Stevanato Group Q4 and Full Year 2022 Financial Results March 2nd, 2023 Exhibit 99.1

Forward-Looking Statements This presentation may include forward-looking statements. The words "expect,” “growth”, “drive,” “create,” “well positioned,” “continues,” “remain,” “estimate,” "'deliver", "accelerating", "sustained", "building", "believe", "future“ and similar expressions (or their negative) identify certain of these forward-looking statements. These forward-looking statements are statements regarding the Company's intentions, beliefs or current expectations concerning, among other things, the investments the Company expects to make, the expansion of manufacturing capacity, the Company’s plans regarding its presence in the U.S., its capital expenditures guidance, business strategies, the Company’s capacity to meet future market demands and support preparedness for future public health emergencies, and results of operations. The forward-looking statements in this presentation are based on numerous assumptions regarding the Company’s present and future business strategies and the environment in which the Company will operate in the future. Forward-looking statements involve inherent known and unknown risks, uncertainties and contingencies because they relate to events and depend on circumstances that may or may not occur in the future and may cause the actual results, performance or achievements of the Company to be materially different from those expressed or implied by such forward looking statements. Many of these risks and uncertainties relate to factors that are beyond the Company's ability to control or estimate precisely, such as future market conditions, currency fluctuations, the behavior of other market participants, the actions of regulators and other factors such as the Company's ability to continue to obtain financing to meet its liquidity needs, changes in the political, social and regulatory framework in which the Company operates or in economic or technological trends or conditions. For a description of the risks that could cause the Company’s future results to differ from those expressed in any such forward looking statements, refer to the risk factors discussed in our most recent annual report on Form 20-F filed with the U.S. Securities and Exchange Commission. Readers should therefore not place undue reliance on these statements, particularly not in connection with any contract or investment decision. Except as required by law, the company assumes no obligation to update any such forward-looking statements. Non-GAAP Financial Information This presentation contains non-GAAP financial measures. Please refer to the tables included in this presentation for a reconciliation of non-GAAP financial measures. Management monitors and evaluates its operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Net Profit, Adjusted Diluted EPS, Capital Employed, Net Cash, Free Cash Flow and CAPEX. The Company believes that these non-GAAP financial measures provide useful and relevant information regarding its performance and improve its ability to assess its financial condition. While similar measures are widely used in the industry in which the Company operates, the financial measures it uses may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. Safe Harbor Statement Q4 and Full Year 2022 Financial Results

Stevanato Group Q4 and Full Year 2022 Financial Results Earnings Call Franco Stevanato Executive Chairman Franco Moro CEO Marco Dal Lago CFO Lisa Miles SVP IR Q4 and Full Year 2022 Financial Results

Franco Stevanato Executive Chairman Q4 and Full Year 2022 Financial Results

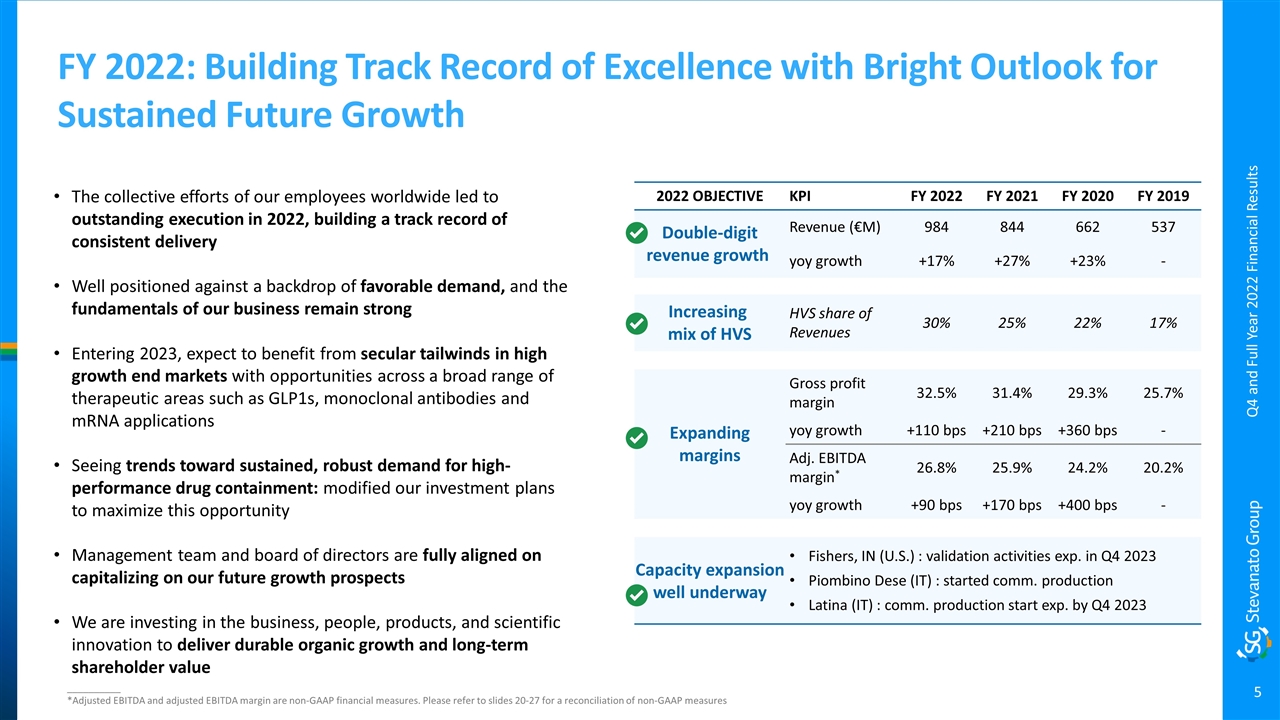

FY 2022: Building Track Record of Excellence with Bright Outlook for Sustained Future Growth The collective efforts of our employees worldwide led to outstanding execution in 2022, building a track record of consistent delivery Well positioned against a backdrop of favorable demand, and the fundamentals of our business remain strong Entering 2023, expect to benefit from secular tailwinds in high growth end markets with opportunities across a broad range of therapeutic areas such as GLP1s, monoclonal antibodies and mRNA applications Seeing trends toward sustained, robust demand for high-performance drug containment: modified our investment plans to maximize this opportunity Management team and board of directors are fully aligned on capitalizing on our future growth prospects We are investing in the business, people, products, and scientific innovation to deliver durable organic growth and long-term shareholder value __________ *Adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. Please refer to slides 20-27 for a reconciliation of non-GAAP measures Q4 and Full Year 2022 Financial Results 2022 OBJECTIVE KPI FY 2022 FY 2021 FY 2020 FY 2019 Double-digit revenue growth Revenue (€M) 984 844 662 537 yoy growth +17% +27% +23% - Increasing mix of HVS HVS share of Revenues 30% 25% 22% 17% Expanding margins Gross profit margin 32.5% 31.4% 29.3% 25.7% yoy growth +110 bps +210 bps +360 bps - Adj. EBITDA margin* 26.8% 25.9% 24.2% 20.2% yoy growth +90 bps +170 bps +400 bps - Capacity expansion well underway Fishers, IN (U.S.) : validation activities exp. in Q4 2023 Piombino Dese (IT) : started comm. production Latina (IT) : comm. production start exp. by Q4 2023

Franco Moro Chief Executive Officer Q4 and Full Year 2022 Financial Results

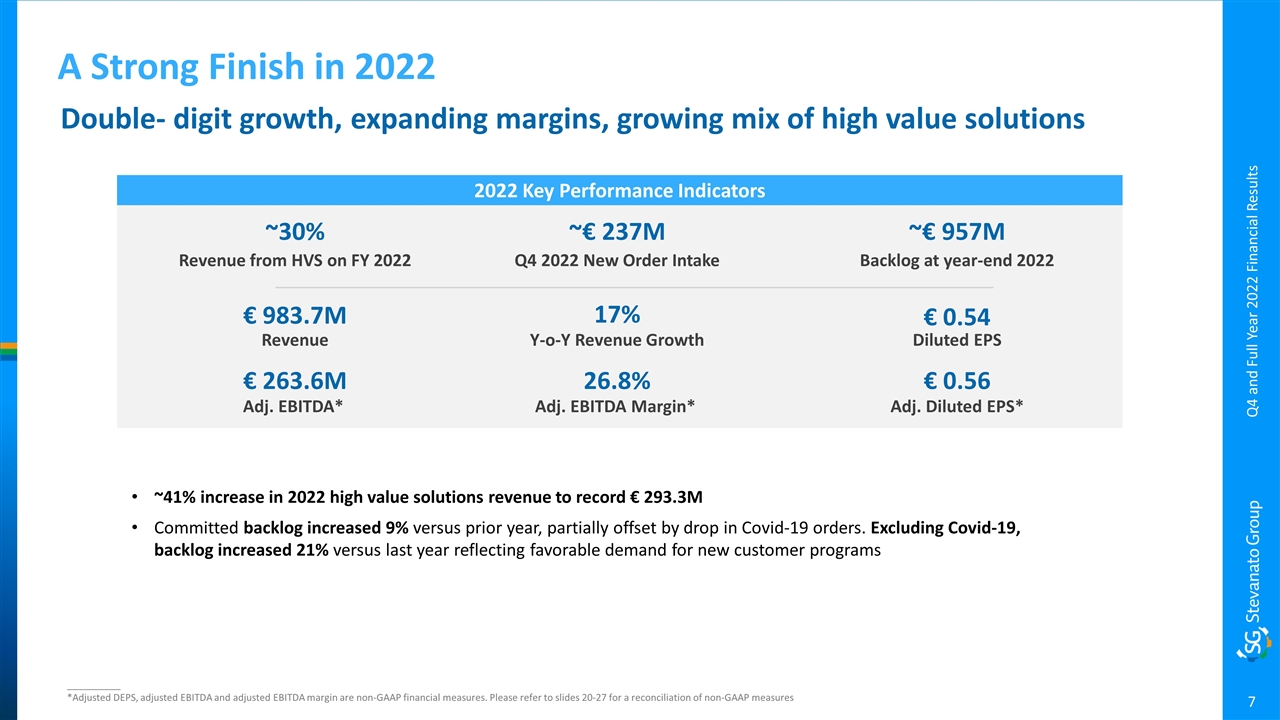

A Strong Finish in 2022 2022 Key Performance Indicators € 983.7M Revenue 17% Y-o-Y Revenue Growth € 263.6M Adj. EBITDA* 26.8% Adj. EBITDA Margin* € 0.54 Diluted EPS ~€ 237M Q4 2022 New Order Intake ~€ 957M Backlog at year-end 2022 ~30% Revenue from HVS on FY 2022 € 0.56 Adj. Diluted EPS* ~41% increase in 2022 high value solutions revenue to record € 293.3M Committed backlog increased 9% versus prior year, partially offset by drop in Covid-19 orders. Excluding Covid-19, backlog increased 21% versus last year reflecting favorable demand for new customer programs Q4 and Full Year 2022 Financial Results Double- digit growth, expanding margins, growing mix of high value solutions __________ *Adjusted DEPS, adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. Please refer to slides 20-27 for a reconciliation of non-GAAP measures

Successful Progression against our Strategic Pillars in 2022 Multi-Year Pipeline HVS Growth Global Expansion R&D Innovation As we further advance these strategic imperatives in 2023, we expect that our efforts will yield sustainable organic growth in years to come Q4 and Full Year 2022 Financial Results Advanced buildout of industrial footprint to add capacity in premium products Signed an agreement with BARDA to further expand vial capacity in Fishers (U.S.) Grew mix of High Value Solutions New treatment classes (biologics) require specialized drug containment to ensure highest integrity and we remain ideally positioned to capitalize on this trend Launched next generation EZ-fill® smart vial platform Advanced our portfolio of Drug Delivery Systems Partnered with Transcoject to expand our syringe portfolio with COC and COP pre-filled syringes Strong multi-year opportunities in high growth end markets like biologics

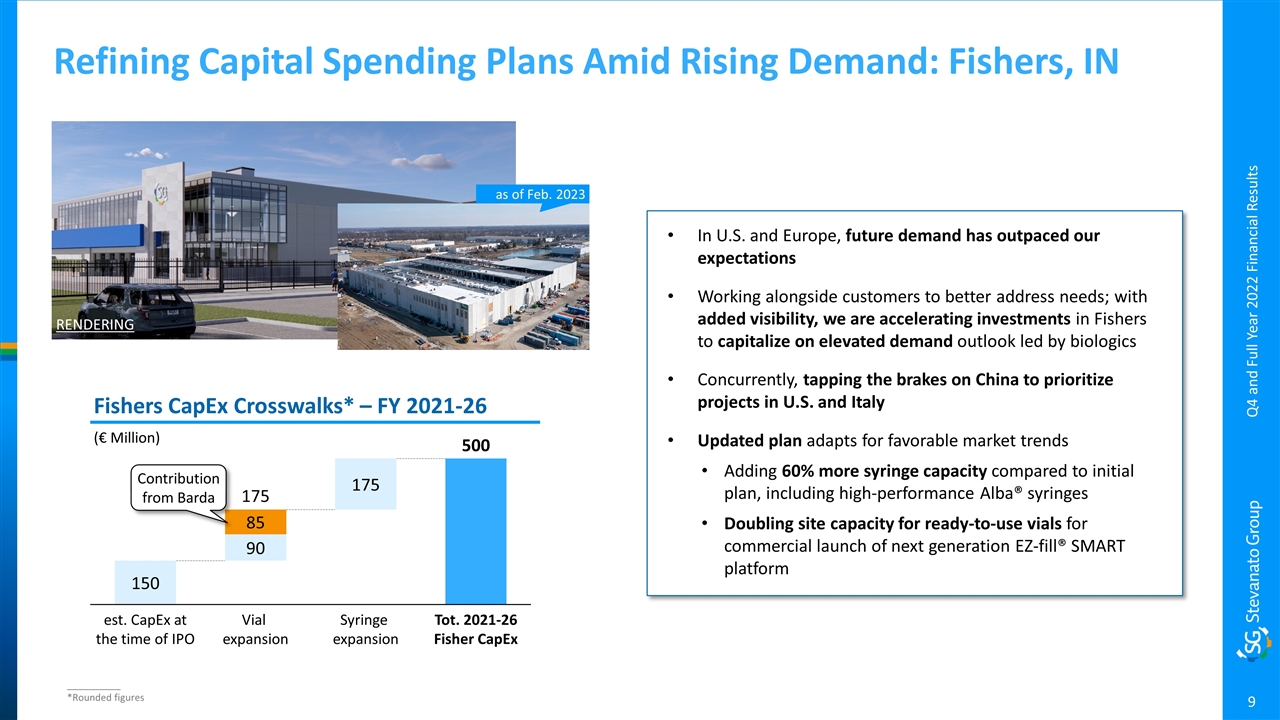

Refining Capital Spending Plans Amid Rising Demand: Fishers, IN Q4 and Full Year 2022 Financial Results In U.S. and Europe, future demand has outpaced our expectations Working alongside customers to better address needs; with added visibility, we are accelerating investments in Fishers to capitalize on elevated demand outlook led by biologics Concurrently, tapping the brakes on China to prioritize projects in U.S. and Italy Updated plan adapts for favorable market trends Adding 60% more syringe capacity compared to initial plan, including high-performance Alba® syringes Doubling site capacity for ready-to-use vials for commercial launch of next generation EZ-fill® SMART platform RENDERING as of Feb. 2023 (€ Million) Fishers CapEx Crosswalks* – FY 2021-26 Contribution from Barda __________ *Rounded figures

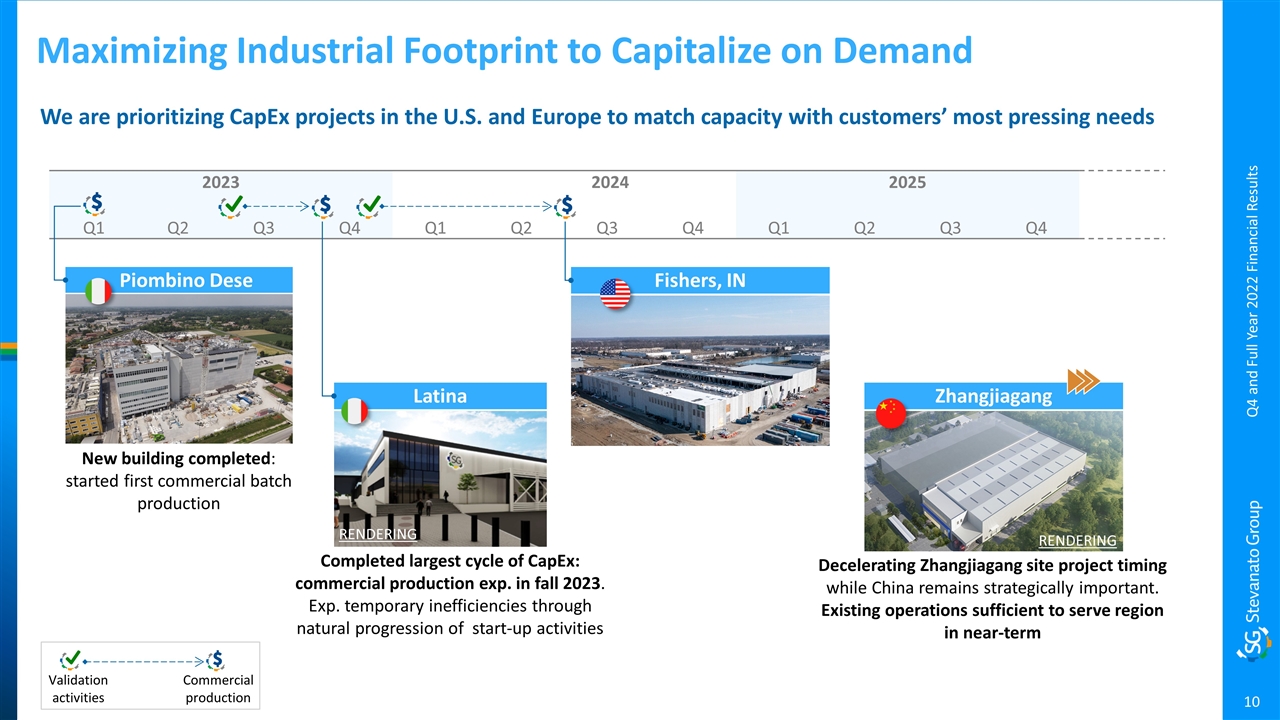

Maximizing Industrial Footprint to Capitalize on Demand Q4 and Full Year 2022 Financial Results Latina Piombino Dese Fishers, IN New building completed: started first commercial batch production Completed largest cycle of CapEx: commercial production exp. in fall 2023. Exp. temporary inefficiencies through natural progression of start-up activities 2023 2024 2025 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Zhangjiagang Decelerating Zhangjiagang site project timing while China remains strategically important. Existing operations sufficient to serve region in near-term We are prioritizing CapEx projects in the U.S. and Europe to match capacity with customers’ most pressing needs RENDERING RENDERING Validation activities Commercial production

Marco Dal Lago Chief Financial Officer Q4 and Full Year 2022 Financial Results

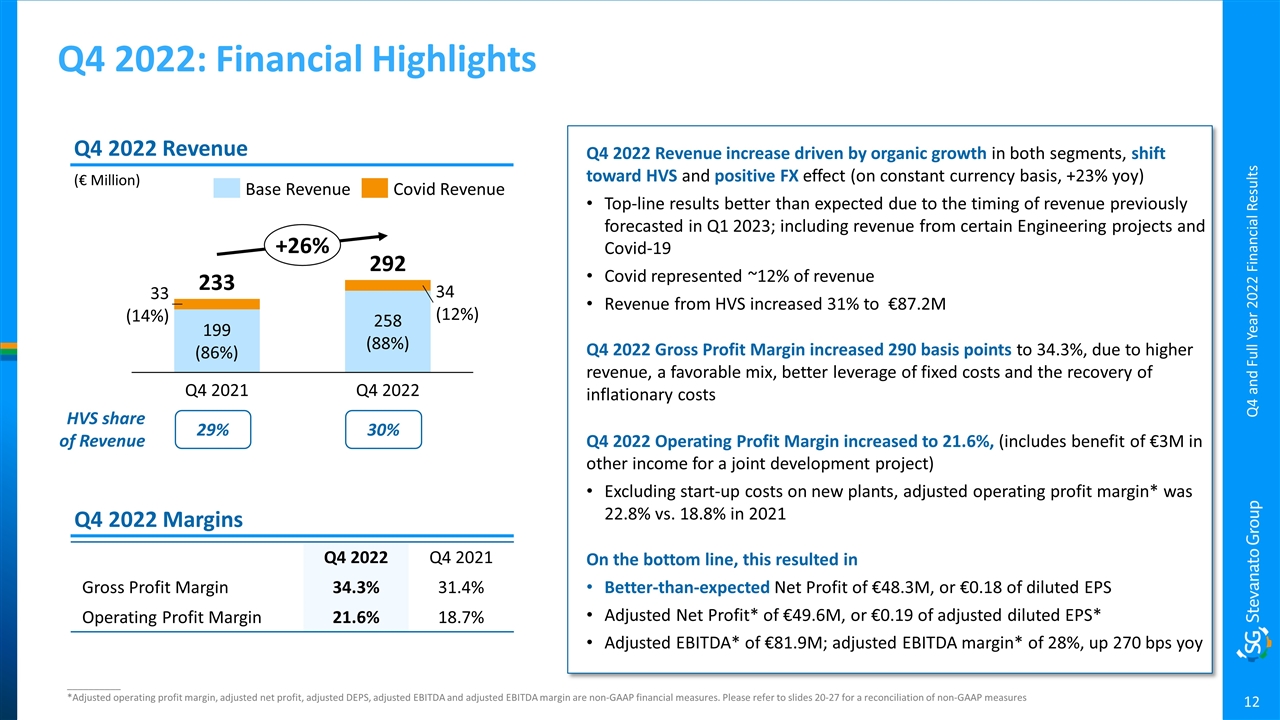

Q4 2022: Financial Highlights Q4 2022 Revenue increase driven by organic growth in both segments, shift toward HVS and positive FX effect (on constant currency basis, +23% yoy) Top-line results better than expected due to the timing of revenue previously forecasted in Q1 2023; including revenue from certain Engineering projects and Covid-19 Covid represented ~12% of revenue Revenue from HVS increased 31% to €87.2M Q4 2022 Gross Profit Margin increased 290 basis points to 34.3%, due to higher revenue, a favorable mix, better leverage of fixed costs and the recovery of inflationary costs Q4 2022 Operating Profit Margin increased to 21.6%, (includes benefit of €3M in other income for a joint development project) Excluding start-up costs on new plants, adjusted operating profit margin* was 22.8% vs. 18.8% in 2021 On the bottom line, this resulted in Better-than-expected Net Profit of €48.3M, or €0.18 of diluted EPS Adjusted Net Profit* of €49.6M, or €0.19 of adjusted diluted EPS* Adjusted EBITDA* of €81.9M; adjusted EBITDA margin* of 28%, up 270 bps yoy Q4 and Full Year 2022 Financial Results () () () () __________ *Adjusted operating profit margin, adjusted net profit, adjusted DEPS, adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. Please refer to slides 20-27 for a reconciliation of non-GAAP measures HVS share of Revenue (€ Million) Q4 2022 Revenue 29% 30% Q4 2022 Margins Q4 2022 Q4 2021 Gross Profit Margin 34.3% 31.4% Operating Profit Margin 21.6% 18.7%

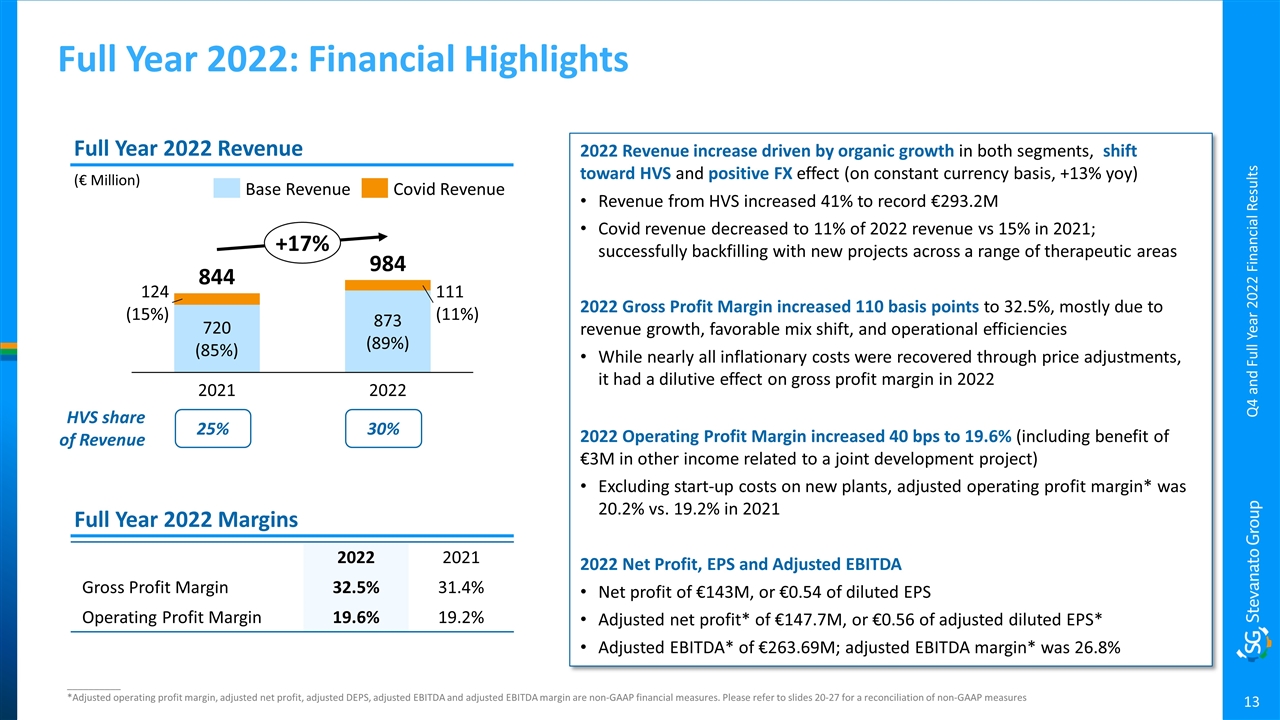

Full Year 2022: Financial Highlights 2022 Revenue increase driven by organic growth in both segments, shift toward HVS and positive FX effect (on constant currency basis, +13% yoy) Revenue from HVS increased 41% to record €293.2M Covid revenue decreased to 11% of 2022 revenue vs 15% in 2021; successfully backfilling with new projects across a range of therapeutic areas 2022 Gross Profit Margin increased 110 basis points to 32.5%, mostly due to revenue growth, favorable mix shift, and operational efficiencies While nearly all inflationary costs were recovered through price adjustments, it had a dilutive effect on gross profit margin in 2022 2022 Operating Profit Margin increased 40 bps to 19.6% (including benefit of €3M in other income related to a joint development project) Excluding start-up costs on new plants, adjusted operating profit margin* was 20.2% vs. 19.2% in 2021 2022 Net Profit, EPS and Adjusted EBITDA Net profit of €143M, or €0.54 of diluted EPS Adjusted net profit* of €147.7M, or €0.56 of adjusted diluted EPS* Adjusted EBITDA* of €263.69M; adjusted EBITDA margin* was 26.8% Q4 and Full Year 2022 Financial Results () () () () HVS share of Revenue (€ Million) Full Year 2022 Revenue 25% 30% Full Year 2022 Margins 2022 2021 Gross Profit Margin 32.5% 31.4% Operating Profit Margin 19.6% 19.2% __________ *Adjusted operating profit margin, adjusted net profit, adjusted DEPS, adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. Please refer to slides 20-27 for a reconciliation of non-GAAP measures

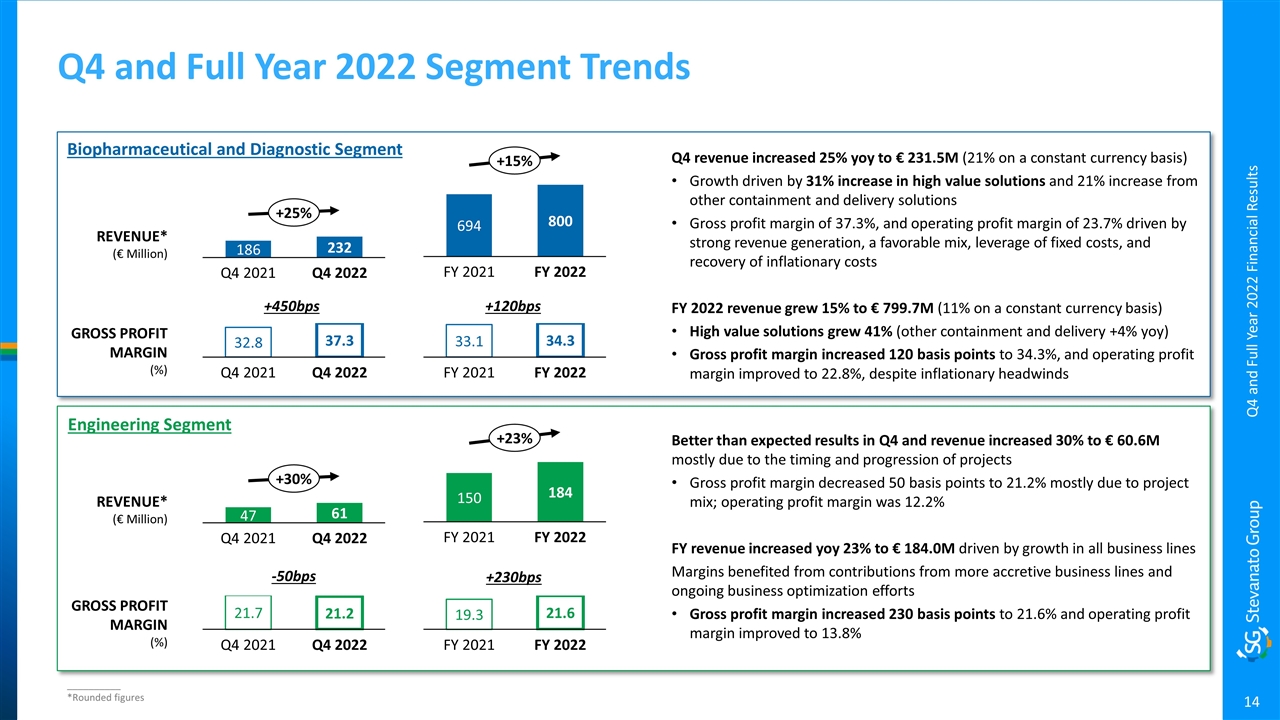

Q4 and Full Year 2022 Segment Trends Q4 and Full Year 2022 Financial Results __________ *Rounded figures Q4 revenue increased 25% yoy to € 231.5M (21% on a constant currency basis) Growth driven by 31% increase in high value solutions and 21% increase from other containment and delivery solutions Gross profit margin of 37.3%, and operating profit margin of 23.7% driven by strong revenue generation, a favorable mix, leverage of fixed costs, and recovery of inflationary costs FY 2022 revenue grew 15% to € 799.7M (11% on a constant currency basis) High value solutions grew 41% (other containment and delivery +4% yoy) Gross profit margin increased 120 basis points to 34.3%, and operating profit margin improved to 22.8%, despite inflationary headwinds Biopharmaceutical and Diagnostic Segment REVENUE* (€ Million) GROSS PROFIT MARGIN (%) Engineering Segment Better than expected results in Q4 and revenue increased 30% to € 60.6M mostly due to the timing and progression of projects Gross profit margin decreased 50 basis points to 21.2% mostly due to project mix; operating profit margin was 12.2% FY revenue increased yoy 23% to € 184.0M driven by growth in all business lines Margins benefited from contributions from more accretive business lines and ongoing business optimization efforts Gross profit margin increased 230 basis points to 21.6% and operating profit margin improved to 13.8% REVENUE* (€ Million) GROSS PROFIT MARGIN (%) +230bps +120bps -50bps +450bps

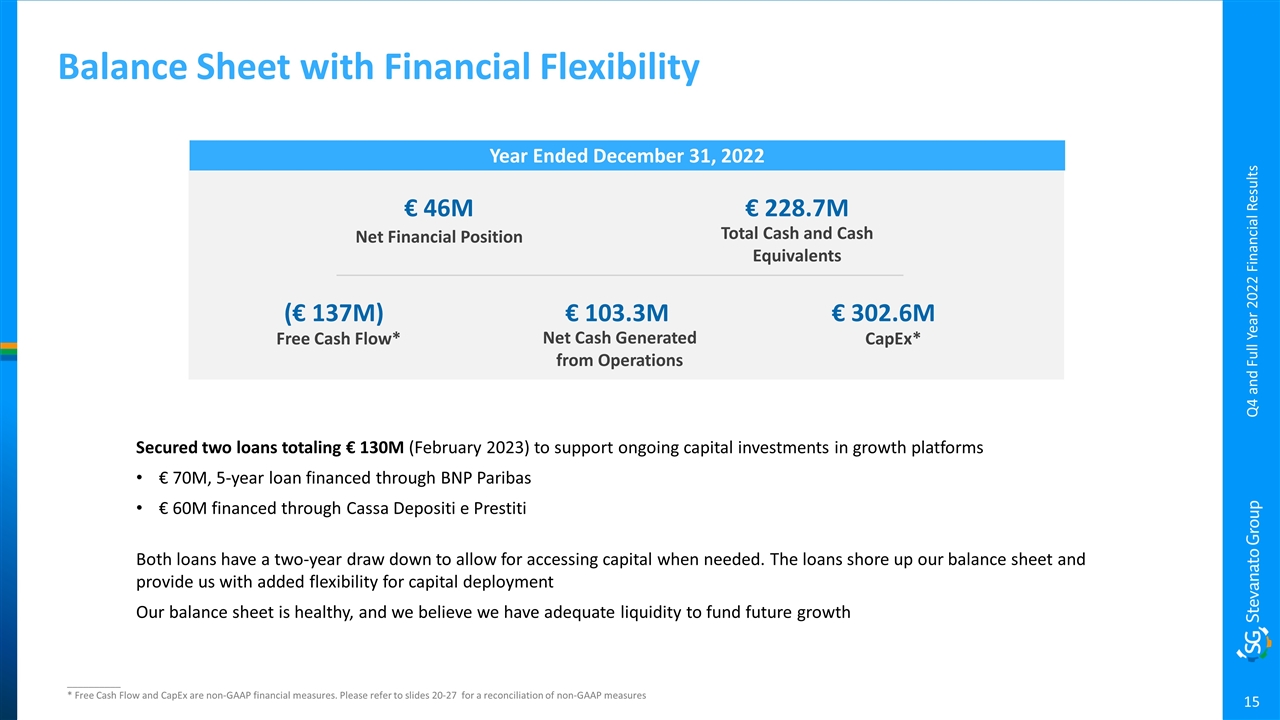

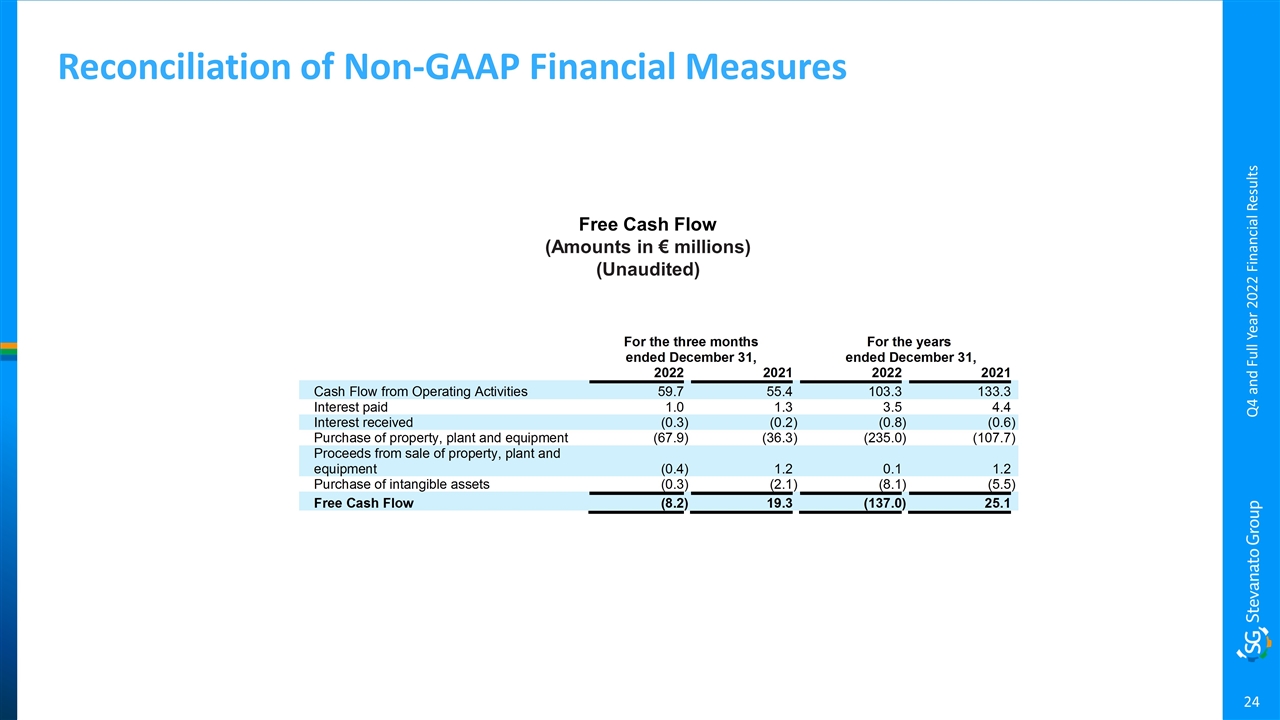

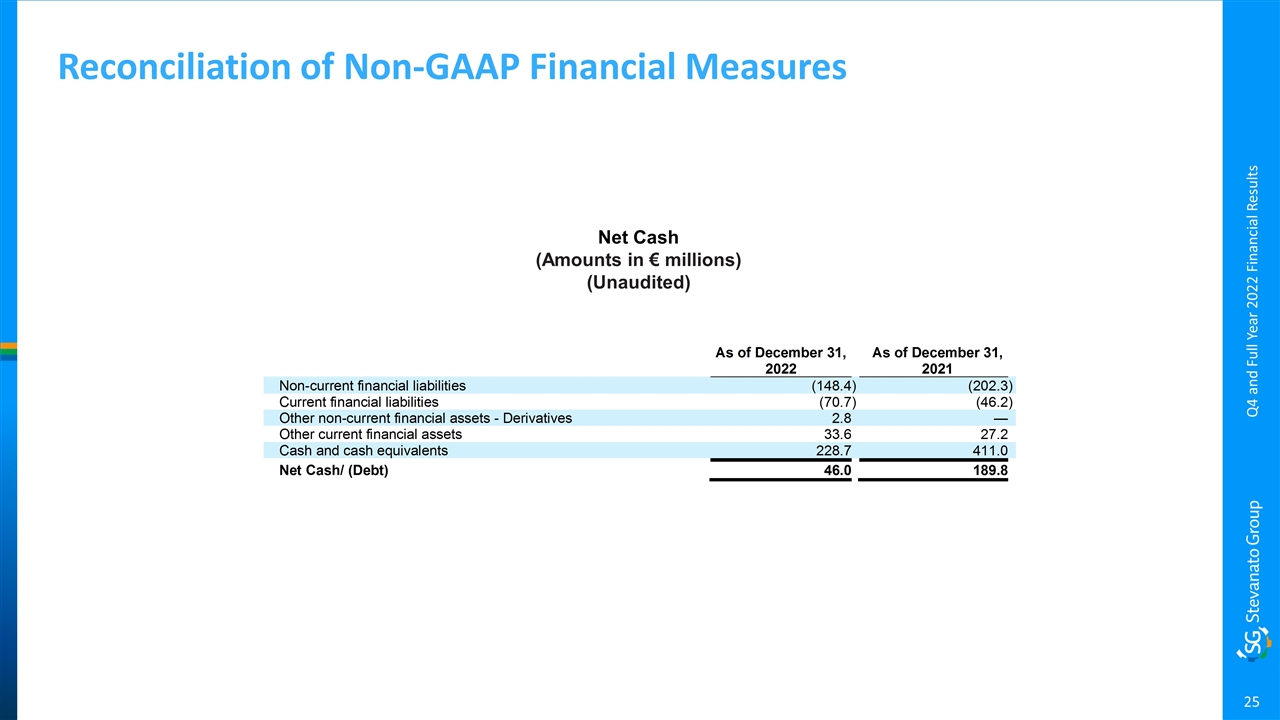

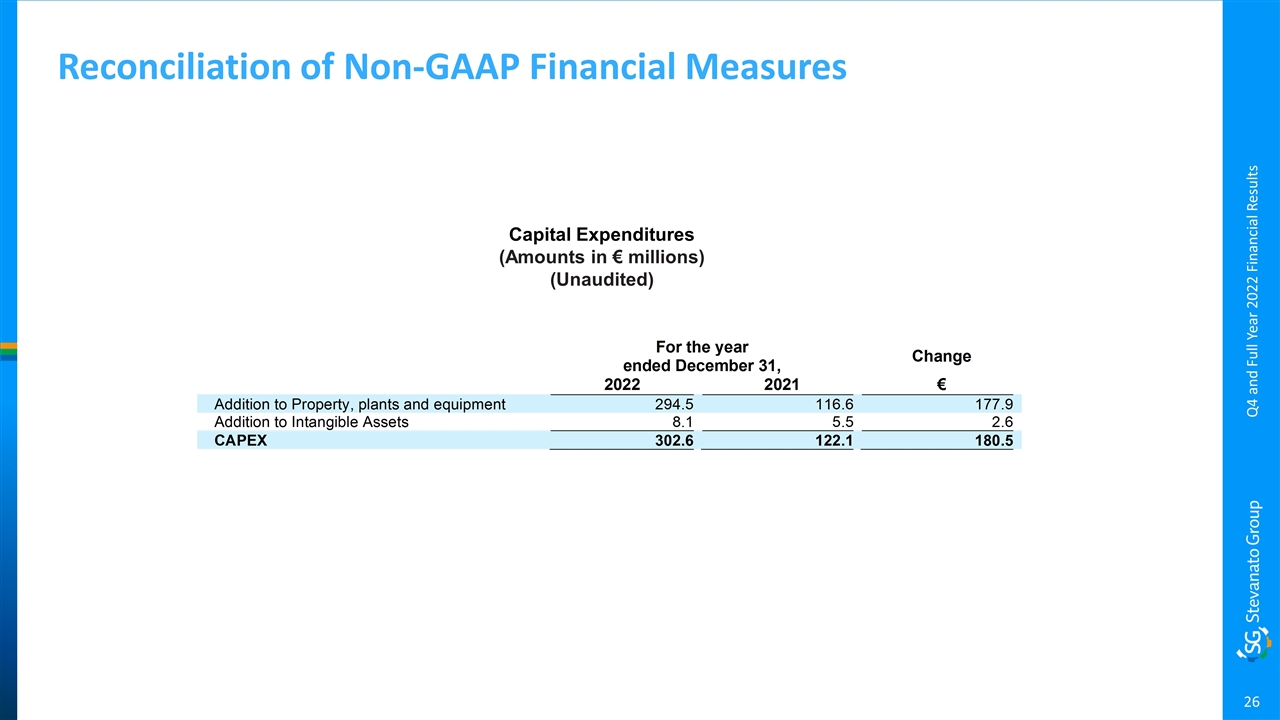

Balance Sheet with Financial Flexibility Year Ended December 31, 2022 € 302.6M CapEx* € 103.3M Net Cash Generated from Operations € 228.7M Total Cash and Cash Equivalents € 46M Net Financial Position (€ 137M) Free Cash Flow* Secured two loans totaling € 130M (February 2023) to support ongoing capital investments in growth platforms € 70M, 5-year loan financed through BNP Paribas € 60M financed through Cassa Depositi e Prestiti Both loans have a two-year draw down to allow for accessing capital when needed. The loans shore up our balance sheet and provide us with added flexibility for capital deployment Our balance sheet is healthy, and we believe we have adequate liquidity to fund future growth Q4 and Full Year 2022 Financial Results __________ * Free Cash Flow and CapEx are non-GAAP financial measures. Please refer to slides 20-27 for a reconciliation of non-GAAP measures

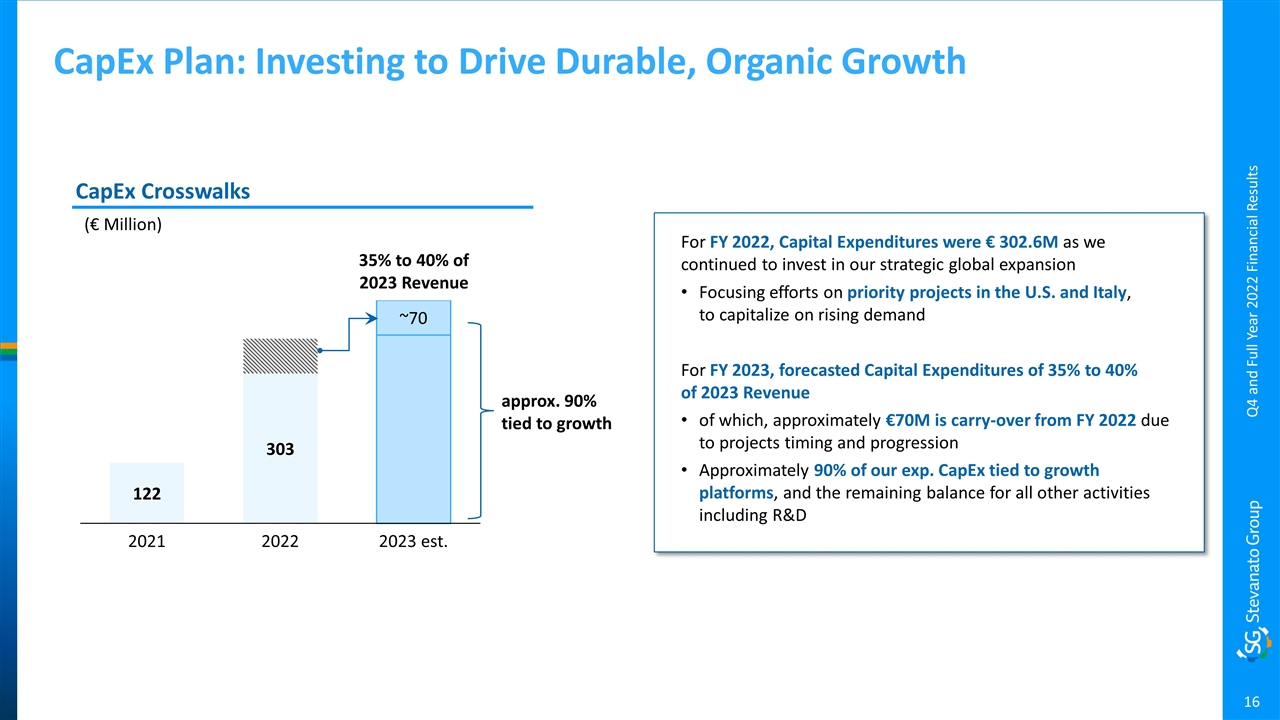

CapEx Plan: Investing to Drive Durable, Organic Growth Q4 and Full Year 2022 Financial Results ~70 35% to 40% of 2023 Revenue (€ Million) CapEx Crosswalks For FY 2022, Capital Expenditures were € 302.6M as we continued to invest in our strategic global expansion Focusing efforts on priority projects in the U.S. and Italy, to capitalize on rising demand For FY 2023, forecasted Capital Expenditures of 35% to 40% of 2023 Revenue of which, approximately €70M is carry-over from FY 2022 due to projects timing and progression Approximately 90% of our exp. CapEx tied to growth platforms, and the remaining balance for all other activities including R&D approx. 90% tied to growth

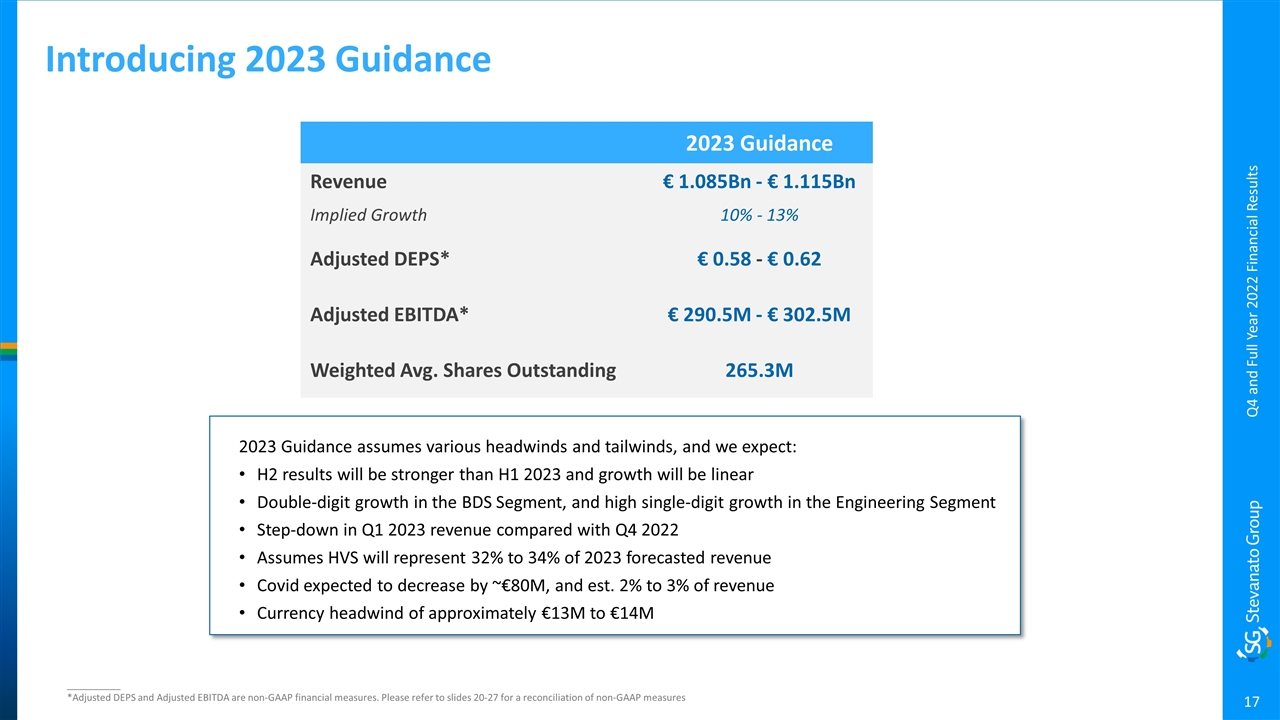

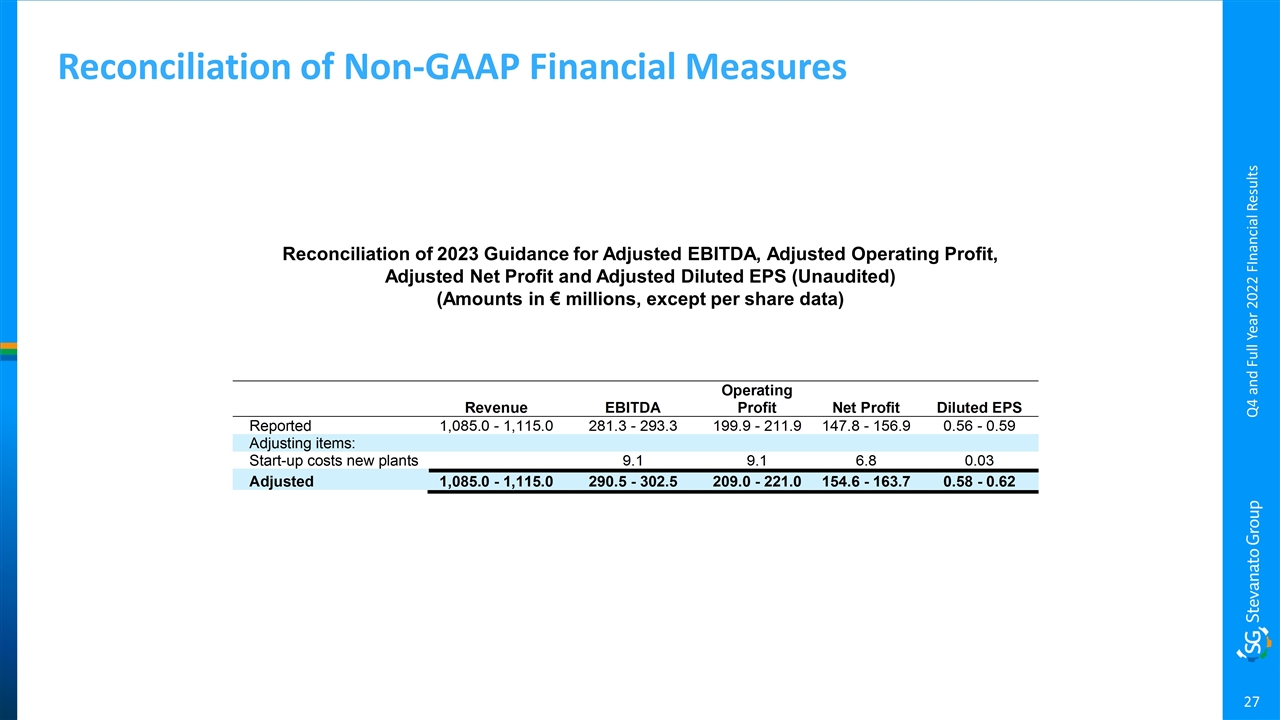

Introducing 2023 Guidance Q4 and Full Year 2022 Financial Results __________ *Adjusted DEPS and Adjusted EBITDA are non-GAAP financial measures. Please refer to slides 20-27 for a reconciliation of non-GAAP measures 2023 Guidance assumes various headwinds and tailwinds, and we expect: H2 results will be stronger than H1 2023 and growth will be linear Double-digit growth in the BDS Segment, and high single-digit growth in the Engineering Segment Step-down in Q1 2023 revenue compared with Q4 2022 Assumes HVS will represent 32% to 34% of 2023 forecasted revenue Covid expected to decrease by ~€80M, and est. 2% to 3% of revenue Currency headwind of approximately €13M to €14M 2023 Guidance Revenue € 1.085Bn - € 1.115Bn Implied Growth 10% - 13% Adjusted DEPS* € 0.58 - € 0.62 Adjusted EBITDA* € 290.5M - € 302.5M Weighted Avg. Shares Outstanding 265.3M

Franco Moro Chief Executive Officer Q4 and Full Year 2022 Financial Results

Summary FY 2022 results demonstrate that we have the right strategy Operating in an environment of strong demand, growing end markets and multi-year secular drivers Capital allocation priorities designed to meet current and future customer demand trends Timing of demand requires investment years in advance of commercial production to seize opportunities in front of us Strong momentum entering 2023: we are well positioned to drive durable organic growth and increase shareholder value Q4 and Full Year 2022 Financial Results

Reconciliation of Non-GAAP Financial Measures (Unaudited) This presentation contains non-GAAP financial measures. Please refer to the tables included in this presentation for a reconciliation of non-GAAP measures. Management monitors and evaluates our operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Net Profit, Adjusted Diluted EPS, Capital Employed, Net Cash, Free Cash Flow, and CapEx. We believe that these non-GAAP financial measures provide useful and relevant information regarding our performance and improve our ability to assess our financial condition. While similar measures are widely used in the industry in which we operate, the financial measures we use may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. Q4 and Full Year 2022 Financial Results Notes to Non-GAAP Financial Measures

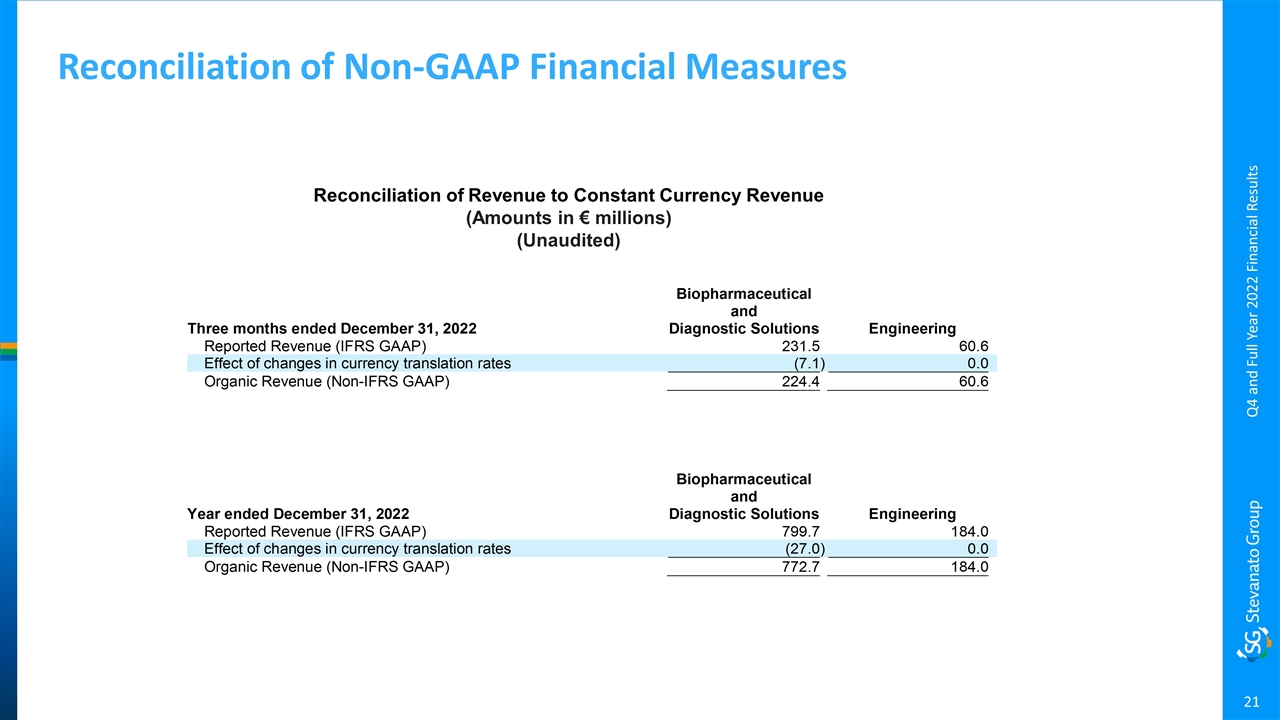

Reconciliation of Non-GAAP Financial Measures Reconciliation of Revenue to Constant Currency Revenue (Amounts in € millions) (Unaudited) Q4 and Full Year 2022 Financial Results

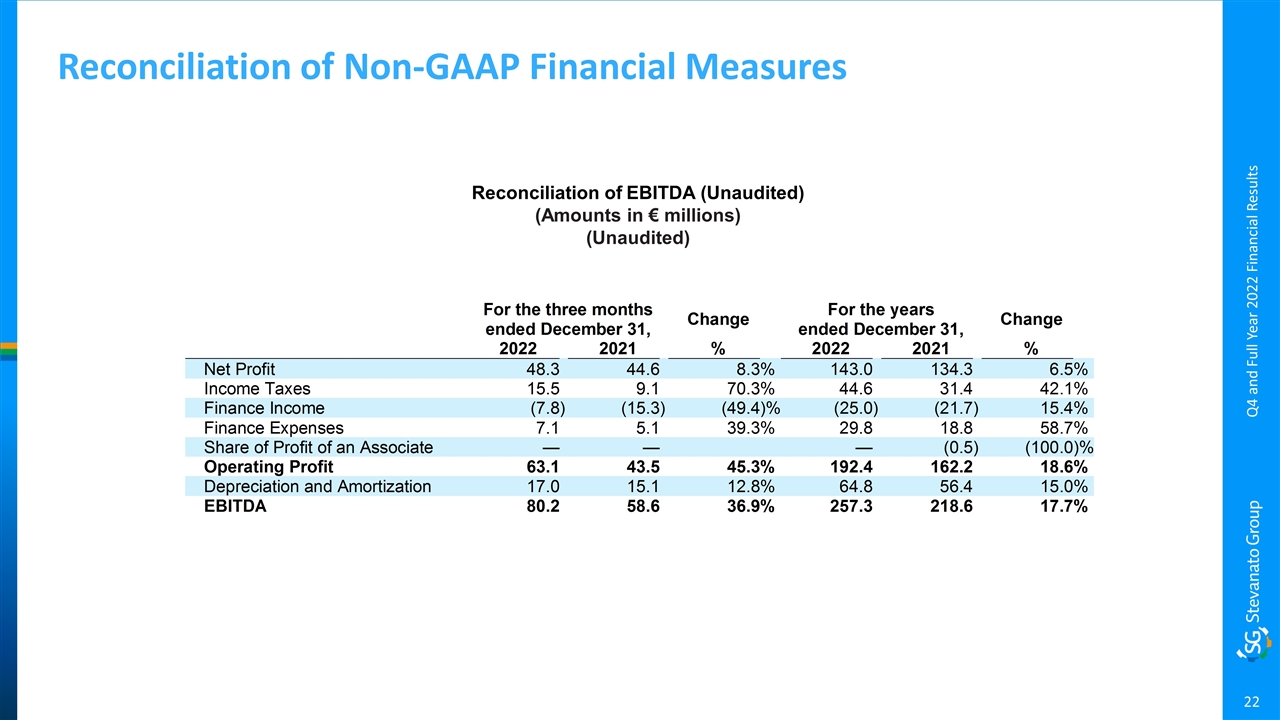

Reconciliation of Non-GAAP Financial Measures Reconciliation of EBITDA (Unaudited) (Amounts in € millions) (Unaudited) Q4 and Full Year 2022 Financial Results

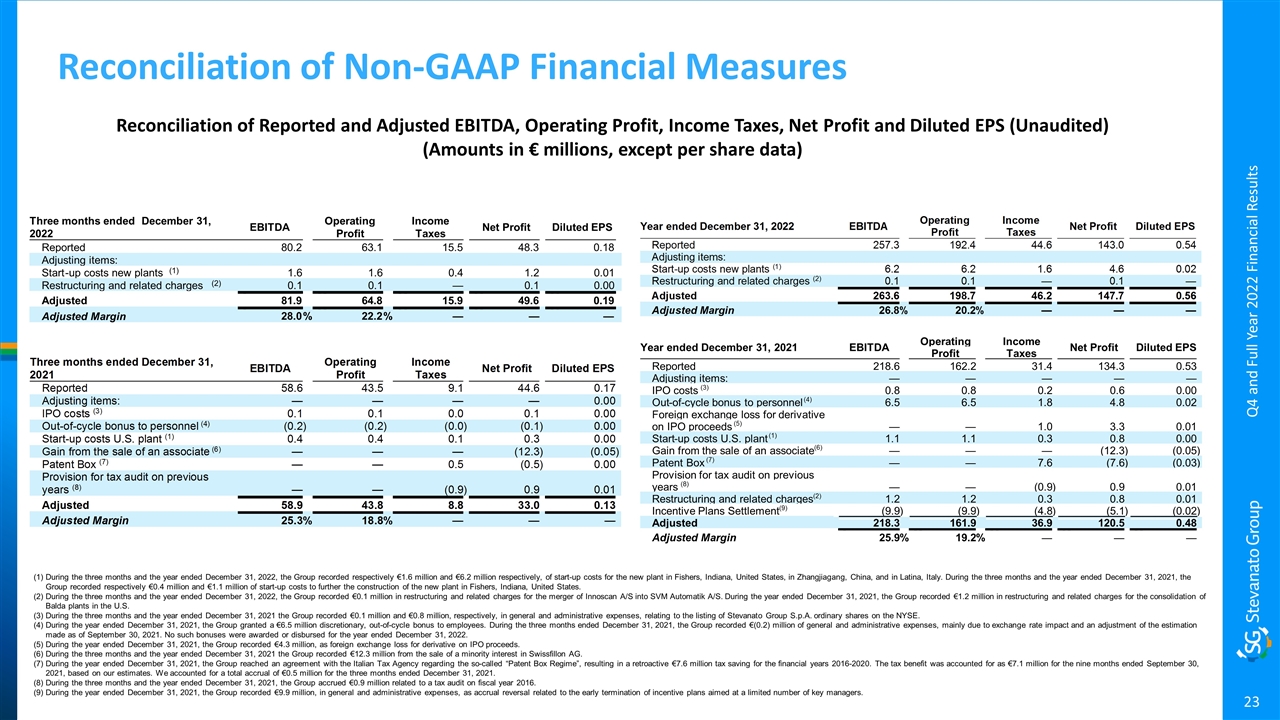

Reconciliation of Reported and Adjusted EBITDA, Operating Profit, Income Taxes, Net Profit and Diluted EPS (Unaudited) (Amounts in € millions, except per share data) Reconciliation of Non-GAAP Financial Measures (1) During the three months and the year ended December 31, 2022, the Group recorded respectively €1.6 million and €6.2 million respectively, of start-up costs for the new plant in Fishers, Indiana, United States, in Zhangjiagang, China, and in Latina, Italy. During the three months and the year ended December 31, 2021, the Group recorded respectively €0.4 million and €1.1 million of start-up costs to further the construction of the new plant in Fishers, Indiana, United States. (2) During the three months and the year ended December 31, 2022, the Group recorded €0.1 million in restructuring and related charges for the merger of Innoscan A/S into SVM Automatik A/S. During the year ended December 31, 2021, the Group recorded €1.2 million in restructuring and related charges for the consolidation of Balda plants in the U.S. (3) During the three months and the year ended December 31, 2021 the Group recorded €0.1 million and €0.8 million, respectively, in general and administrative expenses, relating to the listing of Stevanato Group S.p.A. ordinary shares on the NYSE. (4) During the year ended December 31, 2021, the Group granted a €6.5 million discretionary, out-of-cycle bonus to employees. During the three months ended December 31, 2021, the Group recorded €(0.2) million of general and administrative expenses, mainly due to exchange rate impact and an adjustment of the estimation made as of September 30, 2021. No such bonuses were awarded or disbursed for the year ended December 31, 2022. (5) During the year ended December 31, 2021, the Group recorded €4.3 million, as foreign exchange loss for derivative on IPO proceeds. (6) During the three months and the year ended December 31, 2021 the Group recorded €12.3 million from the sale of a minority interest in Swissfillon AG. (7) During the year ended December 31, 2021, the Group reached an agreement with the Italian Tax Agency regarding the so-called “Patent Box Regime”, resulting in a retroactive €7.6 million tax saving for the financial years 2016-2020. The tax benefit was accounted for as €7.1 million for the nine months ended September 30, 2021, based on our estimates. We accounted for a total accrual of €0.5 million for the three months ended December 31, 2021. (8) During the three months and the year ended December 31, 2021, the Group accrued €0.9 million related to a tax audit on fiscal year 2016. (9) During the year ended December 31, 2021, the Group recorded €9.9 million, in general and administrative expenses, as accrual reversal related to the early termination of incentive plans aimed at a limited number of key managers. Q4 and Full Year 2022 Financial Results Year ended December 31, 2021 EBITDA Operating Profit Income Taxes Net Profit Diluted EPS Reported 218.6 162.2 31.4 134.3 0.53 Adjusting items: — — — — — IPO costs (3) 0.8 0.8 0.2 0.6 0.00 Out - of - cycle bonus to personnel (4) 6.5 6.5 1.8 4.8 0.02 Foreign exchange loss for derivative on IPO proceeds (5) — — 1.0 3.3 0.01 Start - up costs U.S. plant (1) 1.1 1.1 0.3 0.8 0.00 Gain from the sale of an associate (6) — — — (12.3 ) (0.05 ) Patent Box (7) — — 7.6 (7.6 ) (0.03 ) Provision for tax audit on previous years (8) — — (0.9 ) 0.9 0.01 Restructuring and related charges (2) 1.2 1.2 0.3 0.8 0.01 Incentive Plans Settlement (9) (9.9 ) (9.9 ) (4.8 ) (5.1 ) (0.02 ) Adjusted Adjusted Margin 25.9 % 19.2 % — — — 218.3 161.9 36.9 120.5 0.48 Three months ended December 31, 2022 EBITDA Operating Profit Income Taxes Net Profit Diluted EPS Reported 80.2 63.1 15.5 48.3 0.18 Adjusting items: Start - up costs new plants (1) 1.6 1.6 0.4 1.2 0.01 Restructuring and related charges (2) 0.1 0.1 — 0.1 0.00 Adjusted 81.9 64.8 15.9 49.6 0.19 Adjusted Margin 28.0 % 22.2 % — — —

Reconciliation of Non-GAAP Financial Measures Free Cash Flow (Amounts in € millions) (Unaudited) Q4 and Full Year 2022 Financial Results

Reconciliation of Non-GAAP Financial Measures Net Cash (Amounts in € millions) (Unaudited) Q4 and Full Year 2022 Financial Results

Reconciliation of Non-GAAP Financial Measures Capital Expenditures (Amounts in € millions) (Unaudited) Q4 and Full Year 2022 Financial Results

Reconciliation of Non-GAAP Financial Measures Reconciliation of 2023 Guidance for Adjusted EBITDA, Adjusted Operating Profit, Adjusted Net Profit and Adjusted Diluted EPS (Unaudited) (Amounts in € millions, except per share data) Q4 and Full Year 2022 FInancial Results