operating expenses and our ability to maintain profitability and operational and commercial capabilities; our expectations regarding the development of our industry and the competitive environment in which we operate; the expansion of our plants and our expectations to increase production capacity; the global supply chain and our committed orders; the global response to COVID-19 and our role in it; our geographical and industrial footprint; and our goals, strategies and investment plans. These statements are neither promise nor guarantee but involve known and unknown risks, uncertainties and other important factors and circumstances that may cause Stevanato Group’s actual results, performance or achievements to be materially different from its expectations expressed or implied by the forward-looking statements, including conditions in the U.S. capital markets, negative global economic conditions, inflation, potential negative developments in the COVID-19 pandemic, the impact of the conflict between Russia and Ukraine, supply chain and logistical challenges and other negative developments in Stevanato Group’s business or unfavorable legislative or regulatory developments. The following are some of the factors that could cause our actual results to differ materially from those expressed in or underlying our forward-looking statements: (i) our product offerings are highly complex, and, if our products do not satisfy applicable quality criteria, specifications and performance standards, we could experience lost sales, delayed or reduced market acceptance of our products, increased costs and damage to our reputation; (ii) we must develop new products and enhance existing products, adapt to significant technological and innovative changes and respond to introductions of new products by competitors to remain competitive; (iii) our backlog might not accurately predict our future revenue, and we might not realize all or any part of the anticipated revenue reflected in our backlog; (iv) if we fail to maintain and enhance our brand and reputation, our business, results of operations and prospects may be materially and adversely affected; (v) we are highly dependent on our management and employees. Competition for our employees is intense, and we may not be able to attract and retain the highly skilled employees that we need to support our business and our intended future growth; (vi) our business, financial condition and results of operations depend upon maintaining our relationships with suppliers and service providers; (vii) our business, financial condition and results of operations depend upon the availability and price of high-quality materials and energy supply and our ability to contain production costs; (viii) the current conflict between Russia and Ukraine and the financial and economic sanctions imposed by the European Union, the U.S., the United Kingdom and other countries and organizations against officials, individuals, regions, and industries in Russia and Belarus may negatively impact our ability to source gas at commercially reasonable terms or at all and could have a material adverse effect on our operations; (ix) significant interruptions in our operations could harm our business, financial condition and results of operations; (x) as a consequence of the COVID-19 pandemic, sales of syringes and vials to and for vaccination programs globally increased resulting in a revenue growth acceleration. The demand for such products may shrink, if the need for COVID-19 related solutions declines; (xi) our manufacturing facilities are subject to operating hazards which may lead to production curtailments or shutdowns and have an adverse effect on our business, results of operations, financial condition or cash flows; (xii) we may face significant competition in implementing our strategies for revenue growth in light of actions taken by our competitors; (xiii) our global operations are subject to international market risks that may have a material effect on our liquidity, financial condition, results of operations and cash flows; (xiv) we are required to comply with a wide variety of laws and regulations and are subject to regulation by various federal, state and foreign agencies; (xv) if relations between China and the United States deteriorate, our business in the United States and China could be materially and adversely affected; and (xvi) Cyber security risks and the failure to maintain the confidentiality, integrity and availability of our computer hardware, software and internet applications and related tools and functions, could result in damage to our reputation, data integrity and/or subject us to costs, fines or lawsuits under data privacy or other laws or contractual requirements. This list is not exhaustive. We caution you therefore against relying on these forward-looking statements and we qualify all of our forward-looking statements by these cautionary statements. These forward-looking statements speak only as at their dates. The Company undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible to predict all of these factors. Further, the Company cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statements. For a description of certain additional factors that could cause the Company’s future results to differ from those expressed in any such forward-looking statements, refer to the risk factors discussed in our Annual Report on Form 20-F/A for the year ended December 31, 2021 filed with the U.S. Securities and Exchange Commission on April 5, 2022. Non-GAAP Financial Information This presentation contains non-GAAP measures. Please refer to the tables included in this presentation for a reconciliation of non-GAAP measures. Management monitors and evaluates our operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Net Profit, Adjusted Diluted EPS, Capital Employed, Net Cash, Free Cash Flow and CAPEX. We believe that these non-GAAP financial measures provide useful and relevant information regarding our performance and improve our ability to assess our financial condition. While similar measures are widely used in the industry in which we operate, the financial measures we use may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. Second Quarter 2022 Financial Results

Franco Stevanato Executive Board Chairman Stevanato Group First Quarter 2022 Earnings Call Speakers Second Quarter 2022 Financial Results Franco Moro CEO Marco Dal Lago CFO Lisa Miles SVP IR

Franco Stevanato Executive Chairman

Executing on long-term strategic plan to drive sustainable organic growth increase our mix of high value solutions expand EBITDA margins Creating a track record of performance Operating in an environment of robust demand, with attractive end markets characterized by durable, secular multi-year drivers Capitalizing on favorable macro tailwinds of aging populations, pharmaceutical innovation, the growth in biologics, trends towards outsourcing, and the self administration of medicines Driving constant innovation to support customers and improve patients’ lives through a singular focus on products and services for the pharmaceutical industry 2021 Sustainability Report: Embedding sustainability in policies and practices to make a positive impact for all stakeholders across the globe Successfully Executing Strategic Plan Met or exceeded our financial objectives since we have been reporting as a public company Second Quarter 2022 Financial Results

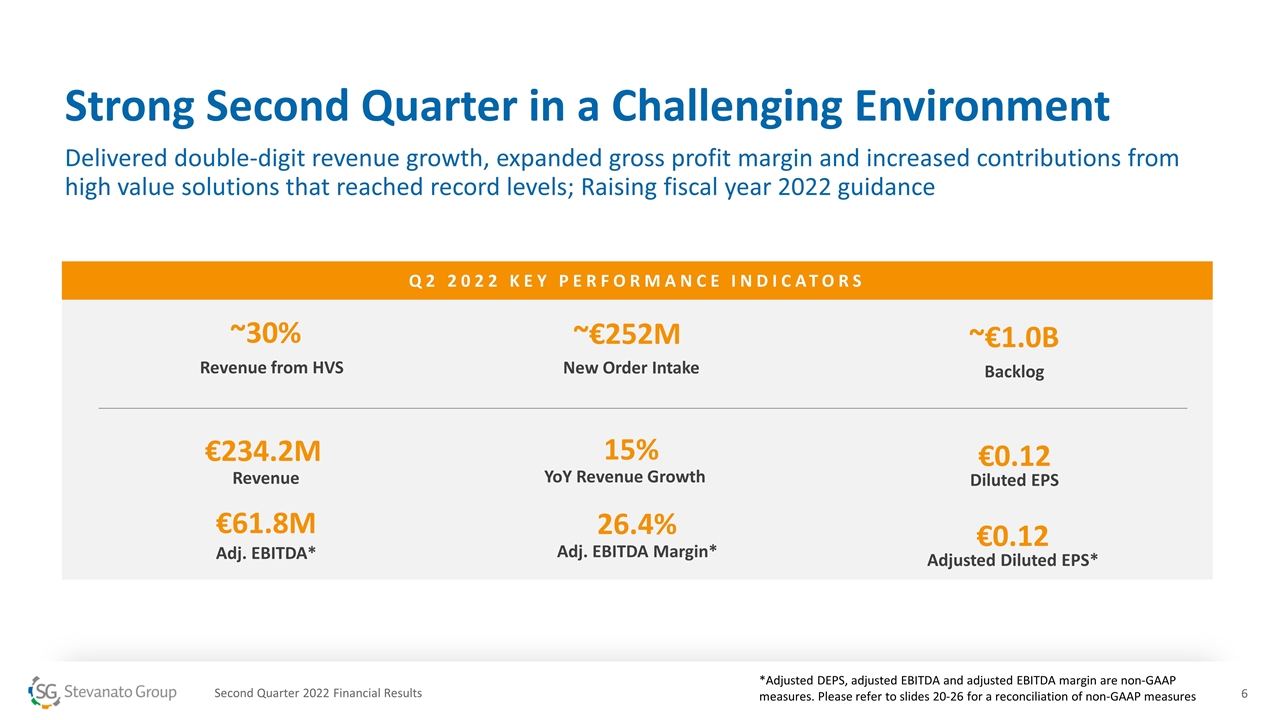

Strong Second Quarter in a Challenging Environment Delivered double-digit revenue growth, expanded gross profit margin and increased contributions from high value solutions that reached record levels; Raising fiscal year 2022 guidance Second Quarter 2022 Financial Results *Adjusted DEPS, adjusted EBITDA and adjusted EBITDA margin are non-GAAP measures. Please refer to slides 20-26 for a reconciliation of non-GAAP measures Q2 2022 KEY PERFORMANCE INDICATORS €234.2M Revenue 15% YoY Revenue Growth €61.8M Adj. EBITDA* 26.4% Adj. EBITDA Margin* €0.12 Diluted EPS ~€252M New Order Intake ~€1.0B Backlog ~30% Revenue from HVS €0.12 Adjusted Diluted EPS*

Advancing Progress on FY 2022 Industrial Plan Second Quarter 2022 Financial Results Firmly focused on execution of these priority projects as we expand our global industrial footprint to meet rising demand and evolving needs China Nearing the end of the design phase for regional EZ-fill® hub Anticipate revenue generation in 2H of 2024 North America Growth in biologics and upcoming wave of biosimilars helped shape our industrial plans Completed foundation work on new facility in Indiana and started building construction On track for commercial operation in late 2023 / early 2024 Italy Solid progress on capacity expansion Construction of new building nearly complete in Piombino Dese Two of three planned new lines for 2022 are operational - including one EZ-fill® syringe line, and one line dedicated to premium Alba® syringes. Expect to operationalized another EZ-fill® syringe line in the Fall

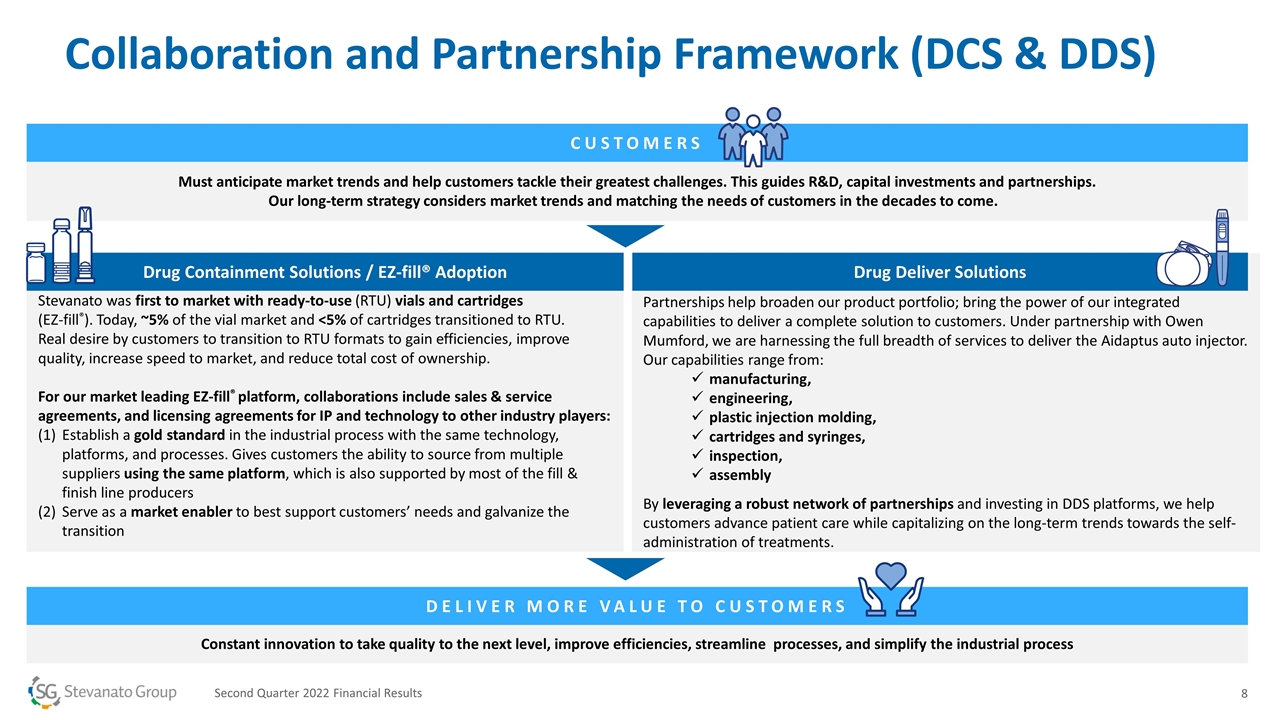

Collaboration and Partnership Framework (DCS & DDS) Second Quarter 2022 Financial Results Must anticipate market trends and help customers tackle their greatest challenges. This guides R&D, capital investments and partnerships. Our long-term strategy considers market trends and matching the needs of customers in the decades to come. Stevanato was first to market with ready-to-use (RTU) vials and cartridges (EZ-fill®). Today, ~5% of the vial market and <5% of cartridges transitioned to RTU. Real desire by customers to transition to RTU formats to gain efficiencies, improve quality, increase speed to market, and reduce total cost of ownership. For our market leading EZ-fill® platform, collaborations include sales & service agreements, and licensing agreements for IP and technology to other industry players: Establish a gold standard in the industrial process with the same technology, platforms, and processes. Gives customers the ability to source from multiple suppliers using the same platform, which is also supported by most of the fill & finish line producers Serve as a market enabler to best support customers’ needs and galvanize the transition Partnerships help broaden our product portfolio; bring the power of our integrated capabilities to deliver a complete solution to customers. Under partnership with Owen Mumford, we are harnessing the full breadth of services to deliver the Aidaptus auto injector. Our capabilities range from: manufacturing, engineering, plastic injection molding, cartridges and syringes, inspection, assembly By leveraging a robust network of partnerships and investing in DDS platforms, we help customers advance patient care while capitalizing on the long-term trends towards the self-administration of treatments. Drug Containment Solutions / EZ-fill® Adoption Drug Deliver Solutions CUSTOMERS Constant innovation to take quality to the next level, improve efficiencies, streamline processes, and simplify the industrial process DELIVER MORE VALUE TO CUSTOMERS

Monitoring situation closely and it is something we must manage Energy costs have increased in the last six months. We are working directly with customers and adjusting prices accordingly Vast majority of our natural gas usage in Europe is in Italy for glass conversion Recent press reports indicate that the Italian government has taken swift action to lower its dependence on Russia through gas agreements with other countries to diversify supply Given mission-critical role in the pharmaceutical supply chain, we believe that we would be eligible for priority status, similar to our designation during Covid Second Quarter 2022 Financial Results European Natural Gas Pricing and Supply

Provides complete and transparent non-financial reporting to our stakeholders Most importantly, creates the foundation for setting future targets Considered the Company’s financial and economic results and highlights the ESG performance of the Group The Report is subject to limited assurance and was prepared in accordance with the Global Reporting Initiative (GRI) Standards, which demonstrates our commitment to sustainability Second Quarter 2022 Financial Results 2021 Sustainability Report

Marco Dal Lago Chief Financial Officer

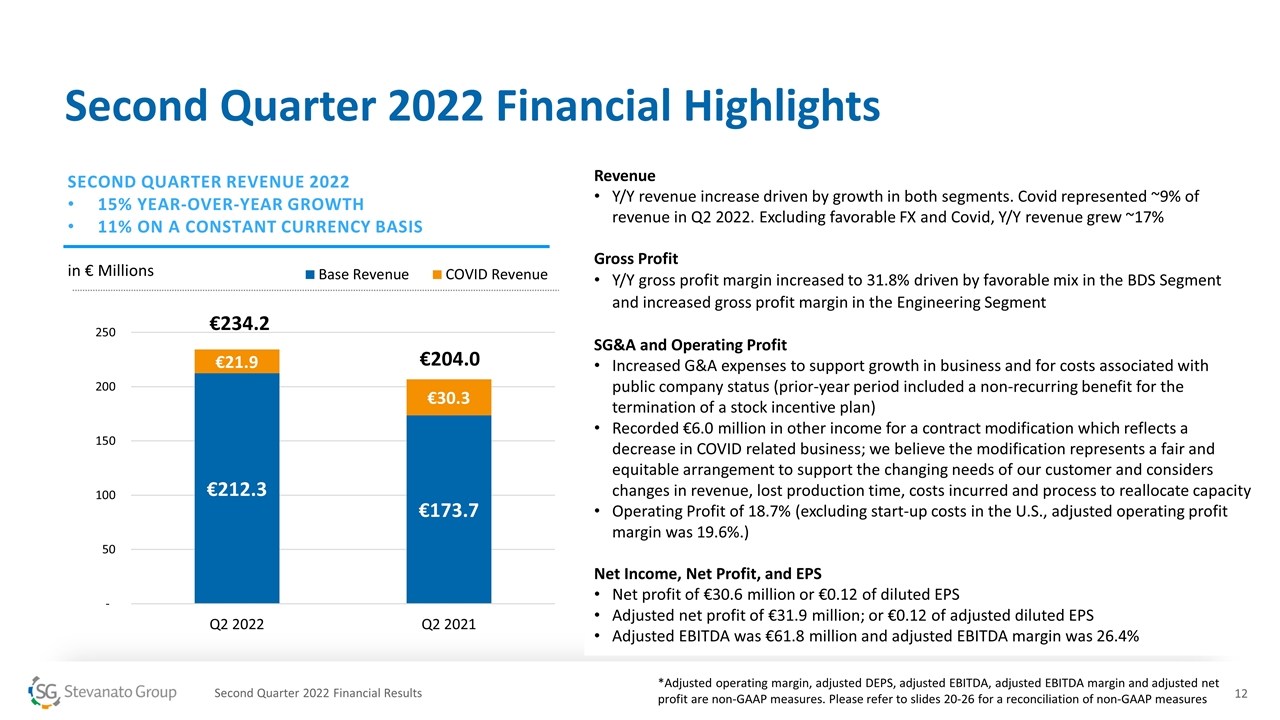

Second Quarter 2022 Financial Highlights Second Quarter 2022 Financial Results €204.0 €234.2 Revenue Y/Y revenue increase driven by growth in both segments. Covid represented ~9% of revenue in Q2 2022. Excluding favorable FX and Covid, Y/Y revenue grew ~17% Gross Profit Y/Y gross profit margin increased to 31.8% driven by favorable mix in the BDS Segment and increased gross profit margin in the Engineering Segment SG&A and Operating Profit Increased G&A expenses to support growth in business and for costs associated with public company status (prior-year period included a non-recurring benefit for the termination of a stock incentive plan) Recorded €6.0 million in other income for a contract modification which reflects a decrease in COVID related business; we believe the modification represents a fair and equitable arrangement to support the changing needs of our customer and considers changes in revenue, lost production time, costs incurred and process to reallocate capacity Operating Profit of 18.7% (excluding start-up costs in the U.S., adjusted operating profit margin was 19.6%.) Net Income, Net Profit, and EPS Net profit of €30.6 million or €0.12 of diluted EPS Adjusted net profit of €31.9 million; or €0.12 of adjusted diluted EPS Adjusted EBITDA was €61.8 million and adjusted EBITDA margin was 26.4% *Adjusted operating margin, adjusted DEPS, adjusted EBITDA, adjusted EBITDA margin and adjusted net profit are non-GAAP measures. Please refer to slides 20-26 for a reconciliation of non-GAAP measures SECOND QUARTER REVENUE 2022 15% YEAR-OVER-YEAR GROWTH 11% ON A CONSTANT CURRENCY BASIS in € Millions

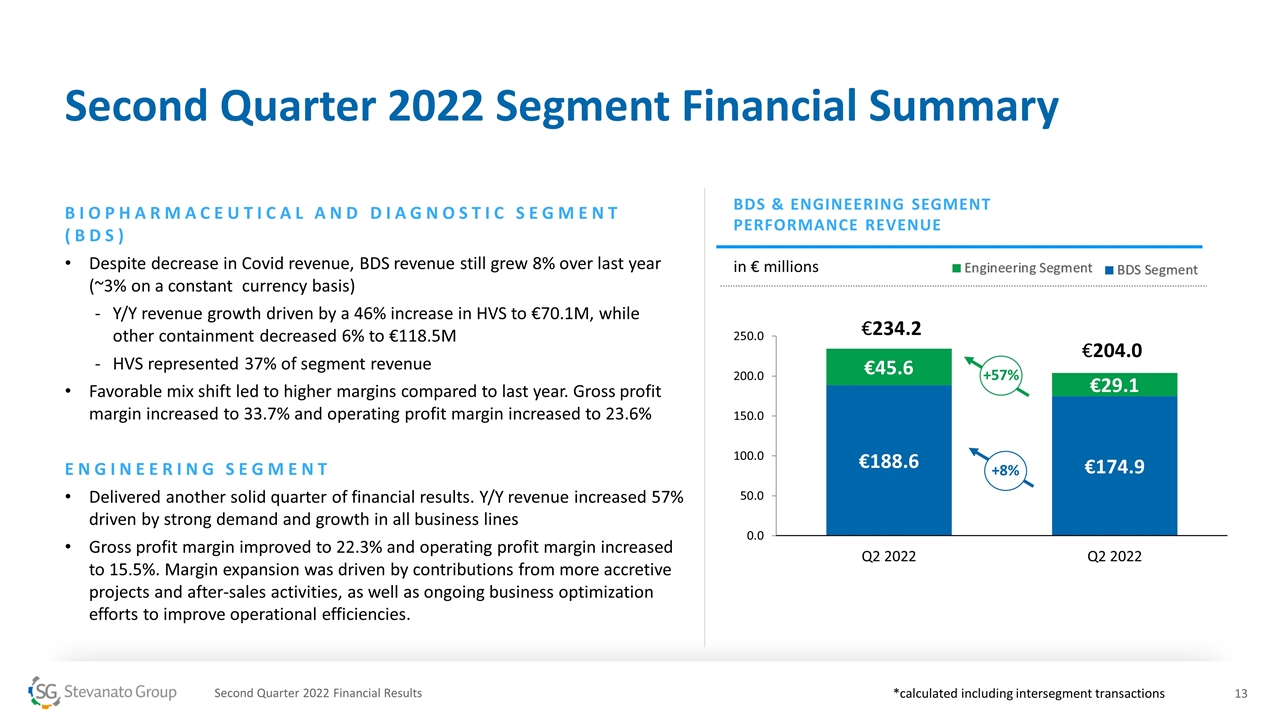

Second Quarter 2022 Segment Financial Summary Second Quarter 2022 Financial Results BIOPHARMACEUTICAL AND DIAGNOSTIC SEGMENT (BDS) Despite decrease in Covid revenue, BDS revenue still grew 8% over last year (~3% on a constant currency basis) Y/Y revenue growth driven by a 46% increase in HVS to €70.1M, while other containment decreased 6% to €118.5M HVS represented 37% of segment revenue Favorable mix shift led to higher margins compared to last year. Gross profit margin increased to 33.7% and operating profit margin increased to 23.6% ENGINEERING SEGMENT Delivered another solid quarter of financial results. Y/Y revenue increased 57% driven by strong demand and growth in all business lines Gross profit margin improved to 22.3% and operating profit margin increased to 15.5%. Margin expansion was driven by contributions from more accretive projects and after-sales activities, as well as ongoing business optimization efforts to improve operational efficiencies. BDS & ENGINEERING SEGMENT PERFORMANCE REVENUE in € millions +8% +57% *calculated including intersegment transactions €234.2

A Healthy Financial Position to Invest in Growth Second Quarter 2022 Financial Results * Free Cash Flow, Capital Expenditures (CAPEX) and Net Cash are non-GAAP measures Please refer to slides 20-26 for a reconciliation of non-GAAP measures QUARTER ENDED June 30, 2022 €109.4M Net Cash* €77.5M Capital Expenditures* €42.2M Cash from Operations €(33.7M) Free Cash Flow* €314.9M Total Cash and Cash Equivalents At June 30, 2022

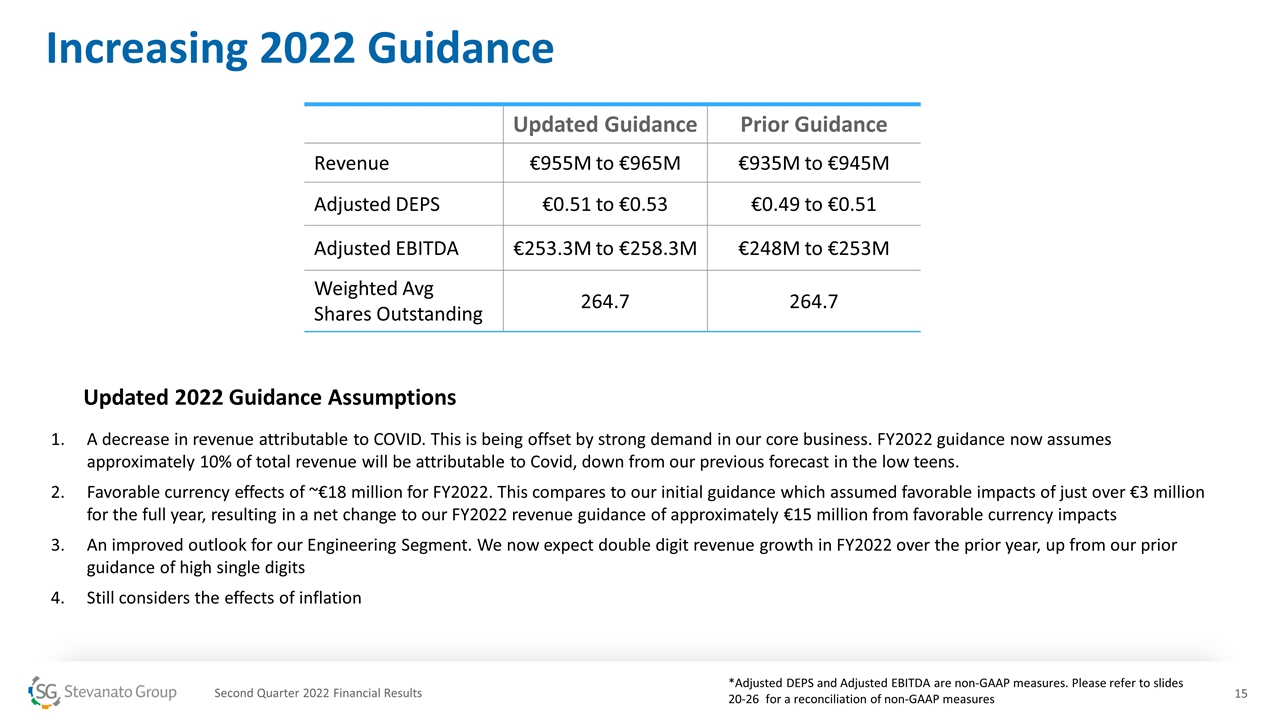

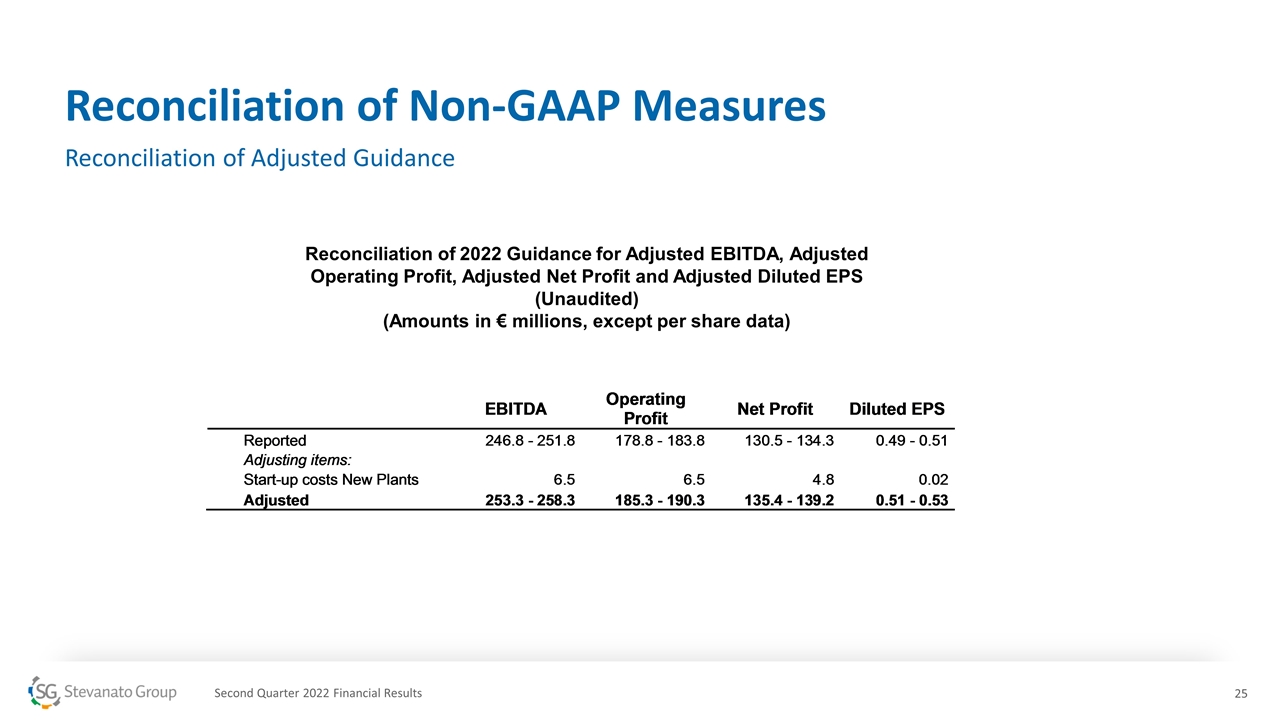

Increasing 2022 Guidance Second Quarter 2022 Financial Results *Adjusted DEPS and Adjusted EBITDA are non-GAAP measures. Please refer to slides 20-26 for a reconciliation of non-GAAP measures A decrease in revenue attributable to COVID. This is being offset by strong demand in our core business. FY2022 guidance now assumes approximately 10% of total revenue will be attributable to Covid, down from our previous forecast in the low teens. Favorable currency effects of ~€18 million for FY2022. This compares to our initial guidance which assumed favorable impacts of just over €3 million for the full year, resulting in a net change to our FY2022 revenue guidance of approximately €15 million from favorable currency impacts An improved outlook for our Engineering Segment. We now expect double digit revenue growth in FY2022 over the prior year, up from our prior guidance of high single digits Still considers the effects of inflation Updated Guidance Prior Guidance Revenue €955M to €965M €935M to €945M Adjusted DEPS €0.51 to €0.53 €0.49 to €0.51 Adjusted EBITDA €253.3M to €258.3M €248M to €253M Weighted Avg Shares Outstanding 264.7 264.7 Updated 2022 Guidance Assumptions

Franco Moro Chief Executive Officer & Chief Operating Officer

Summary: Operating Amid a Challenging but Favorable Environment Strong demand Growing end markets Multi-year secular drivers Satisfying customers’ needs by driving innovation and providing a rich set of end-to-end capabilities through the entire drug life cycle Executing four pillars of 2022 strategic and operational objectives Global Expansion HVS Growth R&D Innovation Multi-Year Pipeline Second Quarter 2022 Financial Results

Notes to Non-GAAP Financial Measures: This presentation contains non-GAAP measures Second Quarter 2022 Financial Results Management monitors and evaluates our operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Net Profit, Adjusted Diluted EPS, Capital Employed, Net Cash, Free Cash Flow and CAPEX. We believe that these non-GAAP financial measures provide useful and relevant information regarding our performance and improve our ability to assess our financial condition. While similar measures are widely used in the industry in which we operate, the financial measures we use may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. A reconciliation of these adjusted Non-GAAP financial measures to the comparable GAAP financial measures is included in the accompanying tables.

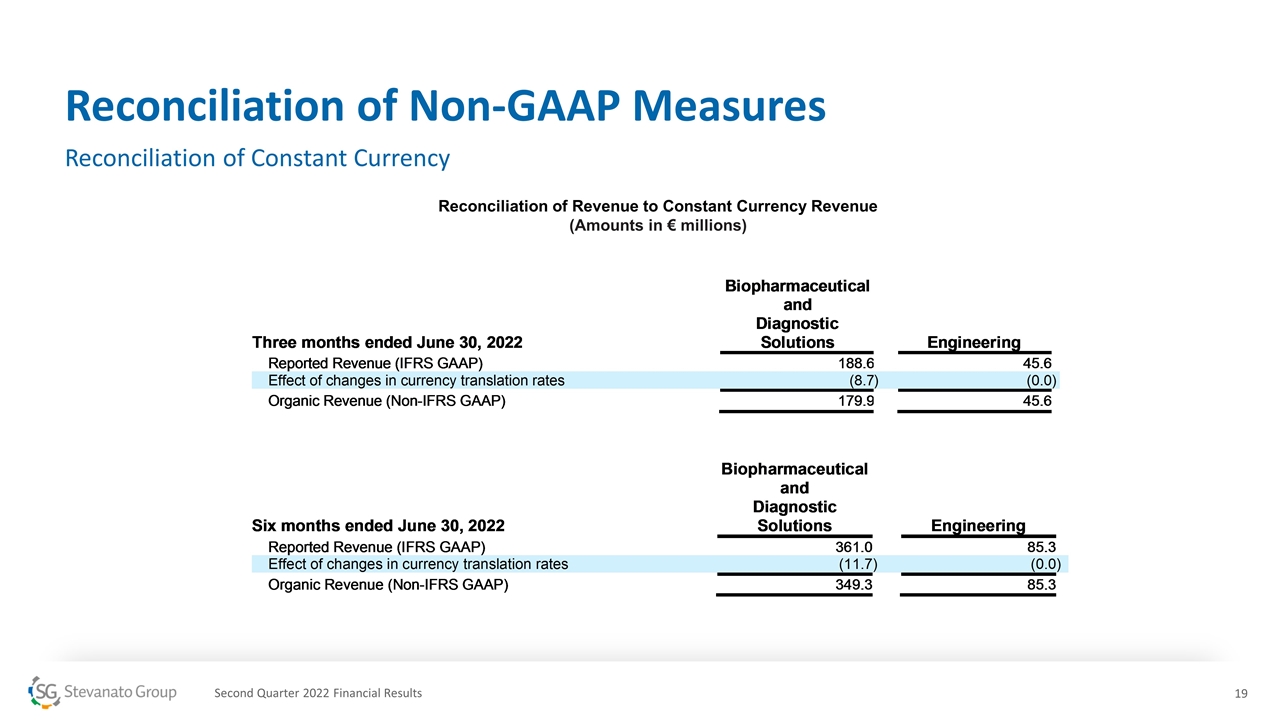

Reconciliation of Non-GAAP Measures Reconciliation of Constant Currency Second Quarter 2022 Financial Results Reconciliation of Revenue to Constant Currency Revenue (Amounts in € millions) Six months ended June 30, 2022Biopharmaceutical and Diagnostic SolutionsEngineeringReported Revenue (IFRS GAAP)361.085.3Effect of changes in currency translation rates(11.7)(0.0)Organic Revenue (Non-IFRS GAAP)349.385.3

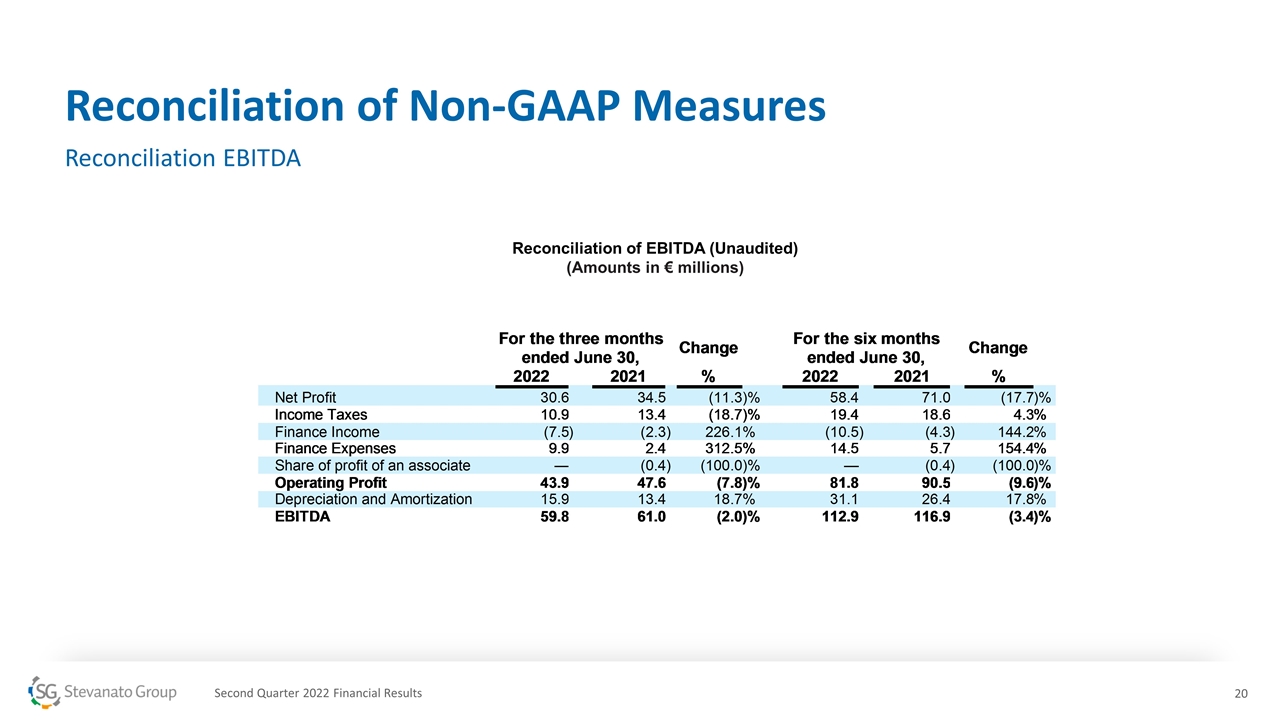

Reconciliation of Non-GAAP Measures Reconciliation EBITDA Second Quarter 2022 Financial Results Reconciliation of EBITDA (Unaudited) (Amounts in € millions)

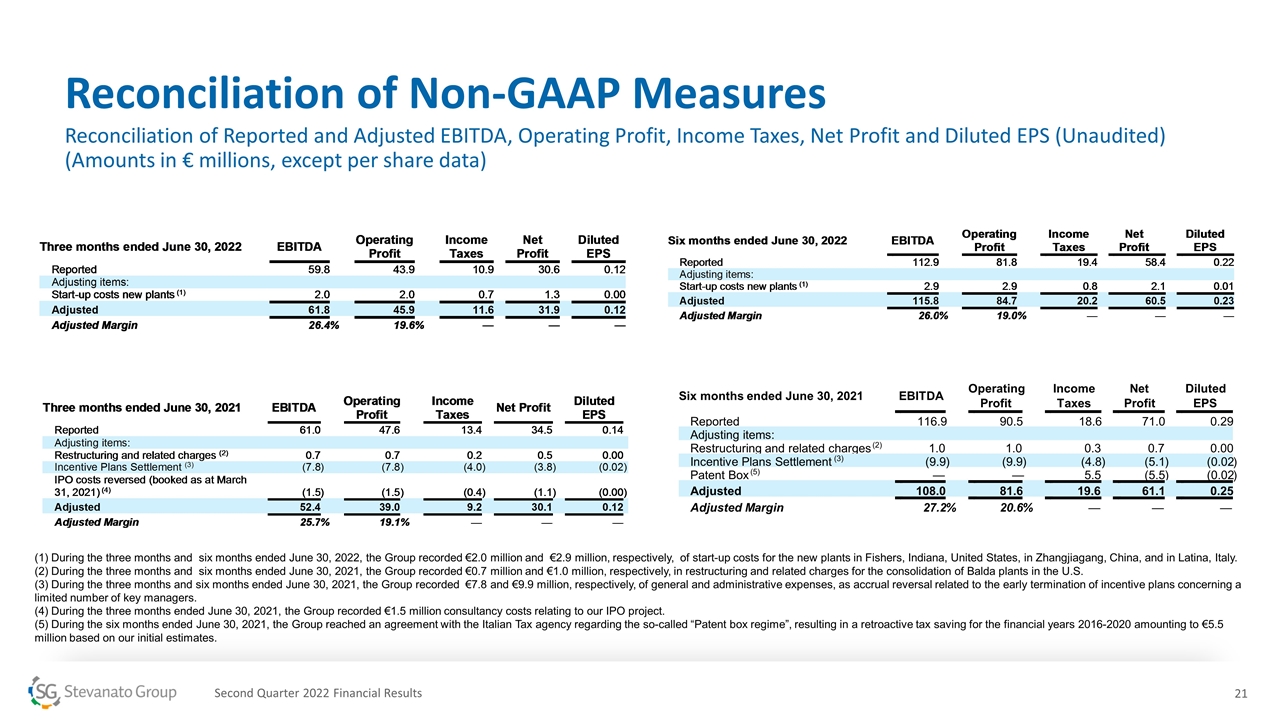

Reconciliation of Non-GAAP Measures Reconciliation of Reported and Adjusted EBITDA, Operating Profit, Income Taxes, Net Profit and Diluted EPS (Unaudited) (Amounts in € millions, except per share data) Second Quarter 2022 Financial Results (1) During the three months and six months ended June 30, 2022, the Group recorded €2.0 million and €2.9 million, respectively, of start-up costs for the new plants in Fishers, Indiana, United States, in Zhangjiagang, China, and in Latina, Italy. (2) During the three months and six months ended June 30, 2021, the Group recorded €0.7 million and €1.0 million, respectively, in restructuring and related charges for the consolidation of Balda plants in the U.S. (3) During the three months and six months ended June 30, 2021, the Group recorded €7.8 and €9.9 million, respectively, of general and administrative expenses, as accrual reversal related to the early termination of incentive plans concerning a limited number of key managers. (4) During the three months ended June 30, 2021, the Group recorded €1.5 million consultancy costs relating to our IPO project. (5) During the six months ended June 30, 2021, the Group reached an agreement with the Italian Tax agency regarding the so-called “Patent box regime”, resulting in a retroactive tax saving for the financial years 2016-2020 amounting to €5.5 million based on our initial estimates. Six months ended June 30, 2021 EBITDA Operating Profit Income Taxes Net Profit Diluted EPS Reported 116.9 90.5 18.6 71.0 0.29 Adjusting items: Restructuring and related charges (2) 1.0 1.0 0.3 0.7 0.00 Incentive Plans Settlement (3) (9.9 ) (9.9 ) (4.8 ) (5.1 ) (0.02 ) Patent Box (5) — — 5.5 (5.5 ) (0.02 ) Adjusted 108.0 81.6 19.6 61.1 0.25 Adjusted Margin 27.2 % 20.6 % — — — Three months ended June 30, 2022EBITDAOperating ProfitIncome TaxesNet ProfitDiluted EPSReported59.843.910.930.60.12Adjusting items:Start-up costs new plants (1)2.02.00.71.30.00Adjusted61.845.911.631.90.12Adjusted Margin26.4%19.6%———Six months ended June 30, 2022EBITDAOperating ProfitIncome TaxesNet ProfitDiluted EPSReported112.981.819.458.40.22Adjusting items:Start-up costs new plants (1)2.92.90.82.10.01Adjusted115.884.720.260.50.23Adjusted Margin26.0%19.0%———

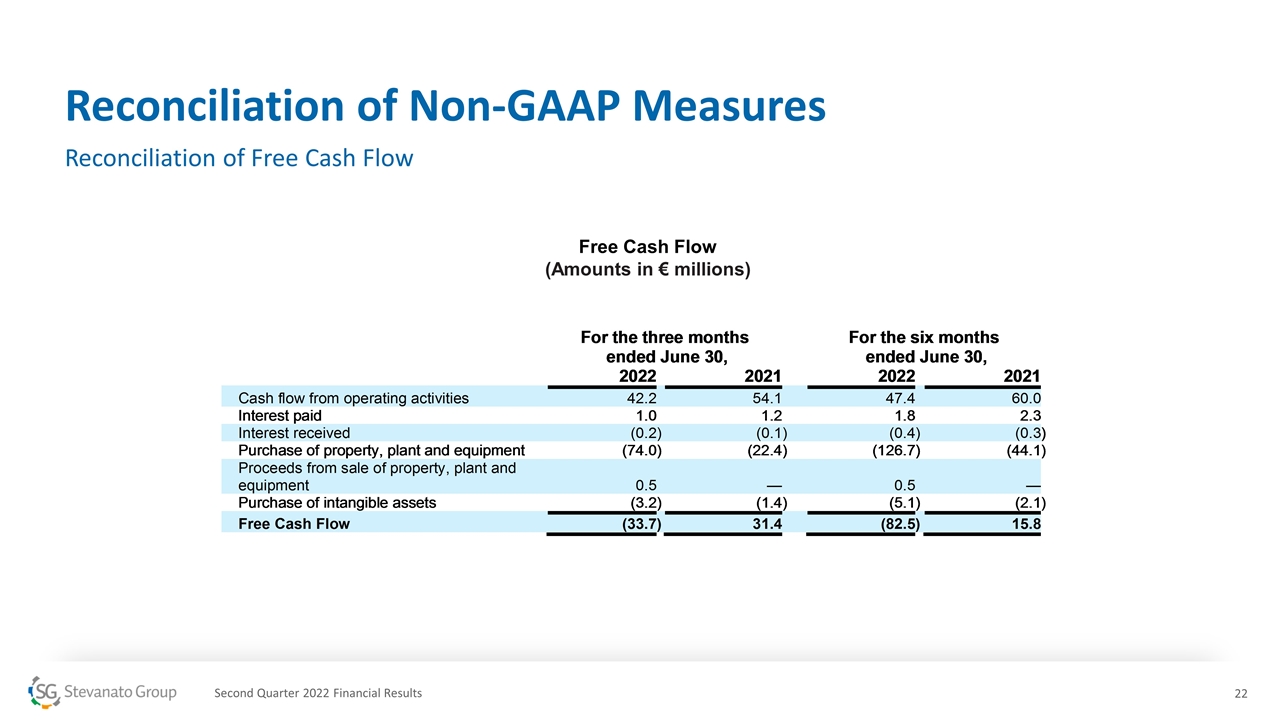

Reconciliation of Non-GAAP Measures Reconciliation of Free Cash Flow Second Quarter 2022 Financial Results Free Cash Flow (Amounts in € millions) For the three months ended June 30,For the six months ended June 30,2022202120222021Cash flow from operating activities42.254.147.460.0Interest paid1.01.21.82.3Interest received(0.2)(0.1)(0.4)(0.3)Purchase of property, plant and equipment(74.0)(22.4)(126.7)(44.1)Proceeds from sale of property, plant and equipment0.5—0.5—Purchase of intangible assets(3.2)(1.4)(5.1)(2.1)Free Cash Flow(33.7)31.4(82.5)15.8

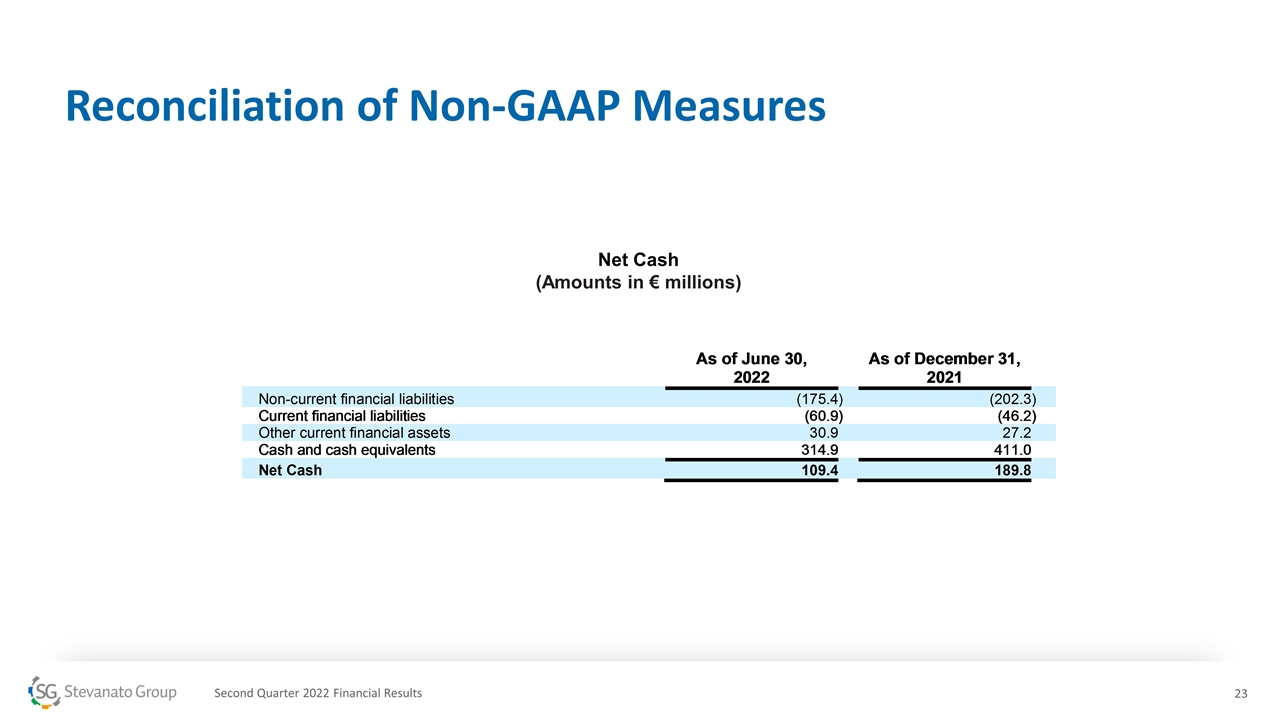

Reconciliation of Non-GAAP Measures Second Quarter 2022 Financial Results Net Cash (Amounts in € millions) As of June 30,As of December 31,20222021Non-current financial liabilities(175.4)(202.3)Current financial liabilities(60.9)(46.2)Other current financial assets30.927.2Cash and cash equivalents314.9411.0Net Cash109.4189.8

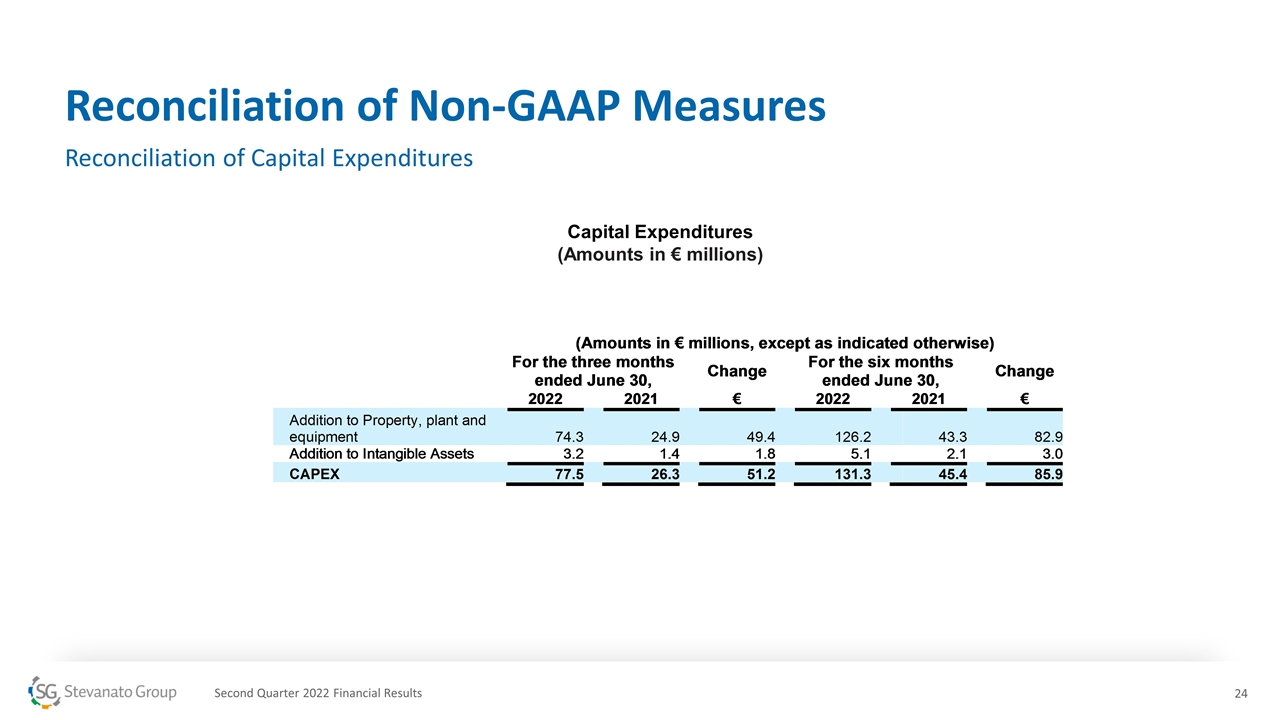

Reconciliation of Non-GAAP Measures Second Quarter 2022 Financial Results Capital Expenditures (Amounts in € millions) Reconciliation of Capital Expenditures (Amounts in € millions, except as indicated otherwise)For the three monthsended June 30,ChangeFor the six monthsended June 30,Change20222021€20222021€Addition to Property, plant and equipment74.324.949.4126.243.382.9Addition to Intangible Assets3.21.41.85.12.13.0CAPEX77.526.351.2131.345.485.9

Reconciliation of Non-GAAP Measures Reconciliation of Adjusted Guidance Second Quarter 2022 Financial Results Reconciliation of 2022 Guidance for Adjusted EBITDA, Adjusted Operating Profit, Adjusted Net Profit and Adjusted Diluted EPS (Unaudited) (Amounts in € millions, except per share data)

Contacts: Media Stevanato Group media@stevanatogroup.com Investor Relations Lisa Miles Lisa.miles@stevanatogroup.com