Filed Pursuant to Rule 424(b)(5)

Registration No. 333-278107

The information contained in this prospectus supplement is not complete and may be changed. This prospectus supplement is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated March 20, 2024

Prospectus supplement

(to Prospectus dated March 20, 2024)

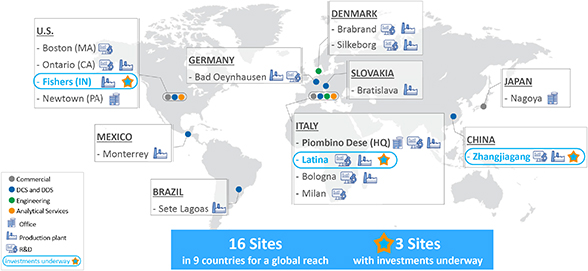

Stevanato Group S.p.A.

$300,000,000

Ordinary Shares

We are offering $150,000,000 of our ordinary shares, no par value per share (the “ordinary shares” or “shares”) and the selling shareholder identified in this prospectus supplement is offering $150,000,000 of ordinary shares. We will not receive any proceeds from the sale of ordinary shares by the selling shareholder.

The ordinary shares are listed on the New York Stock Exchange (the “NYSE”) under the symbol “STVN.” The last reported sale price of the ordinary shares on the NYSE on March 19, 2024 was $29.17 per share. We are a “foreign private issuer” under applicable U.S. Securities and Exchange Commission (the “SEC”) rules and are eligible for reduced public company disclosure requirements.

An investment in our ordinary shares involves various risks. Prospective investors should carefully consider the matters discussed under “Risk Factors” beginning on page S-14 of this prospectus supplement and the matters discussed in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) (2) |

$ | $ | ||||||

| Proceeds, before expenses, to us(2) |

$ | $ | ||||||

| Proceeds, before expenses, to the selling shareholder(2) |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting” for additional information regarding underwriting compensation. |

| (2) | If the underwriters exercise the option in full, the proceeds, before expenses, to us will increase by $ , and to the selling shareholder will increase by $ , and the total underwriting discounts and commissions payable will increase by $ . |

To the extent that the underwriters sell more than $300,000,000 of ordinary shares, the underwriters have the option to purchase up to an additional $22,500,000 of ordinary shares from us and $22,500,000 of ordinary shares from the selling shareholder to cover over-allotments, if any, at the public offering price less underwriting discounts and commissions.

The underwriters expect to deliver the ordinary shares against payment on or about , 2024.

| MORGAN STANLEY | WILLIAM BLAIR | |

Prospectus supplement dated , 2024