| Exhibit 99.6

| ||

STEVANATO GROUP S.P.A.

REPORT ON REMUNERATION POLICY AND PRACTICES

|

|

| Exhibit 99.6

| ||

STEVANATO GROUP S.P.A.

REPORT ON REMUNERATION POLICY AND PRACTICES

|

|

|

|

|

|

2 |

|

|

Stevanato Group S.p.A.

Report on Remuneration Policy and Practices |

Introduction

To attract and retain people fully committed to the vision and purpose of Stevanato Group and able to support the success of our customers, it is fundamental to pay appropriately and fairly, balancing the interests of shareholders and employees, as well as all other stakeholders.

Remuneration policies and practices contribute to the long-term interests of Stevanato Group (“Group”) and enable the Group to reward performance in line with the Mission, Vision and Values.

The Group’s ambition is to motivate and develop people of the highest caliber and potential, and to build the Best Team, creating added value and delivering the best result for the customer. In this perspective, the remuneration policy, through dedicated compensation and welfare programs, aims at fostering a culture that values diversity, innovation and excellence.

The object of this year’s report is to describe the framework and the drivers of the compensation policy and practices of Stevanato Group. To this purpose, the Compensation Committee, established on June 16, 2021, worked along 2022, in close cooperation with Group management, on the development of a remuneration policy that will continuously evolve to ensure its adherence to market best practices, Group’s life cycle and strategic priorities.

In particular, the report provides information on the (a) balance between fixed and variable compensation, (b) bonus opportunity ranges for key positions, (c) qualitative description of the principal strategic objectives included in the bonus scheme, and (d) ESG performance areas included in the bonus scheme.

The Committee, in line with market best practices, has availed itself of the services of the external advisor Mercer, a global leader of HR consulting, with extensive experience in Executive Remuneration.

Approach to Remuneration Policy

The purpose of Stevanato Group’s Remuneration Policy is to support successful business performance through an engaged and motivated team, attracted to the organization by a consistent and differentiated employment offering delivered at an affordable and sustainable cost, in line with business goals and long-term company’s objectives.

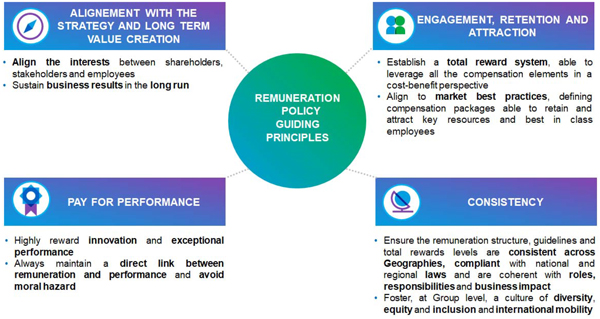

Stevanato Group’s Remuneration Policy is based on the following key pillars:

|

|

3 |

|

|

Stevanato Group S.p.A.

Report on Remuneration Policy and Practices |

Stevanato Group’s Remuneration Practices

The remuneration structure envisages an appropriate combination and balance of all the incentive levers and components (base salary, short-term incentive plan, long-term incentive plan, benefits) to design compensation packages consistent with different clusters of the population, roles and complexity of the positions.

Total remuneration packages are subject to periodical review to ensure internal consistency, as well as adequacy and competitiveness compared to the markets for positions of similar levels of responsibility and complexity.

Pay Mix

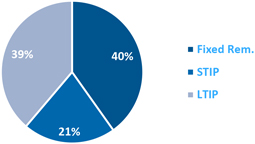

The average pay mix target of the Chief Executive Officer and C-level roles of Stevanato Group shows the balance between the fixed and variable remuneration, which includes a predominant focus on the variable remuneration, especially linked to long-term strategic objectives.

|

|

4 |

|

|

Stevanato Group S.p.A.

Report on Remuneration Policy and Practices |

Base Salary (Fixed Remuneration)

Base Salary is determined and allocated based on pre-defined criteria.

It reflects the role and the responsibilities assigned, taking into consideration skills, contribution and experience required for the position.

The overall amount and weight of Base Salary must be sufficient and appropriate to remunerate the role and is periodically reviewed with respect to a predefined reference market.

Variable Remuneration

The variable component of Stevanato Group’s remuneration framework consists of:

| · | Short Term Incentive Plan |

| · | Long Term Incentive Plan |

Short Term Incentive Plan is a cash-based plan that aims at motivating and rewarding the achievement of annual financial and non-financial objectives, within the framework of long-term sustainable performance.

Key performance indicators, foreseen in the annual bonus scheme, vary depending on the organizational layer and the responsibilities of the participants. There is a mix of financial metrics at the Group level (such as revenues, EBITDA or EBITDA margin, net working capital, and free cash flow) and non-financial metrics (such as strategic objectives linked to business plan priorities, ESG performance areas, and operating metrics in the areas of safety, quality, production, sales, customer satisfaction).

The scorecard of the senior executive positions – CEO and C-Level role – are mainly focused on Group financial metrics (80% of the scorecard) linked to the most relevant strategic priorities for 2023: i) Adjusted EBITDA margin; ii) Revenues; iii) Trade Working Capital. The remaining 20% of the scorecard focus on Individual KPI which may include objectives related to the business development of the Stevanato Group and ESG priorities.

For the CEO role are focused on the business development of the company, strategic projects, and ESG objectives (with a particular focus on Diversity and Environment), while for C-Level roles Individual objectives may vary depending on their specific business accountability.

Short Term Incentive Plan envisages a cap to the maximum award and pre-defined performance and payout curves. In case of achievement of the challenging level of overperformance, the maximum payout for CEO and C-Level roles can reach up to 150% of the target bonus.

Target bonus opportunity for eligible positions is defined according to the level of accountabilities, contribution to company results, and consistent with practices of the reference market. The STI target pay opportunity for the Chief Executive Officer and C-level roles ranges from a minimum of 50% to a maximum of 60% of the base salary.

Long Term Incentive Plan aims at strengthening the link between variable compensation, company performance, and shareholder return over a multi-year period. During the fiscal year 2022, the Compensation Committee has designed the new Long Term Incentive Plan 2023-2027. The aim is to replace the previous Stock Grant Plan which will be terminated following the expiration of the first cycle (2021-2022) and substituted by the Long-Term Incentive Plan 2023-2027, which will become the only long-term incentive plan in place. The aim of the new plan is to reinforce the alignment of the long-term incentive compensation element with the corporate strategy and US most common practices, as well as ensure the attraction and retention of key managers. The Plan provides for the grant to be made in part with Performance Share (“PSP”) and in part with Restricted Shares (“RSP”).

|

|

5 |

|

|

Stevanato Group S.p.A.

Report on Remuneration Policy and Practices |

The Plan, for the Performance Shares part, envisages pre-defined pay for performance curves and a cap to the maximum award that can be earned in terms of the number of shares.

The PSP has a vesting period of three years with a cliff vesting schedule while the RSP vest on annual installments during the three years vesting period.

The number of shares individually granted at the beginning of the vesting period is defined according to the level of accountabilities and business impact of each eligible position and consistent with practices of the reference market. The LTI target pay opportunity for the Chief Executive Officer and C-level roles range from a minimum of 70% to a maximum of 145% of the base salary.

Benefit

As an Employer of Choice, Stevanato Group provides comprehensive and competitive Employee Benefits (such as pension schemes, healthcare plans, and company car) as part of the Total Rewards package. Benefits provide substantial guarantees for the well-being of staff during their active career, as well as their retirement.

Stock Ownership and Retention Guidelines

The Chief Executive Officer is required to hold at least 5 times his base salary while the C-level roles are required to hold at least 2 times their respective base salary. Executives are expected to meet the applicable guideline no more than 5 years after first becoming subject to it, and they are expected to continuously own sufficient shares to meet the guideline once attained.

Stevanato Group’s Commitment to Diversity, Equity & Inclusion (DE&I)

Stevanato Group is committed to ensuring fair treatment in terms of compensation and benefits, as well as in terms of opportunities and career development, regardless of gender, age, ethnicity, disability, sexual orientation, religion, as well as any other traits.

One important ambition of the Group is to foster a culture that values DE&I in all the locations in which the Group operates, promoting staff well-being through dedicated compensation and welfare programs to be competitive globally.

Stevanato Group confirms this commitment also through the inclusion of specific targets on DE&I within the Short-Term Incentive goal card of the CEO and top management, and where progress is regularly monitored.

|

|

6 |